By Todd Rosenbluth, CFRA

By Todd Rosenbluth, CFRA

Invesco QQQ Belief (QQQ) has been one of the crucial common ETFs in 2020, pushed by favorable investor sentiment towards Amazon.com (AMZN), Apple (AAPL), Microsoft (MSFT) and different large-cap progress shares within the Covid-19 pushed new regular. Nevertheless, the ETF misses out on many up-and-coming corporations that fall outdoors of the top-100 non-financial shares listed on the Nasdaq. That’s what makes Invesco NASDAQ Subsequent Gen 100 ETF (QQQJ), which launched in the present day, so attention-grabbing. QQQJ may have stakes in additional reasonably sized and Nasdaq-listed Dunkin’ Manufacturers Group (DNKN), Henry Schein (HSIC), and Lyft (LYFT) together with different rising corporations outdoors of the top-100 listed on the Nasdaq.

At CFRA Analysis, we predict what’s inside an ETF issues greater than its charge, whilst QQQJ’s 0.15% expense ratio is compelling. In score fairness ETFs and mutual funds, CFRA combines ETF holdings stage evaluation and fund attributes like efficiency and prices. An fairness fund is a basket of securities and with the advantages of transparency, we imagine buyers can perceive the danger and reward prospects of those holdings. We mix this evaluation with a evaluate of efficiency and prices.

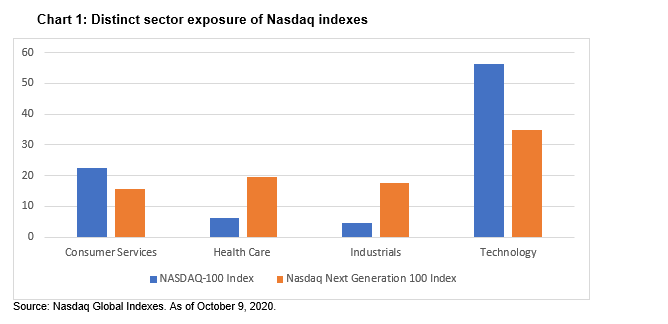

Whereas QQQ is sometimes called a Know-how ETF, the NASDAQ-100 index had a 56% weighting within the sector as of October 9, in accordance FTSE classifications information from Nasdaq, with 23% in Shopper Companies and 6.4% in Well being Care, respectively. In distinction, the NASDAQ Subsequent Technology 100 Index tracked by QQQJ had a 35% place in Know-how with 20% in Well being Care and 16% in Shopper Companies.

In accordance with John Hoffman, Head of Americas, ETFs & Index Methods at Invesco, at the moment there are 35 corporations which are in QQQ that was once a part of the index behind QQQJ and have graduated. He added the commonality is many of those corporations are utilizing know-how to disrupt the industries they’re in, relatively than being labeled within the Know-how sector.

QQQJ may simply be paired with QQQ or the lower-priced Invesco NASDAQ 100 ETF (QQQM), which additionally launched on Tuesday, to supply publicity to the top-200 large-cap progress shares that trades on the Nasdaq. Buyers typically ignore the mid-cap house, selecting to construct portfolios targeted on the biggest or the smallest corporations. However QQQJ will present distinctive publicity that warrants additional consideration.

Todd Rosenbluth is Director of ETF & Mutual Fund Analysis at CFRA.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.