By eVestment, a Nasdaq Firm

Web institutional move for non-cash methods was constructive within the first quarter of 2021, ending an almost three 12 months stretch of internet outflows, in accordance with the most recent Nasdaq Institutional Intelligence Quarterly Report.

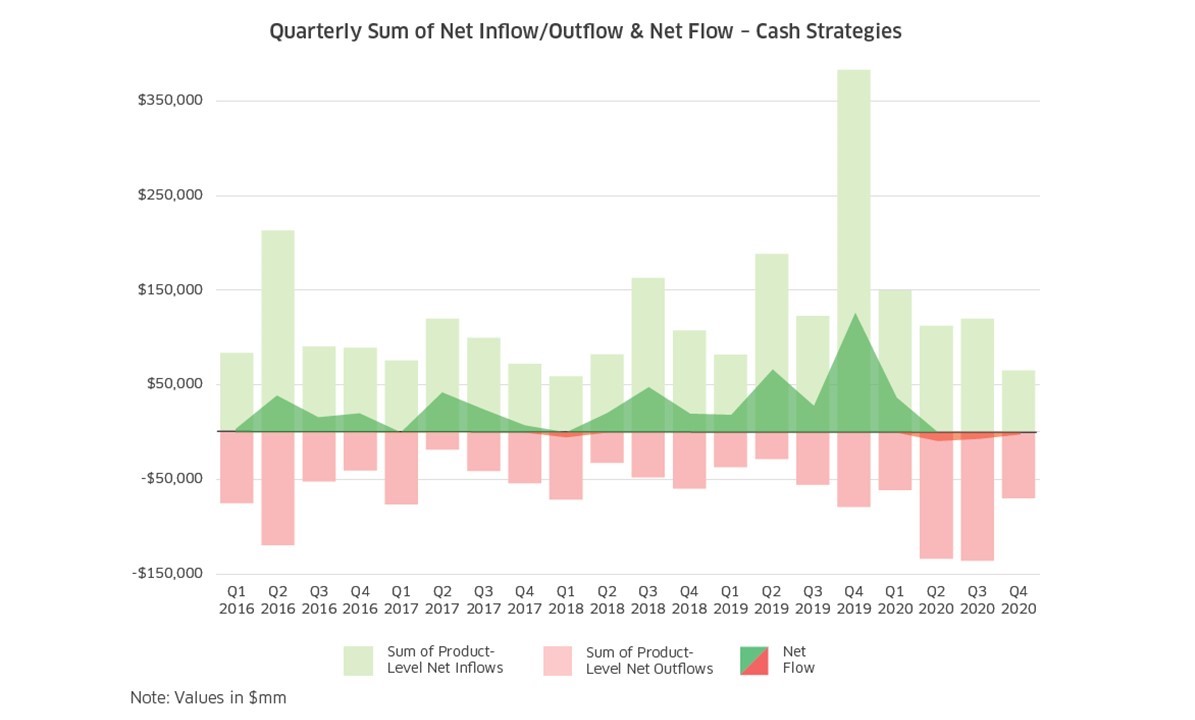

Belongings seemed to be popping out of money administration methods (internet), a reversal of a big medium-term theme. Web flows for money administration methods have been unfavourable in Q1, for the third consecutive quarter.

The web institutional move of property for conventional methods had been trending in a positive path previous to Q1 2021, changing into more and more much less unfavourable over the three quarters previous to Q1 2021.

Given the development within the knowledge, it isn’t a shock to see internet inflows throughout conventional non-cash methods in Q1, however it’s nonetheless important. Not solely was it the primary internet influx since Q1 2018, additionally it is the biggest internet influx of institutional property into non-cash methods since at the least 2005.

With institutional traders like pension funds, endowments, foundations, and sovereign wealth funds collectively making billion- and trillion-dollar investments that may transfer markets, figuring out the investments these massive traders and their consultants are reviewing might be insightful for monetary advisors. Whereas there are not any ensures in investing, figuring out that institutional funding tendencies typically precede retail funding tendencies can present early perception that may very well be invaluable to advisors.

The Nasdaq Institutional Intelligence Quarterly Report, based mostly on knowledge from Nasdaq’s institutional funding and intelligence platform eVestment, can present that early perception. The report delivers a worldwide and regional have a look at the drivers of institutional funding tendencies within the asset administration neighborhood, based mostly on knowledge offered by hundreds of asset managers world wide, reporting on greater than 26,000 energetic institutional funding methods and representing greater than $39 trillion in institutional investor property.

Different highlights from the brand new report embrace:

- There was a rebound of curiosity in US Passive Fairness in Q1 2021 and powerful internet demand for US Core and Quick Period Fastened Revenue, energetic and passive approaches for each classes. Web outflows have been concentrated in US Massive Cap Fairness, but additionally appeared in International Core Fairness and in a couple of US and International Fastened Revenue segments.

- Consultants world wide, primarily outdoors the US, confirmed giant or extremely elevated curiosity in International Core and Rising Markets Core Fairness methods, whereas asset homeowners within the US and Canada confirmed giant and elevated curiosity to International EM All Cap Fairness methods.

- Whereas asset homeowners in EMEA and APAC shared related pursuits in International Massive and All Cap Fairness methods, there have been giant quantities of curiosity in International EM Fastened Revenue from inside Germany, Saudi Arabia, and Singapore.

- There have been three Rising Markets universes among the many 5 most positively trending in Q1 2021, with two of them being EM Fastened Revenue methods. The most important influences for these merchandise look like coming from the Center East.

The Nasdaq Institutional Intelligence Quarterly Report highlights these and plenty of extra tendencies in easy-to-understand graphs, charts, and bullets and gives monetary advisors a glance right this moment into tendencies that can may form the funding panorama tomorrow.

To obtain a duplicate of the report, please click on right here. To look at the Nasdaq/eVestment quarterly tendencies briefing that additionally highlights a few of these tendencies, please click on right here.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.