The Covid-19 pandemic could not cease the worldwide ETF market in 2020, because the business took i

The Covid-19 pandemic could not cease the worldwide ETF market in 2020, because the business took in $7.6 trillion. Merchants feeding off the bullish sentiment within the ETF house can use leveraged funds just like the Direxion Every day S&P 500® Bull 3X Shares ETF (SPXL) to capitalize on the business’s progress in 2021.

“Knowledge from TrackInsight, supplier of TrackInsight™ World View, reveals the worldwide ETF market completed 2020 at a document excessive of $7.6 Trillion throughout 6,518 ETFs,” a Nasdaq article stated. “A mixture of sturdy fairness market efficiency coupled with accelerating investor inflows contributed to the brand new document.”

In capitalizing on that sturdy fairness market efficiency, the S&P 500 is a good place to start out. The benchmark index gained 12% the final three months. Merchants seeking to amplify their returns can get in with SPXL.

SPXL, beneath regular circumstances, invests at the very least 80% of its internet belongings (plus borrowing for funding functions) in monetary devices, comparable to swap agreements, and securities of the index, ETFs) that observe the index and different monetary devices that present every day leveraged publicity to the index or ETFs that observe the index.

Throughout the similar 3-month time-frame, SPXL is up nearly 40% and offering about thrice the return of the S&P 500.

ETFs Handed 2020 with Flying Colours

The Covid-19 pandemic actually threw a wrench into the capital markets’ plans of constructing off 2019, however the ETF house was solely briefly affected. 2021 will solely see the ETF house develop as suppliers scramble to supply merchandise that differentiate themselves from the plenty.

“ETFs confronted an acid take a look at in 2020 and handed with flying colours. The large progress we’ve got witnessed demonstrates how ETFs have efficiently satisfied buyers of the advantages of a liquid, tradable and clear product – particularly throughout risky markets,” stated Anaelle Ubaldino, Head of ETF Analysis and Funding Advisory at TrackInsight.

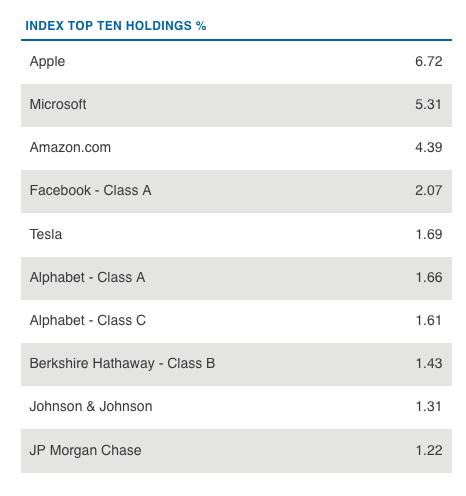

SPXL’s high holdings, buyers will see acquainted names throughout the S&P 500. The holdings embrace Apple, Microsoft, and Amazon.

The relative energy index (RSI) can be utilized in tandem with the stochastic relative energy index (StochRSI) to verify momentum. The RSI studying is just under overbought ranges at 67.77, whereas the StochRSI studying additionally confirms sturdy momentum at 0.814.

As the worldwide financial system continues to heal following a vaccine rollout, search for SPXL to proceed its upward trajectory after its 50-day transferring common crossed over the 200-day transferring common in late August.

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.