American shares are on the ropes to open 2021, led by large losses within the indices. On the midway level of the Wall Avenue session, the DJIA DO

American shares are on the ropes to open 2021, led by large losses within the indices. On the midway level of the Wall Avenue session, the DJIA DOW (-641), S&P 500 SPX (-80), and NASDAQ (-288) are all deep into the crimson. To date, the sentiment is overwhelmingly adverse as merchants think about the opportunity of Congress difficult the Electoral Faculty later this week.

Other than final November’s Election Day, this week has the potential to be probably the most politically-charged in latest historical past. On Tuesday, the Georgia runoffs are scheduled to happen, with the steadiness of energy within the Senate at stake. Wednesday, final month’s Electoral vote is predicted to turn into official, making Democratic challenger Joe Biden the following POTUS. Nonetheless, there’s a rising motion in Congress designed to problem the Electoral Faculty’s vote. Subsequently, right here’s the place issues stand on each fronts:

- Present odds have the Georgia Senate races between Warnock/Loeffler and Ossoff/Perdue in close to toss-up territory.

- Main rallies are scheduled in Washington D.C. to protest the November election. President Trump is scheduled to talk in entrance of the White Home through the 6 January rally.

- At this hour, greater than 100 Republican members of Congress plan to object to the certification of the Electoral Faculty on Wednesday. Amongst these numbers, 12 Senators are standing in assist of the motion.

As a normal rule, markets hate uncertainty. Given this week’s political docket, it appears like traders are bailing out of shares forward of any shock chaos.

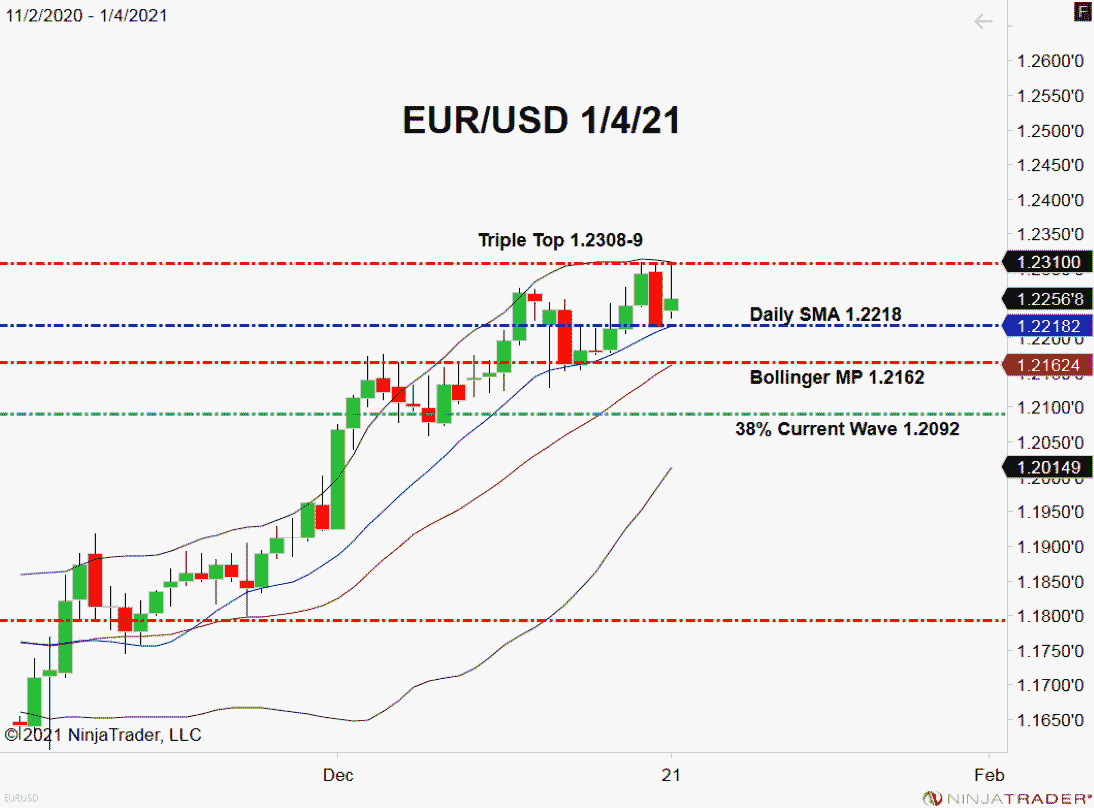

Shares Plummet, EUR/USD Kinds Each day Triple High

One of many beneficiaries of at this time’s plunge in American shares has been the Dollar. In truth, since an early-session rally, the EUR/USD has fallen greater than 50 pips from simply north of 1.2300.

+2021_01_04+(10_22_54+AM).png)

Listed here are the important thing ranges to look at on this market because the week unfolds:

- Resistance(1): Triple High, 1.2308-9

- Assist(1): Each day SMA, 1.2218

- Macro Assist(1): 38% Present Wave, 1.2092

Backside Line: Within the occasion that shares enter correction this week, a shopping for alternative could come into play from EUR/USD’s macro-wave 38% Fibonacci Retracement (1.2092). For the remainder of the week, I’ll have purchase orders within the queue from 1.2106. With an preliminary cease loss at 1.2074, this commerce produces 64 pips on a 1:2 threat vs reward administration plan.