By The BCM Funding Workforce

A lot will probably be written concerning the challenges, difficulties, ache and struggling endured by humanity in 2020. We want to deal with a few of the good that got here out of final yr’s strife:

- Our Democracy, whereas removed from good, works. Whereas many didn’t see their most well-liked candidates win, as all the time, that is a part of Democracy, and Democracy continues to be the very best system of presidency people have but devised.

- Our society, whereas removed from good and thru an excessive amount of tragedy, edged a bit nearer to embracing equality in all that the phrase means. Now all of us have to go forth in peace to lastly make the phrases of our founding fathers our creed, our bond…and everybody’s actuality.

- Our biotechnology and pharmaceutical industries, whereas removed from good, are prodigious. As an alternative of the everyday ten years, they created at the least three viable vaccines from scratch in lower than one yr.

- Our well being care system, whereas removed from good, has been exalted by all those that serve. Confronted with the worst pandemic in additional than a century, these caregivers’ devotion, tenacity, compassion, and disrespect for private well-being is past reproach.

- Love, whereas removed from good, is a a lot stronger power than another. For this, we give thanks…

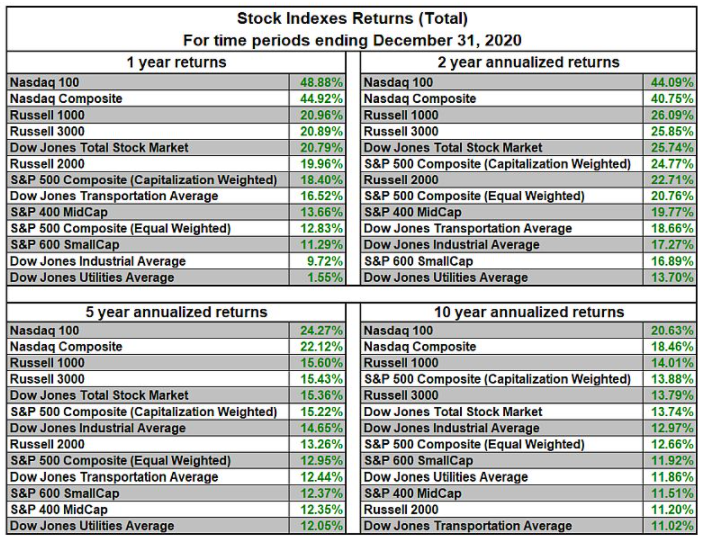

Supply TheChartStore.com, as of 12/31/20. An funding can’t be made straight in an index.

In the meantime, our monetary system and markets—whereas additionally removed from good—confirmed resilience, resolve and reward in 2020. The chart above illustrates how constant U.S. fairness markets have been because the Nice Recession. In reality, at a excessive degree, 2020 was nearly the right continuation of the tendencies established within the decade that preceded it. U.S. equities dominated the roost. The large bought larger. Humanity continued to undertake know-how at an growing price. Don’t combat the Fed. Rates of interest can go to zero…even barely decrease…

In fact, annual returns are wholly inadequate to explain a yr during which we skilled a number of market cycles. We are able to’t hope to adequately seize the entire nuances of 2020’s market panorama, however we do assume it’s value increasing on issue returns—a specific focal point to quantitative managers. Elements, typically marketed as “smart-beta,” are widespread attributes which have traditionally led to at least one group of equities outperforming one other. Examples of broadly accepted elements embrace momentum, measurement, high quality, yield, low volatility, and worth. Not solely have been many of those issue relationships flipped on their heads in 2020, however the change in issue management all year long made it notably difficult for any factor-based buyers to carry out properly. Given the acute and distinctive circumstances of the yr, it seems as if a predominant “Covid issue” emerged.

This Covid issue exhibited attributes of momentum and high quality and represented a brand new means during which buyers segmented the fairness markets. Corporations throughout varied industries with disparate traits have been break up into two teams: those who benefitted from the societal modifications led to by the virus and those who didn’t. For instance, know-how corporations and homebuilders have been beneficiaries of the earn a living from home economic system whereas utilities and industrial actual property corporations weren’t. Of the six most typical elements, just one outperformed the S&P 500 index, and the only issue which outperformed—momentum—captured all of its outperformance within the first half the yr. Whereas the second half provided hope for a few of the extra beleaguered elements, it didn’t offset the losses suffered earlier within the yr. For anybody who lived by means of 2020 daily, this merely confirms our instinct. 2020 proved to be a continuation of some long-term tendencies and a turning level for others.

