Key Speaking Factors:EUR/USD drops to lowest degree since April as USD reveals resilienceNFP information to find out EUR/USD short-term efficiency

Key Speaking Factors:

- EUR/USD drops to lowest degree since April as USD reveals resilience

- NFP information to find out EUR/USD short-term efficiency

EUR/USD has been unable to regain its footing because the selloff two weeks in the past. The US Greenback has proven resilience in what would sometimes be end-of-month rebalancing weak spot for the forex as merchants await the a lot anticipated NFP information out tomorrow. Yesterday’s ADP information confirmed a rise in 629ok jobs in June, which was above the 600ok anticipated. But when something we’ve realized over the previous few months is that ADP is a foul predictor of NFP information, however hopes are excessive for a robust beat over tomorrow’s anticipated variety of 700ok.

The previous two months have proven mediocre readings in non-farm payrolls and that has introduced market sentiment down. It’s not a lot that the information isn’t exhibiting good financial restoration, it’s the truth that the Fed has advised a couple of months of sturdy jobs information earlier than they’ll begin serious about altering financial coverage, which is an efficient factor for shares however was dragging on the US Greenback.

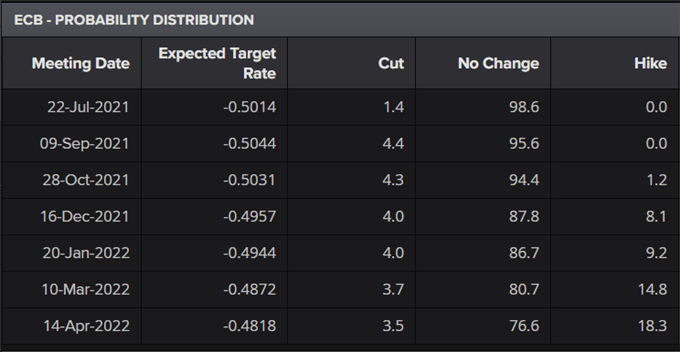

On the euro entrance, there are nonetheless considerations in regards to the unfold of the Delta variant throughout the continent, threatening the summer season vacation season and placing a pressure on the euro. As regards to the ECB, the probability of any coverage change, and even point out of it, earlier than year-end could be very slim, with cash markets not anticipating a charge hike till 2023. This distinction in central financial institution positioning is probably going going to be a key driver for EUR/USD going ahead.

Supply: Refinitiv

EUR/USD Ranges

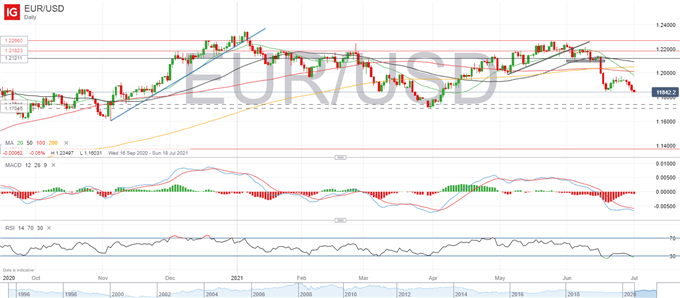

EUR/USD is hovering close to its lowest degree since April, with the stochastic oscillator just under 30, exhibiting that bears are in management. Quick assist could also be discovered on the psychological 1.18 degree adopted by 1.1738 and 1.1704, which might mark the bottom level for the pair in 2021.

A weaker-than-expected NFP studying would seemingly knock the Greenback again and permit EUR/USD to regain some upward momentum. The important thing degree to be careful for is 1.1975 the place two earlier tried rebounds have been halted. Additional than that’s the place the transferring averages are positioned so we may even see some elevated resistance.

EUR/USD Each day chart

Study extra in regards to the inventory market fundamentals right here or obtain our free buying and selling guides.

— Written by Daniela Sabin Hathorn, Market Analyst

Comply with Daniela on Twitter @HathornSabin

component contained in the

component. That is most likely not what you meant to do!Load your utility’s JavaScript bundle contained in the component as an alternative.

www.dailyfx.com