- We consider return enhancements and diversification are the principle causes buyers search out different belongings and funding methods

- We consider conventional asset lessons publicity by typical asset allocation strategies don’t provide publicity to different danger premia

- Our analysis suggests there are diversification advantages from macro investing attributable to using extra versatile funding mandates to entry a broad vary of asset lessons and exposures

WHAT IS MACRO INVESTING

We spend a variety of time at Astor speaking about Macroeconomics and the self-discipline of macro-style investing. Based by Rob Stein on a philosophy that macro inputs are key to figuring out danger asset worth route, Astor has managed methods with macro variables as the important thing enter for practically 20 years. This contains multi-asset, sector rotation, revenue and pure different merchandise. Previous to Astor, our portfolio managers held positions managing quantitative macro funds, giant financial institution foreign money buying and selling, fairness choice buying and selling, and as Federal Reserve analysts.

[wce_code id=192]

Macro investing is an funding self-discipline that may make the most of a myriad of approaches, with lengthy and quick positions throughout a broad vary of asset lessons, to implement an funding thesis. The method that informs this thesis generally is a discretionary macroeconomic view (ie; inflation, oil worth provide/demand). It may also be decided by information evaluation between the connection of asset costs (ie; spreads, foreign money values), sometimes known as quantitative international macro. Our CIO of Astor mentioned in a latest weblog:

“Macro methods, in my thoughts, are the purest of other merchandise – in a position to go wherever and do something in a quest for returns for buyers.” – John Eckstein

Buyers have a great deal of choices in the case of passive fairness and glued revenue market publicity, all around the world. We consider these must be the core of each investor’s portfolio. However markets expertise volatility, and every investor’s wants are distinctive all through their investing lifecycle. Making a sturdy portfolio requires a stable core but additionally options that may add further worth over time. On this write up, we are going to talk about the attributes that we expect make Macro investing enticing.

WHY MACRO NOW

At any given level in market and financial cycles, there are points that buyers should cope with that require a change in outlook. Often there are extra extenuating issues, just like the tech bubble in 2000-01 and the monetary disaster in 2007-08 that ask extra from buyers. The worldwide pandemic of 2020 introduced as idiosyncratic an issue as buyers have ever confronted. Markets have by and enormous recovered as the worldwide financial system continues to fix. The present setting presents structural considerations that buyers and asset allocators should cope with.

Conventional portfolio allocations of equities and bonds run the chance of not offering enough return to buyers over the approaching years. We consider the mix of traditionally low yields and fairly-priced fairness markets counsel returns could also be exhausting to come back by, no less than if historic averages maintain true. Capital Market Assumptions have declined lately, forecasting decrease than common public funding returns. Yields are an enormous issue on this forecast. As we evolve from the worst of the pandemic, a brand new variable with potential dangers has entered the dialog: inflation. The financial acceleration in 2021 mixed with increased costs and structural employment points, might problem that ‘establishment’. Whereas some inflationary stress is welcome, increased ranges of sudden inflation might power the Fed to change gears on asset purchases and different accommodative insurance policies

which have helped the financial system (and fairness markets) lately. Buyers haven’t needed to mannequin for this in a while, which might affect portfolio outcomes and positioning.

Inflation or not, market dynamics have advanced prior to now yr. A post-pandemic financial acceleration is a possible consequence, however that won’t come with out its challenges, as mentioned. A goldilocks state of affairs of low charges with robust equities is feasible, however we really feel that isn’t the base-case state of affairs at this level.

THE USE CASE

Understanding how macro methods arrive at their consequence helps to assist their use case in an general portfolio. Lengthy publicity to conventional asset lessons like equities and glued revenue are what most buyers know. They arrive with sure danger and return profiles. However they’re simply that: lengthy publicity to a given danger premium. With the pliability to take completely different, directional funding positions, macro methods can take an lively outright publicity to a theme. They’ll additionally hedge the chance to current positions if warranted. Within the case of fairness

markets, for example, a macro technique can hedge by lowering, taking off or going quick the equities to mitigate this market particular danger. One other instance is inflation. A macro technique might hypothetically be lengthy oil as commodity costs rise, whereas additionally being quick U.S. Treasuries in expectation of rising yields.

