USD/JPY ANALYSISLengthy-term pattern stays bearishUpcoming US inflation knowledgeIG Shopper Sentiment (IGCS) blended

USD/JPY ANALYSIS

- Lengthy-term pattern stays bearish

- Upcoming US inflation knowledge

- IG Shopper Sentiment (IGCS) blended

The safe-haven Japanese Yen (JPY) has remained resilient towards the US Greenback regardless of vaccine optimism and a broadly risk-on international sentiment. Whereas the Yen has fallen towards most different main currencies, USD/JPY stays beneath stress.

TECHNICAL ANALYSIS

Beneficial by Warren Venketas

Get Your Free JPY Forecast

USD/JPY Each day Chart:

Chart ready by Warren Venketas, IG

USD/JPY worth motion has reverted to a sideways motion since mid-November with evident help and resistance zones. These candles have shaped a rectangle sample (blue) preceded by a bearish/downward pattern. That is extra generally known as a bearish rectangle sample which suggests the potential for additional draw back ought to costs break beneath help.

The bearish case stays with the November swing low 103.12 offering preliminary help ought to the breakout beneath rectangle help happen with the 103.00 psychological stage because the secondary goal.

The much less doubtless, however nonetheless doable, case for an upside break above rectangle resistance may deliver the important thing 105.00 horizontal stage in to consideration with additional resistance at 105.68 (November swing excessive).

The Relative Energy Index (RSI) substantiates worth motion as it’s at present across the 50 stage which means no directional bias. The 59 stage (crimson) stays as resistance on this indicator as worth has topped at this stage in the previous few months. Ought to worth push towards this stage, it needs to be monitored as the extent has been established as a key space of confluence.

Begins in:

Reside now:

Dec 09

( 16:12 GMT )

Maintain updated with worth motion setups!

Weekly Inventory Market Outlook

Additional your information with different in style continuation patterns embrace the rising wedge, falling wedge and pennant patterns!

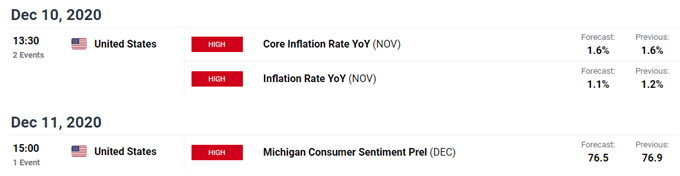

MINIMAL CHANGE EXPECTED IN US INFLATION DATA

At the moment’s inflation announcement is estimated to have negligible influence on the USD/JPY as forecasts are roughly according to earlier figures. Ought to precise figures deviate considerably from estimates there could also be giant worth motion swings.

DailyFX Financial Calendar

Beneficial by Warren Venketas

Buying and selling Foreign exchange Information: The Technique

Key factors to contemplate:

- USD/JPY: Rectangle sample breakout

- RSI 59 resistance stage

- US inflation knowledge

IG CLIENT SENTIMENT SUPPORTIVE OF TECHNICAL CONSOLIDATION

| Change in | Longs | Shorts | OI |

| Each day | -1% | -11% | -5% |

| Weekly | -7% | 2% | -4% |

IGCS exhibits retail merchants are at present web lengthy on USD/JPY, with 66% of merchants at present holding lengthy positions (as of this writing). At DailyFX we usually take a contrarian view to crowd sentiment, and the very fact merchants are net-long is suggestive of a bearish bias on the pair nonetheless, attributable to the next web change in brief positions relative to lengthy positions we settle at a blended sign.

— Written by Warren Venketas for DailyFX.com

Contact and comply with Warren on Twitter: @WVenketas