Shareholders of BancorpSouth Financial institution BXS have authorized the all-stock merger cope with Cadence Bancorporation CADE. The transaction, introduced this April, is predicted to shut within the fourth quarter of 2021 topic to regulatory consents.

The deal will create a number one Texas and Southeastern regional financial institution. Publish completion, the mixed entity will function below the identify and model of Cadence, and is predicted to have a market worth of greater than $6 billion. Full integration is anticipated to happen within the second half of 2022.

Per the earlier launch in April, every frequent shareholder of Cadence will get inventory equal to 0.70 of BancorpSouth share. Additionally, they are going to be entitled to a one-time particular money dividend of $1.25 per share along with the closing of the merger. Publish the closure of the transaction, BancorpSouth shareholders will personal about 55% of the mixed firm, whereas Cadence shareholders will personal 45%.

Coming to management, Dan Rollins would be the chairman and CEO, and Paul Murphy will function the manager vice chairman of the mixed entity. The board of administrators will initially comprise 20 administrators, consisting of 11 from BancorpSouth and 9 from Cadence.

As per earlier disclosure, each corporations foresee long-term monetary advantages from the transaction, which appears enticing for shareholders. The deal is more likely to be 17% accretive to earnings per share (EPS) of each corporations by the top of 2022, assuming fully-realized value financial savings. The EPS is projected to be 14% accretive if 75% value financial savings are realized.

Additionally, speedy accretion to tangible guide worth per share at shut is predicted. Administration estimates professional forma CET 1 ratio of 11.3% and ratio of allowance for credit score losses to loans of two.5% on the shut of the transaction.

Our Take

Within the present state of affairs, banks are transferring towards consolidation to dodge the heightened prices of regulatory compliance and elevated investments in know-how in a bid to stay aggressive. The present low-rate state of affairs and different financial challenges following the pandemic have taken a toll on banks’ profitability.

The merger between BancorpSouth and Cadence is anticipated to result in elevated progress prospects and creation of shareholder worth.

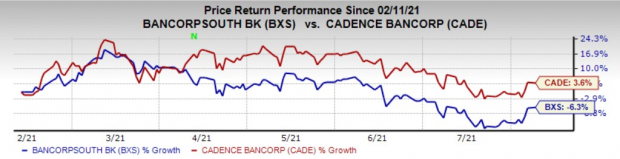

Shares of Cadence have gained 3.6%, as towards the 6.3% fall witnessed by shares of BancorpSouth, over the previous six months.

Picture Supply: Zacks Funding Analysis

At the moment, each shares carry a Zacks Rank #3 (Maintain). You possibly can see the entire record of right this moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Equally final week, shareholders of New York Group Bancorp, Inc. NYCB and Flagstar Bancorp, Inc. FBC authorized the proposed all-stock merger deal between the 2 corporations. The transaction, additionally introduced this April, is predicted to shut within the fourth quarter of 2021, topic to regulatory consents. The merger is more likely to enhance the New York Group Bancorp’s transformation methods by means of geographical in addition to product diversification.

Zacks’ Prime Picks to Money in on Synthetic Intelligence

In 2021, this world-changing know-how is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks buyers must find out about right this moment.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

Flagstar Bancorp, Inc. (FBC): Free Inventory Evaluation Report

BancorpSouth Financial institution (BXS): Free Inventory Evaluation Report

New York Group Bancorp, Inc. (NYCB): Free Inventory Evaluation Report

Cadence Bancorp (CADE): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.