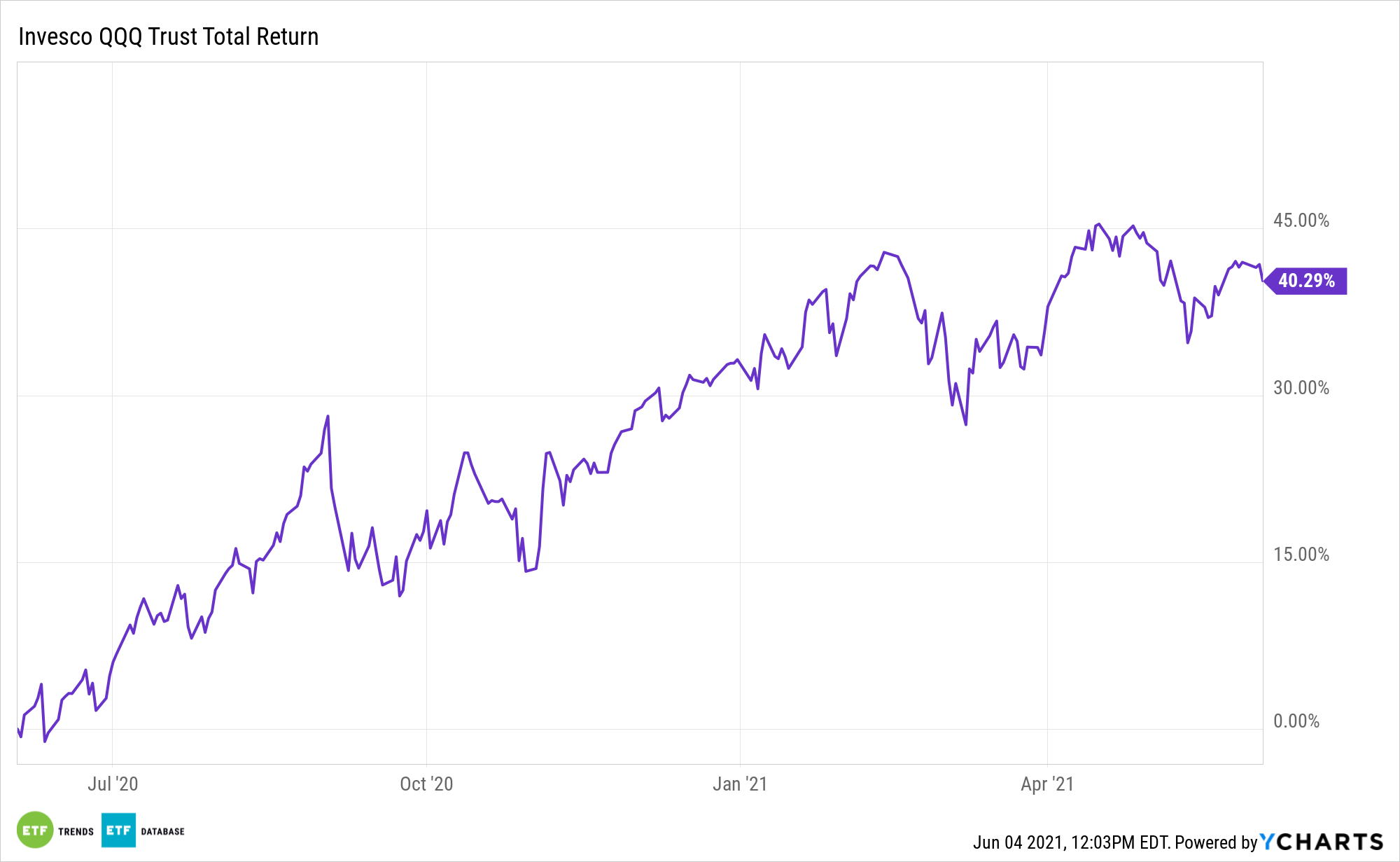

The Invesco QQQ Belief (QQQ), which tracks the extensively adopted Nasdaq-100 Index (NDX), is up 5.18% year-to-date. That is a tepid exhibiting relative to the legacy of the change traded fund and NDX, however that should not be motivation for traders abandon expertise shares.

With a 48% weight to tech and a deep development inventory profile, QQQ is lagging not due to poor fundamentals – broader tech sector fundamentals stay sturdy. Quite, the tech and development shares are trailing due to inflation fears, rising rates of interest lifting financial institution shares, and the financial cycle being within the restoration section – a interval that traditionally favors cyclical fare.

Nonetheless, traders ought to see the tech forest by way of the timber as a result of the long run is vivid for the sector.

“Estimates for calendar 12 months 2022 point out that the tech sector is predicted to have the fourth-highest income development of any sector,” notes Invesco Chief World Market Strategist Kristina Hooper.

Put up-Pandemic Attract for ‘QQQ’

As has been extensively famous, the coronavirus pandemic pressured extra speedy adoption of a plethora of modern applied sciences and ideas, lots of which QQQ has leverage to. Suppose fintech, healthcare innovation, on-line purchasing, streaming leisure, and extra.

Nonetheless, now that extra of us are getting vaccinated and healthcare professionals are higher capable of deal with the virus, there’s concern that a few of the tech niches that benefited from the pandemic are weak to retrenchment. The thesis is comprehensible. In spite of everything, folks need to exit and reside their lives once more, probably hurting the instances for on-line retailers and stay-at-home shares.

But most of the disruptive applied sciences and market segments QQQ offers publicity had been flourishing earlier than COVID-19. All of the pandemic did was transfer that adoption alongside. As Invesco’s Hooper notes, most of the modifications in conduct introduced on by the well being disaster could possibly be everlasting.

“For instance, e-commerce gross sales have dropped not too long ago as COVID-19 infections have fallen and folks have spent much less time sequestered at house; nonetheless I count on they’ll stay a really substantial portion of total retail gross sales — and that portion will quickly resume its rise as a proportion of total retail gross sales,” she mentioned.

To that time, QQQ allocates 17.4% of its weight to shopper discretionary shares, a number of of that are devoted on-line retailers.

As for tech, spending by each firms and shoppers is prone to speed up. Companies “lowered their tech spending in 2020, and due to this fact must spend extra in 2021 as a way to sustain. World info expertise spending is predicted to rise 8.4% in 2021, and it’s projected that the IT spending focus for 2021 will likely be on income development,” in line with Hooper.

For extra information, info, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.