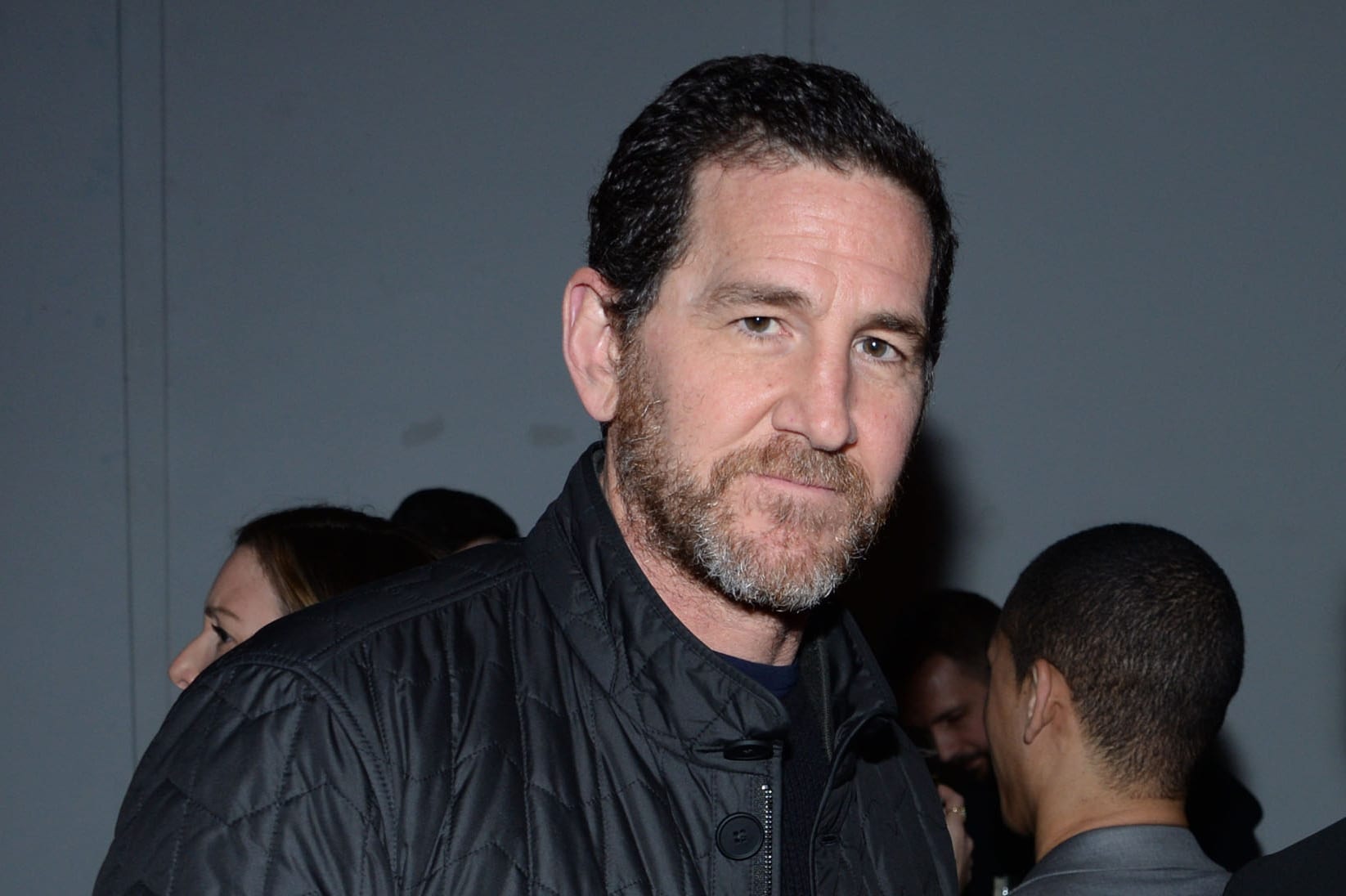

Adam Dell attend Sony Footage Classics And The Cinema Society Host The After Social gathering For "The Burnt Orange Heresy" at New York Academy of

Adam Dell attend Sony Footage Classics And The Cinema Society Host The After Social gathering For “The Burnt Orange Heresy” at New York Academy of Artwork on March 5, 2020 in New York Metropolis.