Supply: Bloomberg and Beaumont Capital Administration (BCM), for the interval 1/1/20 by means of 12/31/20. Elements are represented by the next indices: S&P 500 Momentum Index, S&P 600 Index, S&P 500 Low Volatility Index, S&P 500 Worth Index, S&P 500 High quality Index, and S&P 500 Excessive Dividend Index.

For the rest of this letter we’ll try and look ahead. We people are consistently topic to our emotional coping abilities. Translated, we’ve biases and one of many strongest is recency bias…what has been occurring goes to proceed. This bias can endure even within the face of the plain. Whereas nobody is aware of what the longer term goes to carry, maybe slightly reflection on what could also be essential going ahead is so as.

- The U.S. greenback has been weakening. Since its March peak, the USD has fallen 13.1%1 and is close to the 2018 low. This might present a tailwind for export-oriented industries, akin to manufacturing, and enhance worldwide asset courses and commodities. Rising import costs and better commodity costs could properly start the reflation cycle so notably absent for the previous 10 years.

- When is simply too large too large? Apple is value ~$2.2 trillion, Microsoft ~$1.7 trillion, and Amazon will get the bronze medal at ~$1.6 trillion2. There are a lot of energetic anti-trust lawsuits in progress towards the mega-cap tech and internet-related corporations. In some unspecified time in the future, identical to AT&T and Customary Oil, oligopolies and monopolies will probably be break up up…

- The Federal Reserve dusted off its 2008 QE playbook with nice success and has indicated that financial easing is right here to remain for the foreseeable future. What makes this time completely different is that Congress launched into a revolutionary fiscal stimulus program of its personal. Whereas it’s true that the restoration has been Ok-shaped, it’s secure to say that the U.S. has by no means earlier than emerged from a recession with family wealth at an all-time excessive.

- Rates of interest can not fall without end; there’s a sensible flooring even whether it is barely damaging. This ensures that returns from fastened earnings will probably be decrease sooner or later and conventional static asset allocation portfolios should rely nearly completely on equities to fulfill their return expectations. Worse, if charges rise, fastened earnings may show to be a brief headwind to portfolio returns.

Supply: JPM Information to the markets, as of 12/31/2020

- Retail buyers, many working from residence with “time on their arms,” have embraced the market in a magnitude not seen because the web bubble of the late 90’s. A report was set for probably the most IPOs in a single yr, over half of the IPO proceeds went to particular objective acquisition companies (SPACs, additionally known as “clean test corporations”), and retail curiosity in fairness choices is at an all-time excessive. Whereas there’s disagreement concerning the degree of affect these market contributors maintain, their presence is simply too massive to disregard and has added extra emotion to the markets’ actions.

Supply: Dealogic and Goldman Sachs World Funding Analysis, as of 12/16/20

All in all, we consider optimism is warranted as we launch into 2021. Yearly, the diploma of life’s challenges might be just like the diploma of the market’s challenges…they’re unknown and sometimes briefly set us again, however our resiliency and can to beat have all the time prevailed.

As all the time, we thanks on your confidence in and enterprise with BCM.

This text was contributed by Dave Haviland, Portfolio Supervisor and Managing Associate at Beaumont Capital Administration, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosures:

1 Supply: The Chart Retailer, from 1/8/21

2 Supply: “Record of Public Companies by Market Capitalization.” Wikipedia, Wikimedia Basis, 12/31/20, https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization

Copyright © 2021 Beaumont Capital Administration LLC. All rights reserved. All supplies showing on this commentary are protected by copyright as a collective work or compilation underneath U.S. copyright legal guidelines and are the property of Beaumont Capital Administration. You might not copy, reproduce, publish, use, create spinoff works, transmit, promote or in any means exploit any content material, in complete or partly, on this commentary with out specific permission from Beaumont Capital Administration.

Previous efficiency is not any assure of future outcomes. Index efficiency is proven on a gross foundation and an funding can’t be made straight in an index.

This materials is supplied for informational functions solely and doesn’t in any sense represent a solicitation or supply for the acquisition or sale of a selected safety or different funding choices, nor does it represent funding recommendation for any individual. The fabric could comprise ahead or backward-looking statements concerning intent, beliefs concerning present or previous expectations. The views expressed are additionally topic to vary primarily based on market and different circumstances. The knowledge offered on this report is predicated on information obtained from third occasion sources. Though it’s believed to be correct, no illustration or guarantee is made as to its accuracy or completeness.

