Value shares are again in vogue, however buyers mul

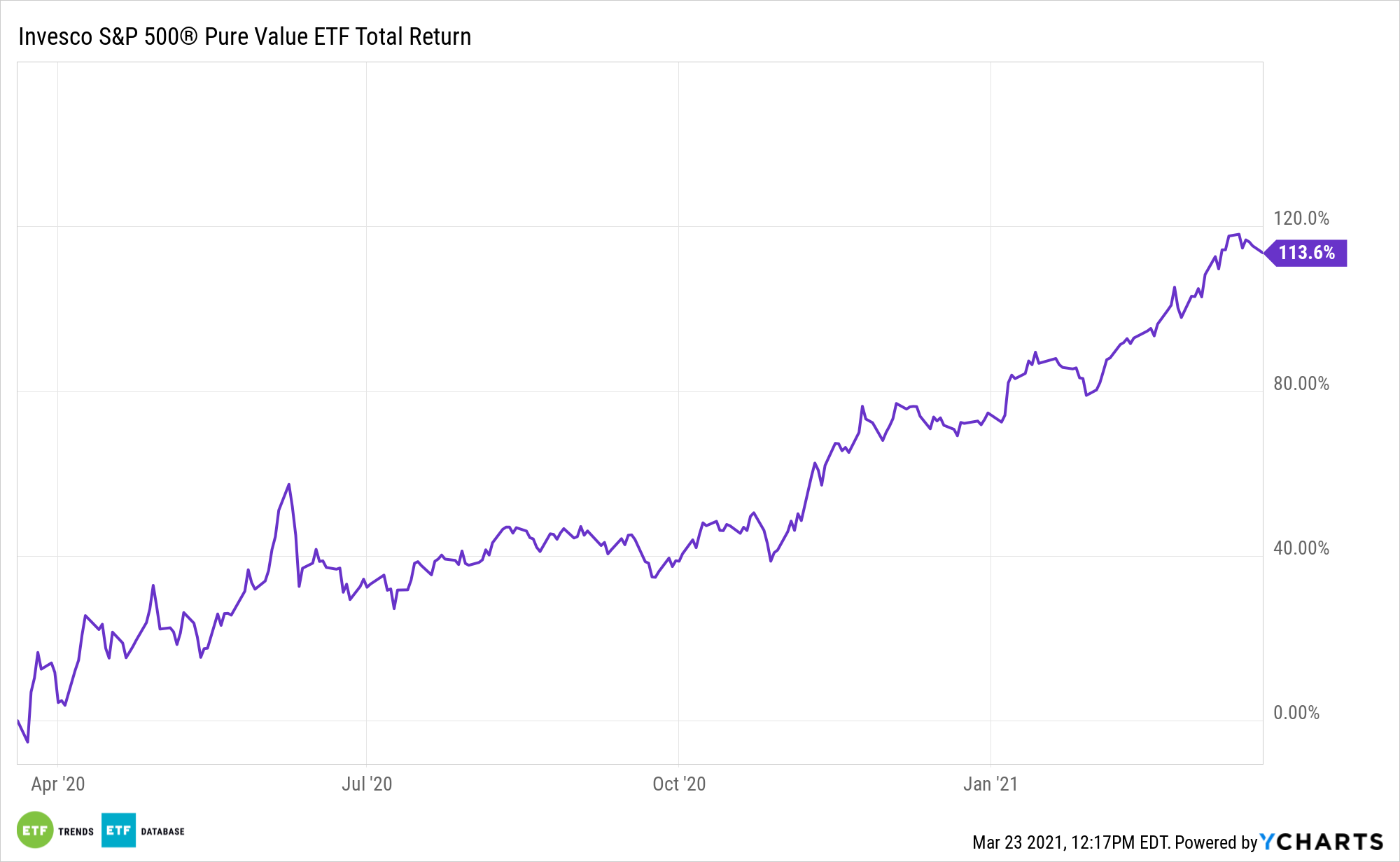

Value shares are again in vogue, however buyers mulling entry through trade traded funds ought to take into account these funds’ purity. That is a bell answered by the Invesco S&P 500® Pure Worth ETF (RPV).

RPV maintains a “pure worth” focus, holding a comparatively small variety of companies that display essentially the most vital worth traits.

The fund is a extra focused selection for these buyers who’re in search of to focus explicitly on worth corporations. Not surprisingly, RPV reveals a bias towards sure sector of the U.S. economic system, typically tilting publicity in direction of monetary corporations, which is a profit as Treasury yields rise.

“After a 14-year stretch of outperformance for progress shares in comparison with worth, buyers appear to lastly be rewarding the left-behind names. That is smart: worth sectors are likely to do higher in the beginning of an financial cycle, in any case. However there have been a number of worth head fakes over time, and growthier names seize extra headlines,” reviews Andrea Riquier for MarketWatch.

Why Now for RPV

Gone are the times when the FAANGs (Fb, Amazon, Apple, Netflix, Google) dominated the earth, not less than for now. The rotation to worth has been exceedingly obvious by the lens of 2021 ETF inflows.

In accordance with MarketWatch: “Progress’s dominance relative to worth peaked within the fall of 2020,” wrote Keith Lerner, chief market strategist, and Dylan Kase, funding analyst, at Truist Advisory Companies.

“We nonetheless see extra upside in worth relative to progress over the subsequent 12 months given worth’s dramatic longer-term underperformance in addition to the U.S. economic system being on the cusp of the perfect progress in additional than 35 years,” they added. “It will not be uncommon to see worth consolidate a few of its current outperformance, however we might persist with the worth development and use any short-term setbacks so as to add to the place.”

The reversal of fortunes for the worth play has been years within the making after huge progress names, notably expertise shares, outperformed for the reason that monetary disaster.

Many look to the extra engaging valuations within the worth phase, particularly after a rally final yr that elevated costs on expertise and progress names. On the finish of February, the Russell 1000 Worth Index was hovering round 21.89 occasions the previous 12 months’ earnings, in response to FTSE Russell. Compared, the Russell 1000 Progress Index was buying and selling at round 37.22 occasions earnings.

For extra information, data, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.