The S&P 500, a frequent bellwether for basic threat urge for food, prolonged losses into a 3rd consecutive week. The tendency

The S&P 500, a frequent bellwether for basic threat urge for food, prolonged losses into a 3rd consecutive week. The tendency for financial information on this planet’s largest economic system to shock increased has been shrinking for the reason that center of July. Catching a bid currently has been the anti-risk Japanese Yen and to a lesser extent the haven-linked US Greenback.

Really useful by Nick Cawley

Don’t give into despair, make a sport plan

This previous week, the Federal Reserve may need left buyers wanting extra, particularly on the quantitative easing side. Doubts over additional US fiscal stimulus could have additionally performed a task in retaining the USD suppressed. Sentiment-linked Crude Oil costs have been on the rise, bolstered by a mixture of falling US crude inventories and compliance in output from OPEC+ producers.

With that in thoughts, all eyes flip to testimony from Fed Chair Jerome Powell and Treasury Secretary Steven Mnuchin. They are going to be speaking earlier than the Home Monetary Providers Committee on the CARES Act. Throughout the northern border, the Canadian Greenback will probably be eyeing Prime Minister Justin Trudeau. He will probably be providing a brand new agenda for a spending plan amid the financial restoration.

Really useful by Nick Cawley

Learn to grow to be a extra constant foreign exchange dealer

Following current energy, the New Zealand Greenback awaits this week’s RBNZ financial coverage announcement. Casual contacts between the UK and the European Union round Brexit could drive volatility within the British Pound and Euro. Volatility threat, as proven by the VIX ‘worry gauge’, appears to be on the decline nonetheless. What else is in retailer for markets forward?

Uncover your buying and selling character to assist discover optimum types of analyzing monetary markets

Basic Forecasts:

Euro Forecast: EUR/USD Outlook Turns Extra Bearish After Failure at 1.20

The outlook for the EUR/USD pair has worsened after its failure to maneuver again to the excessive simply above 1.20 touched on September 1 regardless of the ECB’s choice earlier this month to not discuss down the Euro.

Japanese Yen Reveals Bullish Conduct as BoJ Braces for Adverse CPI

The Japanese Yen could proceed to exhibit a bullish conduct because the Financial institution of Japan (BoJ) seems to be in no rush to change the trail for financial coverage.

Crude Oil Costs Susceptible Amid Fading Demand, Oversupply Issues

Crude oil costs may reverse decrease because the OPEC Month-to-month Oil Market Report (MOMR) forecasts fading world demand and oversupply issues.

US Greenback Outlook Bearish on Mnuchin & Powell Testimonies, Key US Information

The US Greenback could fall if demand for haven-linked property fall after testimonies from Powell and Mnuchin to the Home. Higher-than-expected information could compound the Dollar’s promoting streak.

New Zealand Greenback Outlook: NZD/USD Might Rise on RBNZ, Watch S&P 500

The expansion-linked New Zealand Greenback could rise on the upcoming RBNZ price choice following rosy financial information. Nonetheless, draw back potential within the S&P 500 may offset NZD/USD good points

Nasdaq 100, DAX 30 & FTSE 100 Forecasts for the Week Forward

Know-how shares proceed to be a supply of weak spot for US equities, undermining threat urge for food. In the meantime, US-China tensions simmer beneath the floor creating uncertainty.

Technical Forecasts:

Mexican Peso Technical Forecast: Bearish Stress Stays for USD/MXN

USD/MXN decide up additional draw back momentum as assist ranges are taken out

British Pound (GBP) Weekly Outlook – GBP/USD and EUR/GBP Forecasts

Sterling stays trapped by overarching fundamentals drivers and each GBP/USD and EUR/GBP are going to have to attend till the Brexit mud settles.

US Greenback Outlook: DXY Nonetheless Struggling to Rise From Huge Help

The Greenback has bottoming potential, however that’s beginning to drop some weight because it fails to maintain any elevate; subsequent week might be a giant one for USD’s near-term outlook.

Oil Worth Outlook: Crude Restoration Susceptible beneath Pattern Resistance

Oil costs noticed a reprieve to the current promoting stress however stay in danger whereas beneath downtrend resistance. Listed here are the degrees that matter on the WTI technical chart.

Australian Greenback Forecast: AUD/USD Could also be Setting Stage for Reversal

It was a quiet week in Aussie as AUD/USD put in its second consecutive week of indecision. However taking a extra granular look highlights the potential for a reversal situation.

S&P 500 Index Might Wrestle Close to-Time period, Pattern Nonetheless Leads Increased

The S&P 500 index could battle within the close to time period – drifting sideways throughout the bounds of its Bollinger Band – however the general development nonetheless seems bullish.

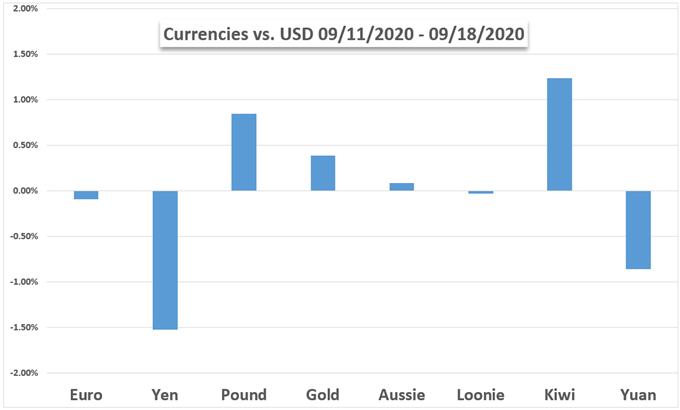

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD

.jpg)