Whereas a macro investing method actually can result in taking lengthy fairness asset class publicity, we consider the investing method tends to result in decrease correlation over time to equities and even fastened revenue. Correlation is the primary level of reference when evaluating diversification and alternate options choices. The choice’s universe is made up of passive belongings and lively methods, of which Macro investing is a kind. Different belongings and methods can have a decrease correlation to fairness and glued revenue belongings, to offer a diversification profit to conventional portfolio allocations.

The above desk is a simplified illustration of the connection amongst numerous asset lessons. For the aim of illustration by the remainder of the paper, we will probably be utilizing the HFRI Macro (Complete) Index as consultant of worldwide macro investing methods. That is an index of funding managers that make the most of a typical thematic technique of worldwide macro investing. The index contains managers that use each systematic and/or discretionary approaches to investing in broad monetary devices, with the frequent theme of how macroeconomic information will impacts asset costs.

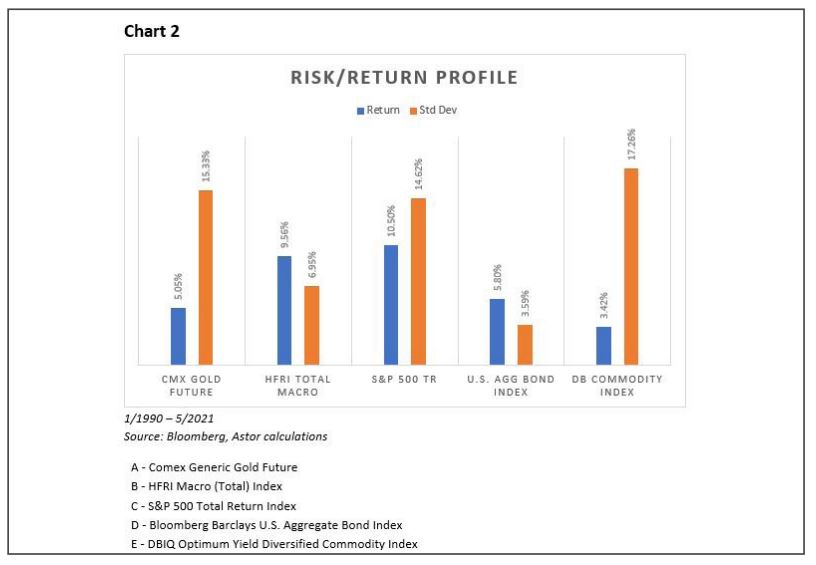

The S&P 500 and the U.S. Agg Bond Index signify historically utilized asset allocation instruments. Gold futures and the DB Commodity Index signify different belongings that may present passive different danger premia. The HFRI Macro (Complete) Index represents an aggregation of macro-focused funding types, additionally designed to show buyers to a novel different danger premia in comparison with conventional belongings.

Chart 2 beneath illustrates the return and danger profile of those investments. As isn’t any shock, top quality bonds (U.S. Agg Bond) provide a horny danger profile, which together with a secure yield attracts many risk-minded buyers and has supplied good diversification by its low correlation to fairness markets. Lately, public fairness markets have supplied probably the most enticing return, creating a possibility price for allocating to different asset lessons. Nevertheless, we are able to see beneath that over an extended time interval, different belongings can provide an inexpensive return, with some having larger risk-adjusted returns than public fairness markets, whereas offering stable correlation advantages to conventional asset allocation.

As yields have declined, particular person and institutional buyers alike added danger to their portfolios by ‘yield reaching’, growing the portfolio correlation to risk-based occasions. Because of this, conventional asset allocation might solely go thus far in occasions of market stress. We consider buyers can profit from different danger premia of their portfolio that at occasions have decrease correlations to conventional equities and glued revenue.

