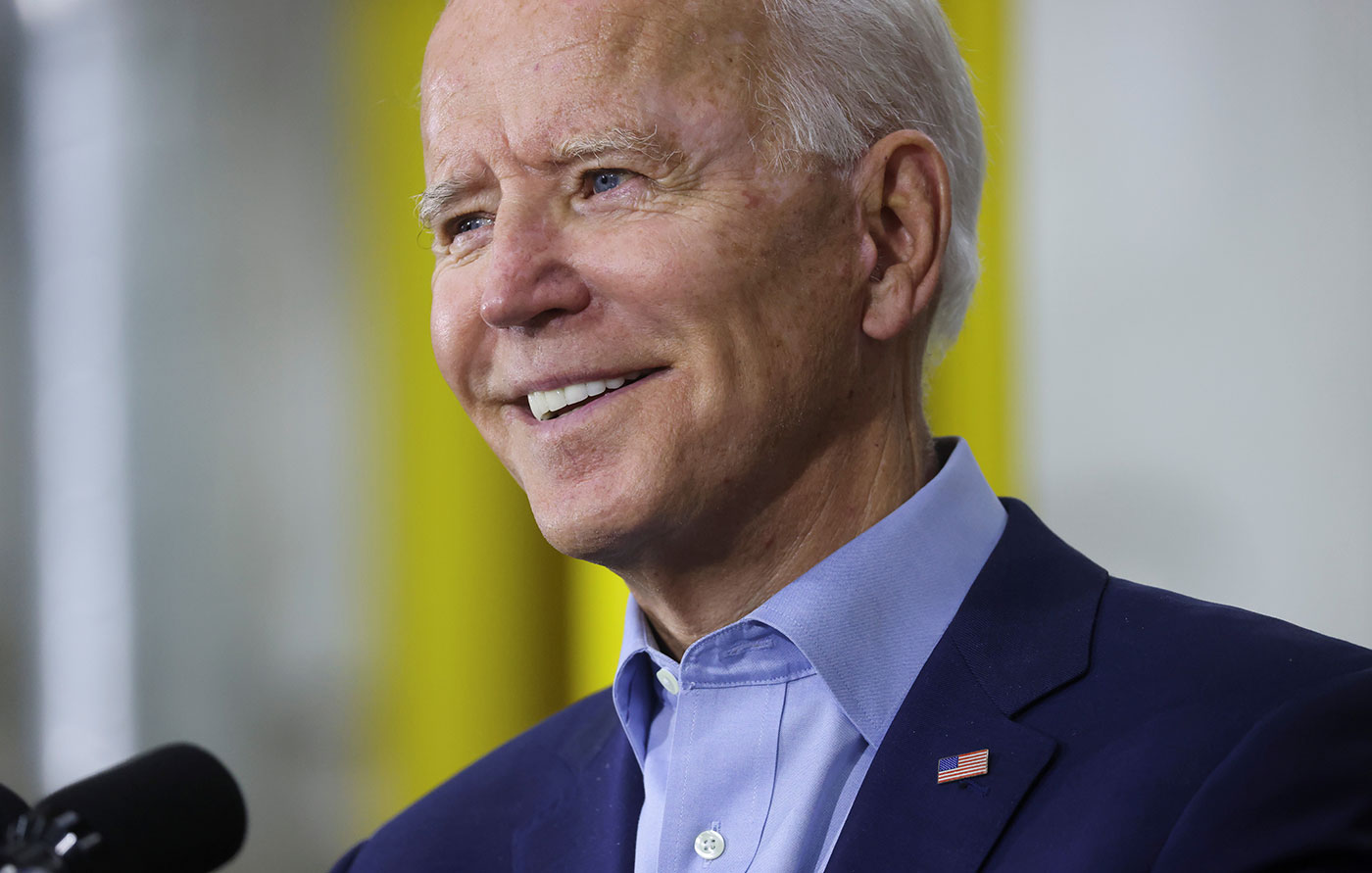

On Wednesday, Joe Biden was sworn in because the 46th president of america. Clearly, it has been gr

On Wednesday, Joe Biden was sworn in because the 46th president of america. Clearly, it has been greater than two months since Election Day and practically three weeks because the Senate runoff elections in Georgia, giving market members ample time to digest the notion of the Democrats controlling the White Home and each homes of Congress.

Buyers appear to be at peace with that. Over the previous 90 days, the Nasdaq-100 Index (NDX) is increased by 14.08 p.c. That features a 4.11 p.c achieve over the previous month – a interval together with the Democrats capturing the Georgia Senate seats and Biden pitching a $1.9 trillion stimulus bundle.

