By Gabor Gurbacs, Director, Digital Belongings Technique; Kyle DaCruz, Product Supervisor, Lively M

By Gabor Gurbacs, Director, Digital Belongings Technique; Kyle DaCruz, Product Supervisor, Lively Methods; Denis Zinoviev, Affiliate Product Supervisor, ETFs

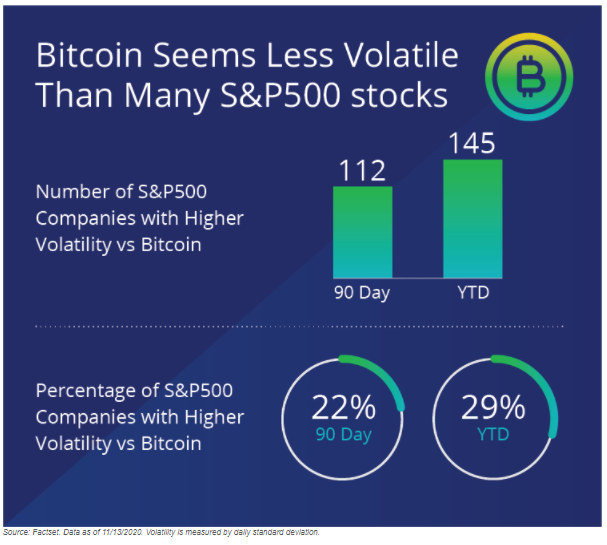

Traditionally, bitcoin has been mentioned within the information and amongst traders as a nascent and unstable asset exterior of the normal inventory and capital markets. A lot of the volatility over the previous few years might be attributed to sensitivity to small complete market measurement, regulatory hurdles and usually restricted penetration in mainstream inventory and capital markets. Whereas bitcoin continues to be a unstable asset, it could shock researchers and traders as to what different main belongings have been extra unstable than bitcoin.

In our long-term research of bitcoin, we had in contrast bitcoin correlations to conventional asset courses and now see one other fascinating current pattern with its volatility. In our present volatility analysis, we in contrast the 90 day and 12 months thus far volatility—as measured by their each day customary deviation[1] as of November 13, 2020—of bitcoin towards the constituents of the S&P 500 Index. We discovered that bitcoin has exhibited decrease volatility than 112 shares of the S&P 500 in a 90 day interval and 145 shares YTD.

Whereas there aren’t any U.S. bitcoin alternate traded funds (ETFs) obtainable in the present day, we imagine such merchandise might present comparable volatility traits—primarily based on the comparability above—as many shares in well-known indices and ETFs, such because the S&P 500 and associated merchandise.

Initially revealed by VanEck, 11/20/20

DISCLOSURES

1 Customary deviation is a statistic that measures the dispersion of a dataset relative to its imply and is calculated because the sq. root of the variance.

This isn’t a proposal to purchase or promote, or a solicitation of any supply to purchase or promote any of the securities/monetary devices talked about herein. The knowledge introduced doesn’t contain the rendering of customized funding, monetary, authorized, or tax recommendation. Sure statements contained herein might represent projections, forecasts and different ahead trying statements, which don’t replicate precise outcomes, are legitimate as of the date of this communication and topic to vary with out discover. Data offered by third get together sources are believed to be dependable and haven’t been independently verified for accuracy or completeness and can’t be assured. The knowledge herein represents the opinion of the creator(s), however not essentially these of VanEck.

All indices are unmanaged and embody the reinvestment of all dividends however don’t replicate the fee of transactions prices, advisory charges or bills which might be usually related to managed accounts or funding funds. Indices have been chosen for illustrative functions solely and usually are not securities through which investments might be made.

The S&P® 500 Index: a float-adjusted, market-cap-weighted index of 500 main U.S. corporations from throughout all market sectors.

All S&P indices listed are merchandise of S&P Dow Jones Indices LLC and/or its associates and has been licensed to be used by Van Eck Associates Company. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P International, Inc., and/or its associates. All rights reserved. Redistribution or replica in complete or partly are prohibited with out written permission of S&P Dow Jones Indices LLC. For extra data on any of S&P Dow Jones Indices LLC’s indices please go to www.spdji.com. S&P® is a registered trademark of S&P International and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third get together licensors make any illustration or guarantee, categorical or implied, as to the flexibility of any index to precisely symbolize the asset class or market sector that it purports to symbolize and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their associates nor their third get together licensors shall have any legal responsibility for any errors, omissions, or interruptions of any index or the information included therein.

All investing is topic to danger, together with the potential lack of the cash you make investments. As with all funding technique, there isn’t any assure that funding aims will probably be met and traders might lose cash. Diversification doesn’t guarantee a revenue or shield towards a loss in a declining market. Previous efficiency isn’t any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.