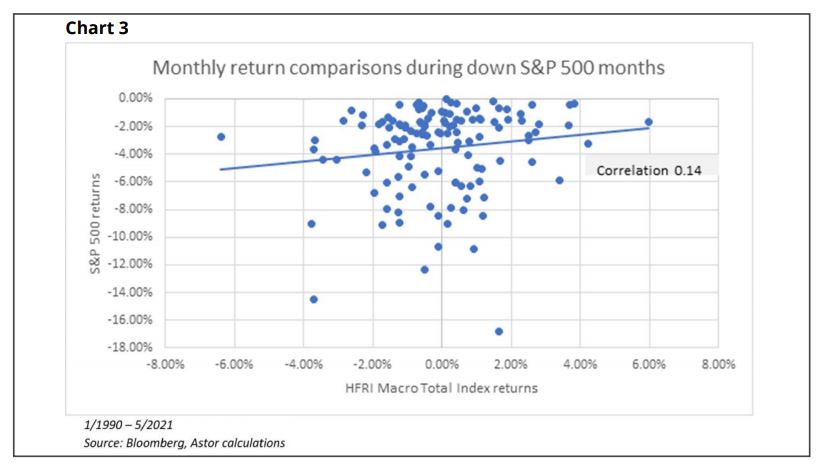

Wanting again to chart 1, we see the HFRI Macro (Complete) Index has a 0.32 correlation to the S&P 500 over the previous 30 years. Whereas optimistic, these belongings actually don’t show a robust tendency to maneuver collectively. We broke the info pattern down additional to research how they behave in down months for the S&P 500. When developing portfolios, it’s vital to see how belongings behave in intervals when danger will increase to know the true habits.

- In months when the S&P 500 posted a detrimental return, the correlation between the HFRI Macro (Complete) Index and the S&P 500 fell to 0.14 (see the scatter plot in chart 3).

- The common return for the HFRI Macro (Complete) Index in these down months was -0.08%, in comparison with -3.62% for the S&P 500.

There isn’t any assure that these relationships persist shifting ahead, but it surely does reveal an independence between the 2 indexes. This is a crucial attribute when taking a look at investments to diversify a portfolio.

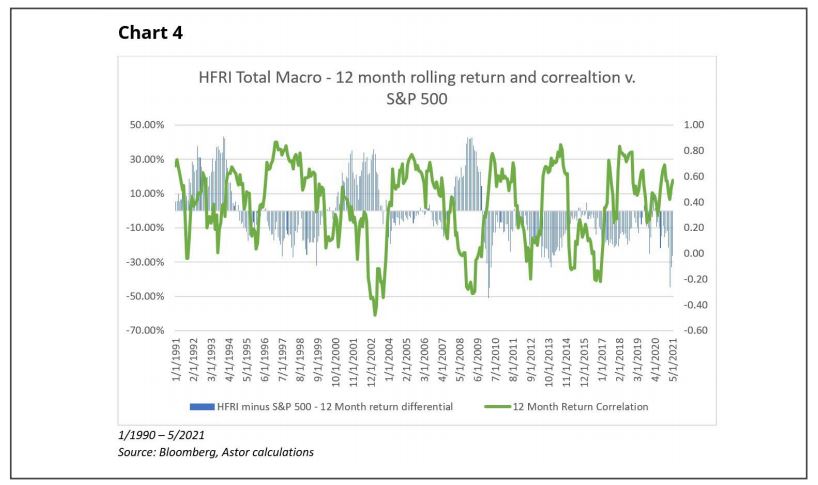

A correlation information level gives a snapshot of a relationship. It’s a superb reference level, but it surely doesn’t precisely inform you what the trail seemed like getting there. If we had the luxurious of closing the time capsule and coming again in 20 or 30 years, solely the outcome issues. Sadly, monetary wants and different determination factors can happen alongside the way in which. The journey itself is vital. Within the chart beneath, we took the evaluation a step additional and noticed how the correlation itself moved over the 30-year interval.

We additionally seemed on the efficiency unfold of the HFRI Macro (Complete) Index towards the S&P 500 Index and located some fascinating outcomes. In intervals the place correlation declined, the HFRI Macro (Complete) Index confirmed intervals of outperformance.

- Whereas the correlation coefficient between the indexes was 0.32 over the interval, the rolling 12-month correlation between the indexes was as excessive as 0.85 and as little as -0.50.

- This tells us there have been 12-month intervals the place the S&P 500 Index and the HFRI Macro (Complete) Index had detrimental correlation, which generally occurred when the HFRI Macro (Complete) Index outperformed the S&P 500 Index over the given interval.

