Data and analytics little doubt play a significant position in giving corporations the knowledge th

Data and analytics little doubt play a significant position in giving corporations the knowledge they should make sound funding selections. As extra information turns into out there within the debt markets, funds just like the VanEck Vectors Moody’s Analytic (MBBB) can incorporate a quantitative technique tilt for numbers-focused ETF buyers.

MBBB seeks to trace, as intently as doable, earlier than charges and bills, the worth and yield efficiency of the MVIS® Moody’s Analytics® US BBB Company Bond Index, which incorporates BBB rated company bonds which have engaging valuations and a decrease likelihood of being downgraded to excessive yield in comparison with different BBB rated bonds.

Total, the fund offers buyers a:

- Portfolio of BBB rated bonds with engaging valuations relative to their “Anticipated Default Frequency”

- Quantitative strategy supported by Moody’s Analytics’ in depth dataset and a crew of 30 researchers

- Course of pushed by the identical platform that powers credit score threat administration at over 650 of the world’s largest institutional buyers

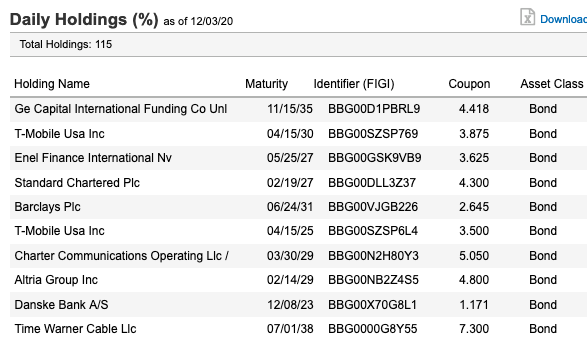

Taking a look at its high 10 holdings, you’ll be able to see a pleasant mixture of company debt points. Because the debt market continues to be on shaky floor amid the pandemic (like the remainder of the capital markets), MBBB has an assortment of short-term debt and long-term debt the place essential to account for period threat.

How Does the MBBB ETF Work?

How precisely does MBBB choose its holdings? A Searching for Alpha publish that includes Invoice Sokol, Director of ETF Product Administration at VanEck, highlighted the necessity for utilizing a quantitative strategy in funding grade company debt when it got here to funds like MBBB:

“We expect {that a} quantitative strategy makes a whole lot of sense within the funding grade bond market if you’re attempting to establish essentially the most attractively valued bonds, as a result of it permits you to be extra forward-looking and consider what the market is telling you,” Sokol mentioned. “That is in distinction to a extra elementary strategy by means of monetary assertion evaluation, or by counting on credit score rankings alone, which are likely to lag the market and doubtless will not offer you the suitable alerts which are frequent sufficient as a way to establish these worth alternatives after they come up. Moody’s Analytics is the business chief when it comes to credit score threat modeling. Their mannequin is backed by an intensive information set of worldwide bond default and restoration information over a number of many years.”

“It is also supported by a crew of over 30 researchers. And that is why a whole lot of the world’s largest establishments depend on Moody’s Analytics for his or her credit score threat administration selections,” Sokol added.

For extra information and data, go to the Tactical Allocation Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.