As with all investments, there are related inherent dangers together with lack of principal. Inventory markets, particularly overseas markets, are unstable and might decline considerably in response to opposed issuer, political, regulatory, market, or financial developments. Sector and issue investments focus in a specific trade or funding attribute, and the investments’ efficiency may rely closely on the efficiency of that trade or attribute and be extra unstable than the efficiency of much less concentrated funding choices and the market as a complete. Securities of corporations with smaller market capitalizations are typically extra unstable and fewer liquid than bigger firm shares. Overseas markets, notably rising markets, might be extra unstable than U.S. markets as a consequence of elevated political, regulatory, social or financial uncertainties. Fastened Earnings investments have publicity to credit score, rate of interest, market, and inflation threat.

Diversification doesn’t guarantee a revenue or assure towards a loss.

The Customary & Poor’s (S&P) 500® Index is an unmanaged index that tracks the efficiency of 500 broadly held, large-capitalization U.S. shares. Indices should not managed and don’t incur charges or bills. The S&P Small Cap 600® Index is an unmanaged index that tracks the efficiency of 600 broadly held, small-capitalization U.S. shares. The MSCI World Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets, excluding the US. The MSCI ACWI Index captures massive and mid-cap illustration throughout 23 Developed Markets and 26 Rising Markets international locations. The MSCI ACWI Index ex-U.S. captures massive and mid-cap illustration throughout 22 Developed Markets and 26 Rising Markets international locations, excluding the US. The Bloomberg Barclay’s U.S. Mixture Bond Index is a broad base index and is usually used to signify funding grade bonds being traded in the US.

“S&P 500®”, and “S&P Small Cap 600®” are registered logos of Customary & Poor’s, Inc., a division of S&P World, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

For Funding Skilled use with shoppers, not for impartial distribution. Please contact your BCM Regional Advisor for extra data or to deal with any questions that you will have.

Beaumont Capital Administration was initially created in 2009 as a separate division of Beaumont Monetary Companions, LLC. Beaumont Capital Administration LLC spun off as its personal entity as of half/2020. Beaumont Monetary Companions, LLC was initially registered as Beaumont Belief Associates in 1981 and was reorganized into Beaumont Monetary Companions, LLC in 1999.

Beaumont Capital Administration LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

BCM 4Q20 Market Commentary: Trying Again to Transfer Ahead—Searching for Larger Floor in an Imperfect World

By The BCM Funding Workforce A lot will probably be written

By The BCM Funding Workforce

A lot will probably be written concerning the challenges, difficulties, ache and struggling endured by humanity in 2020. We want to deal with a few of the good that got here out of final yr’s strife:

Supply TheChartStore.com, as of 12/31/20. An funding can’t be made straight in an index.

In the meantime, our monetary system and markets—whereas additionally removed from good—confirmed resilience, resolve and reward in 2020. The chart above illustrates how constant U.S. fairness markets have been because the Nice Recession. In reality, at a excessive degree, 2020 was nearly the right continuation of the tendencies established within the decade that preceded it. U.S. equities dominated the roost. The large bought larger. Humanity continued to undertake know-how at an growing price. Don’t combat the Fed. Rates of interest can go to zero…even barely decrease…

In fact, annual returns are wholly inadequate to explain a yr during which we skilled a number of market cycles. We are able to’t hope to adequately seize the entire nuances of 2020’s market panorama, however we do assume it’s value increasing on issue returns—a specific focal point to quantitative managers. Elements, typically marketed as “smart-beta,” are widespread attributes which have traditionally led to at least one group of equities outperforming one other. Examples of broadly accepted elements embrace momentum, measurement, high quality, yield, low volatility, and worth. Not solely have been many of those issue relationships flipped on their heads in 2020, however the change in issue management all year long made it notably difficult for any factor-based buyers to carry out properly. Given the acute and distinctive circumstances of the yr, it seems as if a predominant “Covid issue” emerged.

This Covid issue exhibited attributes of momentum and high quality and represented a brand new means during which buyers segmented the fairness markets. Corporations throughout varied industries with disparate traits have been break up into two teams: those who benefitted from the societal modifications led to by the virus and those who didn’t. For instance, know-how corporations and homebuilders have been beneficiaries of the earn a living from home economic system whereas utilities and industrial actual property corporations weren’t. Of the six most typical elements, just one outperformed the S&P 500 index, and the only issue which outperformed—momentum—captured all of its outperformance within the first half the yr. Whereas the second half provided hope for a few of the extra beleaguered elements, it didn’t offset the losses suffered earlier within the yr. For anybody who lived by means of 2020 daily, this merely confirms our instinct. 2020 proved to be a continuation of some long-term tendencies and a turning level for others.

Supply: Bloomberg and Beaumont Capital Administration (BCM), for the interval 1/1/20 by means of 12/31/20. Elements are represented by the next indices: S&P 500 Momentum Index, S&P 600 Index, S&P 500 Low Volatility Index, S&P 500 Worth Index, S&P 500 High quality Index, and S&P 500 Excessive Dividend Index.