As is at all times the case with a altering of the guard on the White Home, Biden’s victory is stoking ample chatter relating to what investments are poised to learn beneath the brand new administration. After all, alternate traded funds make for environment friendly avenues for accessing methods and themes poised to learn from the brand new president’s coverage goals.

A few of these methods are already hovering with apparent beneficiaries together with hashish and clear power ETFs, amongst others. Listed below are a couple of extra ETFs that would ship for traders beneath the Biden presidency.

World X U.S. Infrastructure Growth ETF (PAVE)

The World X U.S. Infrastructure Growth ETF and rival infrastructure funds spent a lot of the second half of 2020 rallying in anticipation of Election Day. The thesis was, and it nonetheless holds true, is that infrastructure is a bipartisan subject, so PAVE wasn’t tethered to a selected election end result.

Moreover, large-scale home infrastructure aren’t simply wanted and wanted as quickly as doable, infrastructure makes for a sensible avenue for rejuvenating an financial system nonetheless feeling the consequences of the coronavirus pandemic.

“Biden ran on a platform that featured aggressive infrastructure funding as a key pillar of financial coverage and potential COVID-19 restoration efforts,” writes World X analyst Andrew Little. “His $2 trillion cleantech and infrastructure plan seeks to supply stimulus and job-creation by constructing and retrofitting bodily infrastructure that facilitates commerce and improves the American high quality of life.”

There are compelling causes to spend and spend large on infrastructure. Politicians looking for reelection know this and that might be a catalyst to lastly get a complete infrastructure carried out.

“Whereas the sudden and extreme onset of the COVID-19-induced recession created new budgetary challenges, it additionally supplied a chance for renewed infrastructure spending,” notes S&P World. “S&P World Economics estimates {that a} $2.1 trillion increase in public infrastructure spending over 10 years, to the degrees (relative to GDP) of the mid-20th century, might add as a lot as $5.7 trillion to the U.S. over the following decade, creating 2.three million jobs by 2024 because the work is being accomplished.”

Invesco Photo voltaic ETF (TAN)

The Invesco Photo voltaic ETF returned a staggering 233.9 p.c final 12 months with a lot of that efficiency attributable to an array of Democratic presidential candidates pitching bold renewable power platforms. Clearly, Biden is now president and he is received his personal large-scale clear power objectives that decision for $2 trillion in spending.

Photo voltaic is a centerpiece of the Biden agenda and TAN displays as a lot, climbing greater than 18 p.c to start out 2021. TAN is exceedingly related as a result of photo voltaic is adaptable for company and residential consumption and with costs declining, extra clients can go inexperienced.

As of late final 12 months, photo voltaic was only a $53 billion business on a worldwide foundation, however analysts consider that determine might exceed $223 billion by 2026, indicating there’s nonetheless important long-term potential with TAN.

This 12 months, the dangers to contemplate with TAN are twofold. First is historical past repeating, that means TAN was a dreadful performer for many of the Obama Administration. Second, enthusiasm for Biden’s inexperienced power objectives and the president’s guarantees are closely baked into photo voltaic equities, making TAN and its parts susceptible to disappointment. The excellent news is that a few of that vulnerability is defrayed by states setting their very own local weather change agendas and extra nations outdoors the U.S. embracing renewable power.

WisdomTree Cloud Computing Fund (WCLD)

One benefit of the WisdomTree Cloud Computing Fund is that its skill to ship for traders is not instantly depending on the president, no matter social gathering. On that foundation, it makes for a related inclusion on this listing as a result of it could act as a diversifier with PAVE and TAN, which could be moved by political jostling.

The most recent of the devoted cloud computing ETFs, WCLD is separating itself from the pack by way of efficiency, having greater than doubled final 12 months. Asking WCLD to repeat that displaying is tough, however extra upside is a professional chance.

“Even inside this excessive performing basket of market disruptors, the businesses main the pack on this race of market efficiency are beginning to emerge,” based on Bessemer, the agency that companions with Nasdaq on WCLD’s index. “We consider that greater than a dozen corporations inside this elite public basket will turn into long run market leaders; nevertheless, 4 are prime contenders—Salesforce, Adobe, Shopify, and Twilio. Microsoft and Amazon are the 2 further corporations to comply with inside the broader tech business contemplating each how shortly they’ve embraced cloud computing and the way elementary cloud is to their development technique.”

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.