Paul Bruinooge | Patrick McMullan | Getty Pictures

Goldman Sachs is one step nearer to creating what it calls the digital financial institution of the long run.

The financial institution has simply launched the primary model of a private finance administration instrument that provides prospects of its Marcus retail model a top-down view of all their monetary accounts, in addition to insights into spending and a month-to-month snapshot of their finances, in response to Adam Dell, a Goldman accomplice and head of product at Marcus.

The characteristic, known as Marcus Insights, is the most recent step that Goldman – recognized for many of its 151-year historical past as a financial institution for the rich and highly effective – is taking into the monetary lives of peculiar customers. The financial institution hopes that by serving to customers get a deal with on their funds with a easy, clear interface, they are going to be extra inclined to belief Goldman – and take a look at a few of the agency’s present and upcoming merchandise.

“We wish to make understanding your monetary well being approachable and straightforward,” Dell mentioned in a telephone interview. “What did you spend this month and the place did you spend it and the way a lot do you could have left? And is there any additional that you would put aside for an emergency fund, or simply put in a high-yield financial savings account?”

Insights is bundled in an replace to the financial institution’s Marcus app and shall be obtainable at first solely to those that have a mortgage or deposit account with the financial institution. By year-end, anybody who desires to obtain the Marcus app will be capable to make use of the instruments, that are free.

Goldman Sach app options

Supply: Goldman Sachs

Dell, an entrepreneur and brother of billionaire Michael Dell, got here to Goldman in 2018 after promoting a start-up known as Readability Cash to the financial institution for $100 million. That app, which remains to be a separate providing run by Goldman, is a private finance instrument that makes use of machine studying to nudge customers into higher habits.

“A variety of our considering for Marcus Insights was knowledgeable by the expertise we had at Readability Cash and what we all know prospects care about,” Dell mentioned.

The Marcus app can join with hundreds of economic establishments, both by a partnership with fintech agency Plaid, or with direct relationships Goldman has with banks and brokerages.

There’s one notable exception, nonetheless. Clients will not be capable to hyperlink up with the Apple Card, although Goldman is the financial institution behind that product. That is as a result of Apple does not share person information with Goldman, mentioned an individual with information of the association.

Since there may be now overlap within the capabilities of Marcus and Readability Cash, which had greater than 1 million customers when Goldman bought it, it is honest to surprise what the financial institution will finally do with it. Dell would solely say that Goldman continues to help Readability, for now.

Checking account, investing coming

The Marcus app, which began out early this yr as a really fundamental option to examine balances and schedule funds, is about to get extra capabilities past private finance, Dell mentioned. Subsequent up is a digital checking account and an investing service, each anticipated to be launched sooner or later subsequent yr, he mentioned.

These strikes pit Goldman extra instantly towards quickly rising mobile-banks reminiscent of Chime, Sq.’s Money App, fee-free brokerage Robinhood, and the digital choices from megabanks together with JPMorgan Chase and Financial institution of America.

Regardless of what might really feel like a big head begin by these rivals, it’s nonetheless early on this sport, mentioned Dell. Opponents have begun cracking the code, however no person has fairly put all of the items collectively.

“The tip state of the financial institution of the long run is a digital assistant that’s consistently serious about your greatest monetary pursuits,” Dell mentioned. “Virtually like having your personal CFO whose job it’s to optimize your cash, uncover methods so that you can enhance your monetary state of affairs, and is relentless in that pursuit.”

That can finally occur over the subsequent 5 years to decade, in response to Dell.

“We’re on an extended marathon to construct that imaginative and prescient,” he mentioned, “and every of those steps we take alongside the way in which get us nearer, and we’re very excited in regards to the issues which are to come back.”