SUMMARY DISCUSSION

Portfolio diversification is an oft-pursued course of, many occasions with sub-optimal outcomes. {The marketplace} has created quite a few instruments to assist diversify firm idiosyncratic danger, specifically index funding by funds. Systemic danger, nonetheless, seems to catch buyers off-guard. The explanation? As we talked about earlier than, correlations are a snapshot of a relationship, however don’t signify finest and worst-case moments in that relationship. When systemic market danger begins to extend, reminiscent of Feb/Mar of 2020, asset correlations generally tend to extend as buyers search liquidity and promote belongings considerably indiscriminately. What this implies is that belongings with decrease correlations to equities, reminiscent of gold and different commodities, are inclined to see their diversification

advantages fade on the most inopportune occasions. We predict a versatile macro-investing method can establish this dynamic change and alter publicity accordingly. We consider analysis helps this concept of macro investing having correlation advantages in intervals the place fairness markets are challenged.

DISCLOSURES

Astor Funding Administration LLC (“Astor”) is a registered funding adviser with the Securities and Alternate Fee. This isn’t a solicitation to supply funding recommendation or providers in any state the place to take action can be illegal. Evaluation and analysis are supplied for informational functions solely, not for buying and selling or investing functions. All opinions expressed are as of the date of publication and topic to alter. They don’t seem to be supposed as funding suggestions. These supplies include basic data and haven’t been tailor-made for any particular recipient. Astor and its associates should not answerable for the accuracy, usefulness, or availability of any such data or answerable for any buying and selling or investing primarily based on such data. There isn’t any assurance that Astor’s funding applications will produce worthwhile returns or that any account may have related outcomes. You could lose cash. Previous outcomes are not any assure of future outcomes and no illustration is made {that a} shopper will or is probably going

to realize outcomes which can be much like these proven. Any explicit shopper might expertise outcomes completely different from different shoppers. Elements impacting shopper returns, outcomes, and allocations embody account inception, cash transfers, client-imposed restrictions, technique and product choice, charges and bills, and dealer/seller choice, in addition to different elements. An funding can’t be made immediately into an index. Please consult with Astor’s Type ADV Half 2A Brochure for extra data relating to charges, dangers, and providers.

DEFINITIONS

Bloomberg Barclays US Mixture Bond Index: The Bloomberg Barclays U.S. Mixture Bond Index is a broad-based index representing the dollardenominated, funding grade bond market and contains Treasuries,

authorities securities, and mortgage securities.

COMEX Gold Futures: A contract for 100 troy ounces of gold bullion traded on the COMEX change by the Chicago Mercantile Alternate. Statistics proven listed below are calculated utilizing the entrance month contract. Commodity: An funding in bodily commodities reminiscent of treasured metals, agriculture crops, livestock, and vitality sources or a futures contract for these belongings.

Correlation: A statistical measure of the interdependence of two or extra random variables, computed utilizing month-to-month returns. Basically, the worth signifies how a lot of a change in a single variable is defined by a

change in one other. Particularly, the correlation between the portfolio and the S&P 500 Index. A correlation of 1 implies the safety strikes in the identical route because the index and a correlation of -1 implies the alternative. A

correlation nearer to Zero signifies that the portfolio doesn’t transfer with the actions of the index.

DBIQ Optimum Yield Diversified Commodity Index: The DBIQ Optimum Yield Diversified Commodity Index is an index that tracks a portfolio of 14 bodily commodities and is rebalanced yearly to pre-determined base weights. The Index is managed by DWS Funding Administration Americas Inc. with licensing from Deutsche Financial institution AG.

HFRI Macro (Complete) Index: The index efficiency is rebalanced month-to-month and calculated web of all charges. The HFRI Macro (Complete) Index is an unmanaged, equal-weighted composite of funds listed within the HFR Database having

both $50 million or larger in belongings or a 12-month monitor report. HFRI is a registered trademark of Hedge Fund Analysis, Inc. An funding can’t be made immediately into an index.

Danger Premium: The surplus return of an funding asset over a risk-free price of return.

Rolling Calculations: Refers to calculations the place every information level is calculated by summing a set interval of previous information factors (e.g.36 month rolling calculation would include 36 months of information at every level).

Customary Deviation: A measure of the diploma of variation of returns across the imply (common) return. The upper the volatility of the funding returns, the upper the usual deviation.

Customary & Poor’s 500 Complete Return Index: The S&P 500 Index measures the efficiency of 500 giant cap shares, which collectively signify roughly 80% of the overall equities market in america. The

complete return calculation contains the price-plus-gross money dividend return. The S&P 500 is registered trademark of McGraw Hill Monetary.

Yield: The revenue return on an funding.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.