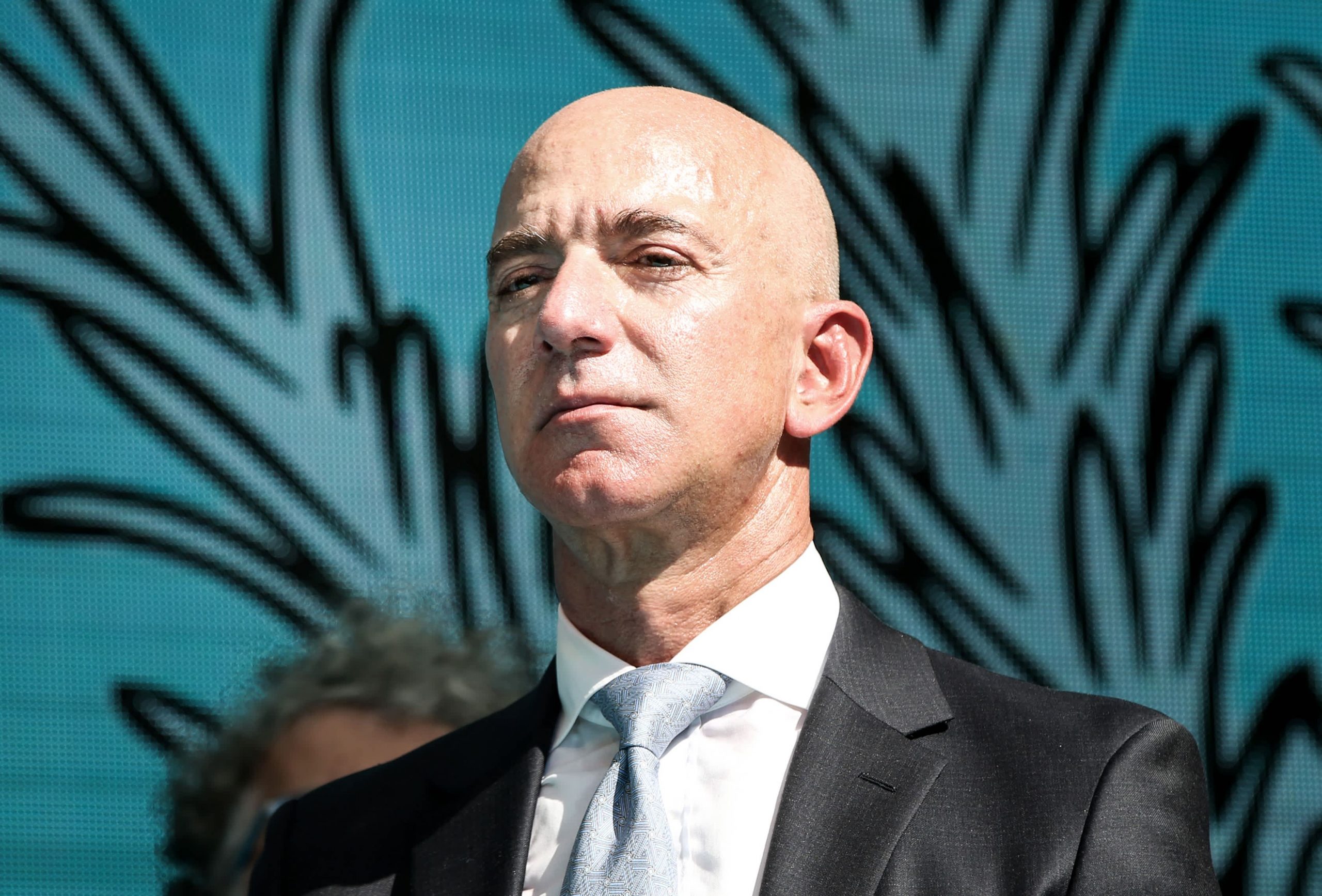

Jeff Bezos would owe about $2 billion a yr in state revenue taxes beneath Washington's proposed wealth tax, based on legislators.As a part of an ef

Jeff Bezos would owe about $2 billion a yr in state revenue taxes beneath Washington’s proposed wealth tax, based on legislators.