For the rest of this letter we’ll try and look ahead. We people are consistently topic to our emotional coping abilities. Translated, we’ve biases and one of many strongest is recency bias…what has been occurring goes to proceed. This bias can endure even within the face of the plain. Whereas nobody is aware of what the longer term goes to carry, maybe slightly reflection on what could also be essential going ahead is so as.

Supply: JPM Information to the markets, as of 12/31/2020

Supply: Dealogic and Goldman Sachs World Funding Analysis, as of 12/16/20

All in all, we consider optimism is warranted as we launch into 2021. Yearly, the diploma of life’s challenges might be just like the diploma of the market’s challenges…they’re unknown and sometimes briefly set us again, however our resiliency and can to beat have all the time prevailed.

As all the time, we thanks on your confidence in and enterprise with BCM.

This text was contributed by Dave Haviland, Portfolio Supervisor and Managing Associate at Beaumont Capital Administration, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosures:

1 Supply: The Chart Retailer, from 1/8/21

2 Supply: “Record of Public Companies by Market Capitalization.” Wikipedia, Wikimedia Basis, 12/31/20, https://en.wikipedia.org/wiki/List_of_public_corporations_by_market_capitalization

Copyright © 2021 Beaumont Capital Administration LLC. All rights reserved. All supplies showing on this commentary are protected by copyright as a collective work or compilation underneath U.S. copyright legal guidelines and are the property of Beaumont Capital Administration. You might not copy, reproduce, publish, use, create spinoff works, transmit, promote or in any means exploit any content material, in complete or partly, on this commentary with out specific permission from Beaumont Capital Administration.

Previous efficiency is not any assure of future outcomes. Index efficiency is proven on a gross foundation and an funding can’t be made straight in an index.

This materials is supplied for informational functions solely and doesn’t in any sense represent a solicitation or supply for the acquisition or sale of a selected safety or different funding choices, nor does it represent funding recommendation for any individual. The fabric could comprise ahead or backward-looking statements concerning intent, beliefs concerning present or previous expectations. The views expressed are additionally topic to vary primarily based on market and different circumstances. The knowledge offered on this report is predicated on information obtained from third occasion sources. Though it’s believed to be correct, no illustration or guarantee is made as to its accuracy or completeness.

As with all investments, there are related inherent dangers together with lack of principal. Inventory markets, particularly overseas markets, are unstable and might decline considerably in response to opposed issuer, political, regulatory, market, or financial developments. Sector and issue investments focus in a specific trade or funding attribute, and the investments’ efficiency may rely closely on the efficiency of that trade or attribute and be extra unstable than the efficiency of much less concentrated funding choices and the market as a complete. Securities of corporations with smaller market capitalizations are typically extra unstable and fewer liquid than bigger firm shares. Overseas markets, notably rising markets, might be extra unstable than U.S. markets as a consequence of elevated political, regulatory, social or financial uncertainties. Fastened Earnings investments have publicity to credit score, rate of interest, market, and inflation threat.

Diversification doesn’t guarantee a revenue or assure towards a loss.

The Customary & Poor’s (S&P) 500® Index is an unmanaged index that tracks the efficiency of 500 broadly held, large-capitalization U.S. shares. Indices should not managed and don’t incur charges or bills. The S&P Small Cap 600® Index is an unmanaged index that tracks the efficiency of 600 broadly held, small-capitalization U.S. shares. The MSCI World Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets, excluding the US. The MSCI ACWI Index captures massive and mid-cap illustration throughout 23 Developed Markets and 26 Rising Markets international locations. The MSCI ACWI Index ex-U.S. captures massive and mid-cap illustration throughout 22 Developed Markets and 26 Rising Markets international locations, excluding the US. The Bloomberg Barclay’s U.S. Mixture Bond Index is a broad base index and is usually used to signify funding grade bonds being traded in the US.

“S&P 500®”, and “S&P Small Cap 600®” are registered logos of Customary & Poor’s, Inc., a division of S&P World, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

For Funding Skilled use with shoppers, not for impartial distribution. Please contact your BCM Regional Advisor for extra data or to deal with any questions that you will have.

Beaumont Capital Administration was initially created in 2009 as a separate division of Beaumont Monetary Companions, LLC. Beaumont Capital Administration LLC spun off as its personal entity as of half/2020. Beaumont Monetary Companions, LLC was initially registered as Beaumont Belief Associates in 1981 and was reorganized into Beaumont Monetary Companions, LLC in 1999.

Beaumont Capital Administration LLC

75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com

RECOMMENDED FOR YOU