Last week, the variety of US jo

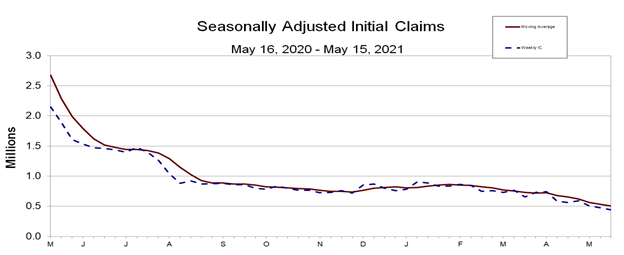

Last week, the variety of US jobless claims fell to 440,000, the bottom quantity for the reason that COVID-19 pandemic started final March, the Division of Labor reported.

The variety of weekly claims has continued to fall all 12 months, an encouraging signal that the job market continues to enhance, spurred by the persevering with vaccination rollout and the comparatively fast re-opening of the U.S. financial system.

Supply: Division of Labor, Could 20, 2020.

As of the week ending Could 1, about 16 million People have been nonetheless receiving unemployment advantages, down from 16.9 million People the week prior.

That too suggests an America that’s getting again to work.

Entrepreneurs: Poised to Profit from the Re-Opening

A lot of this enchancment within the U.S. employment market will be traced again to entrepreneurial companies, which are usually job creators, hiring aggressively to serve an aggressive tempo of progress.

Entrepreneurial firms present the services and products that disrupt their industries, leveraging cutting-edge know-how and the newest scientific developments to vary the way in which enterprise is completed in the whole lot from bioscience to vogue.

Used to disrupting the established order, these firms can also typically provide enticing perks for potential workers, together with flex work hours, beneficiant PTO and parental depart insurance policies, and distant work choices.

That makes them notably poised to profit from an financial reopening that acknowledges the brand new realities in workers’ lives, together with digital/hybrid education, elevated caretaking tasks, and higher reliance on digital types of communication and collaboration.

Entry Entrepreneurs with ‘ENTR’

Buyers looking for publicity to those job-creating entrepreneurial shares can look to the ERShares Entrepreneurs ETF (ENTR), from ERShares.

ENTR holds a concentrated basket of U.S. mid- and large-cap shares which can be screened in opposition to the issuer’s proprietary Entrepreneur Issue mannequin, which mixes lively administration with machine studying methods.

At the moment, the fund’s high sector exposures embody data know-how (36%), healthcare (23%), and communication companies (17%).

See additionally: How one can Entry the 5G Revolution by means of Entrepreneurial Shares

Contained in the portfolio are a number of of the same old FAANG names—Fb (FB), Alphabet (GOOGL), and Amazon (AMZN)—but additionally some much less acquainted performs on the disruptive innovation theme, together with Mercado Libre (MELI) and EPAM Programs (EPAM).

ENTR, which at the moment has $128 million in belongings underneath administration, has an expense ratio of 0.47%.

For extra data, go to the Entrepreneur ETF channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.