As a part of an effort to scale back inequality and offset the state’s lack of an revenue tax, Washington state legislators are proposing a 1% levy on wealth over $1 billion. Lawmakers say the tax would increase about $2.5 billion a yr in income and would solely apply to so-called nontangible monetary property, or monetary investments like shares or choices.

But tax consultants say the state’s wealth tax can be overreliant on 4 megabillionaires who name Washington state house: Bezos, Invoice Gates, MacKenzie Scott and Steve Ballmer.

Jared Walczak of the Tax Basis wrote that 97% of the income from the tax would come from these 4 billionaires. Bezos, at the moment value about $200 billion, would owe about $2 billion a yr beneath the brand new tax. Gates, value about $135 billion, would owe about $1.three billion, whereas Ballmer would owe about $870 million. Scott, Bezos’ ex-wife, would owe about $600 million a yr.

Since none of Washington’s Huge 4 have any day-to-day company roles, they might merely transfer to a different state to keep away from the tax, critics mentioned. The truth is, for his or her income estimate, state tax consultants might have assumed that Bezos, who simply stepped down as Amazon CEO, or one of many others would depart, because the complete quantity of taxes owed by the 4 billionaires exceeds the $2.5 billion projection.

Walczak mentioned any of those people might transfer to a different state, setting it as their main residence, and nonetheless spend as much as 182 days a yr in Washington state and keep away from the tax.

“This is able to not solely foil the wealth tax however would deprive the state of different income as effectively,” Walczak mentioned. “These rich residents nonetheless pay a disproportionate share of state and native taxes and contribute considerably to the native economic system. Chasing them out would have severe penalties past the failure of a brand new tax.”

Proponents say the wealth tax is required to deliver equity to essentially the most unequal tax system within the nation. As a result of it has no revenue tax, and raises authorities income from gross sales tax, property taxes and different taxes, low- and middle-income taxpayers pay a bigger share of their revenue in state taxes, they are saying.

Noel Body, the state consultant who launched the invoice, mentioned the bottom earners pay 18% of their revenue in state taxes whereas the highest 1% pay 6% of their revenue in state taxes.

“We have now a tax code that’s totally inequitable,” Body mentioned. “I simply do not assume that is acceptable any longer.”

Body mentioned that by solely taxing monetary property, Washington’s wealth tax avoids the issue of making an attempt tax property like artwork, actual property, collectibles and different property which might be onerous to worth.

Whereas the Huge 4 would bear the brunt of the tax, she mentioned the state’s Division of Income estimates that there are almost 100 billionaires within the state who might pay the tax, spreading out the danger. Forbes estimates Washington has a couple of dozen billionaires.

As for the criticism that the state’s high billionaires might go away, she mentioned that except Bezos, the remainder of Washington’s billionaires have sturdy ties to it.

“The concept that they’ll simply choose up and go away is a cynical view and it isn’t supported by proof,” Body mentioned, citing research that states that hiked taxes on the rich did not see a larger-than-expected improve in outmigration by millionaires and excessive earners.

But a concentrated tax on only a handful of mega-billionaires could possibly be completely different. Orion Hindawi, co-founder and CEO of Tanium, who just lately moved his household and his firm to Washington from California, mentioned throughout a chat with the Washington Know-how Trade Affiliation that the state would lose its competitiveness if it raised taxes on the rich.

With distant conferences and on-line productiveness, he mentioned staff and executives are now not tied to at least one metropolis or state like they was. He mentioned a wealth tax might be considered as “vilification” by his friends.

“The truth of the scenario is that people who find themselves in Washington state have flexibility they didn’t have a yr in the past, and that’s persistent flexibility,” Hindawi mentioned. Excessive earners and versatile staff, he mentioned, “are mainly nation-states in their very own proper. They will transfer wherever they need, and it is trivial.”