The five-page temporary focuses on arguments about what drives productiveness, wage development, innovation and fairness within the economic system

The five-page temporary focuses on arguments about what drives productiveness, wage development, innovation and fairness within the economic system. All are points that predate the coronavirus recession and restoration, and which Democrats, specifically, have pledged for years to handle.

It begins by attacking the “outdated orthodoxy” of tax-cutting insurance policies by presidents and Congress, together with the 2017 tax lower regulation handed by Republicans beneath President Donald J. Trump. A driving rationale behind these cuts was an effort to encourage extra funding by non-public companies, boosting what economists name the nation’s capital inventory. The temporary faults these insurance policies for not producing the fast positive aspects in financial development that the champions of these insurance policies promised, and it says that elevating taxes on excessive earners “will assist make sure that the positive aspects from financial development are extra broadly shared.”

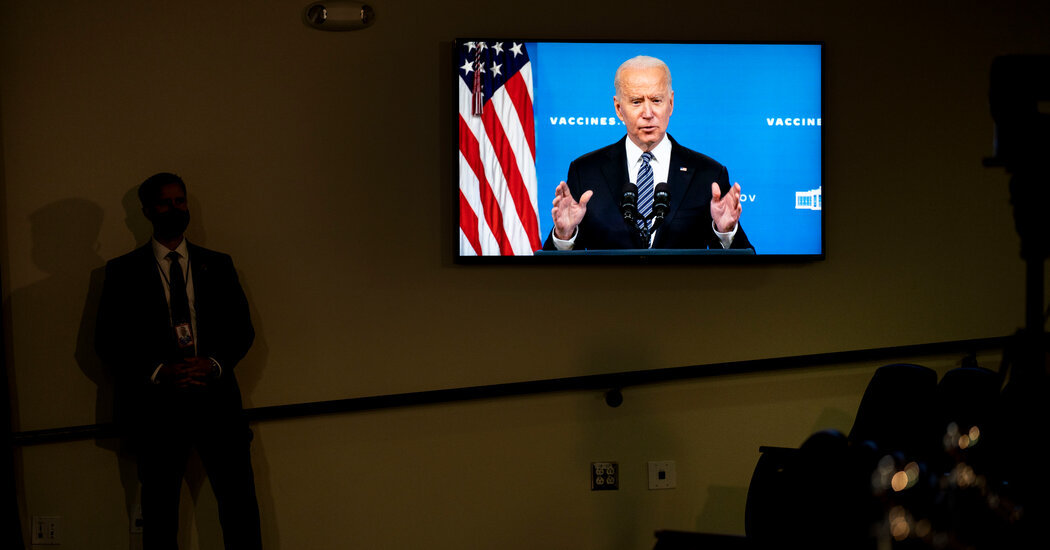

It additionally recounts what it calls the federal authorities’s underinvestment in insurance policies that assist educate youngsters and adults, facilitate the event of recent applied sciences and industries and assist mother and father in order that they can work and earn extra. It singles out the wave of fast-developed Covid-19 vaccines from Pfizer and Moderna, which grew out of publicly funded analysis, for example of public investments yielding private-sector innovation.

“These began with concepts that have been funded by the general public sector a long time in the past,” Dr. Rouse mentioned. “After which the non-public sector constructed on prime of that, so it’s actually, the non-public sector must work with the general public sector. We’re all very grateful that the general public sector was keen to take that threat, and it didn’t repay straight away.”

“In some ways, the federal authorities must be affected person,” she mentioned. “We’re a form of entity, we must be affected person. So I’m not saying we now have to attend one million years for one thing to repay, however we don’t must have the form of instant payoff {that a} non-public firm may must see.”

That argument is, in some ways, a departure from how administrations usually pitch financial insurance policies throughout a disaster. There is no such thing as a focus within the temporary on instant job creation or a fast bump in financial development.

Weeks after Mr. Biden detailed each halves of his plan, the administration nonetheless has supplied no projections in regards to the influence of his insurance policies on jobs or development. As a substitute, Dr. Rouse and others within the administration have taken to citing forecasts by the Moody’s Analytics economist Mark Zandi, that are among the many extra favorable exterior analyses of Mr. Biden’s agenda.