Trinseo S.A. TSE lately accomplished the beforehand introduced transaction to amass Aristech Surfaces LLC. The latter is a number one North American producer and world supplier of polymethyl methacrylates (“PMMA”) steady forged, strong floor and architectural resin sheets serving the wellness, architectural, transportation and industrial markets.

The buyout is in sync with Trinseo’s transformation efforts. Noatbly, the corporate’s efforts are centered on changing into a world specialty supplies and sustainable options supplier. The Aristech buyout will strengthen Trinseo’s place in acrylic options and broaden its product portfolio choices in vital markets equivalent to constructing & building and client items.

Aristech is predicted to speed up Trinseo’s development in Asia. Higher publicity to new markets, and improved potential to generate money and steady margins are prone to result in additional development alternatives.

Trinseo’s attain in North America, Europe and Asia is predicted to result in the transaction producing annual pretax price synergies to the tune of roughly $10 million by 2024 and extra income synergies. It goals to speed up development and ship significant worth to shareholders.

The buyout consists of the addition of roughly 300 workers throughout two manufacturing and R&D areas in Florence, KY and Belen, NM. Aristech will proceed to function as a stand-alone entity throughout the Engineered Supplies section, whereas Trinseo continues the combination of the PMMA enterprise it acquired earlier this yr.

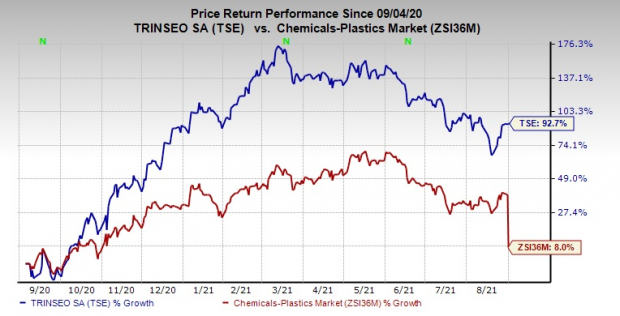

Shares of Trinseo have appreciated 92.7% up to now yr in contrast with 8% rise of the trade.

Picture Supply: Zacks Funding Analysis

Trinseo, in its final earnings name, said that for 2021 it sees web earnings from persevering with operations within the vary of $344 million to $380 million. Adjusted EBITDA is forecast within the band of $750-$800 million.

The corporate additionally expects money from operations of $425-$475 million and free money circulate of $275-$325 million for full-year 2021.

Trinseo envisions sturdy earnings efficiency from continued business excellence actions and excessive demand for many of its merchandise within the second half of the yr. Nevertheless, it expects earnings to say no from the primary half of 2021 primarily attributable to no anticipated contribution from the Feedstocks section.

Trinseo S.A. Worth and Consensus

Trinseo S.A. price-consensus-chart | Trinseo S.A. Quote

Zacks Rank & Key Picks

Trinseo at the moment carries a Zacks Rank #3 (Maintain).

Some better-ranked shares within the fundamental supplies house are Nucor Company NUE, Dow Inc. DOW and Cabot Company CBT.

Nucor has a projected earnings development charge of round 478.7% for the present yr. The corporate’s shares have soared 145.8% in a yr. It at the moment sports activities a Zacks Rank #1 (Sturdy Purchase). You possibly can see the whole checklist of right this moment’s Zacks #1 Rank shares right here.

Dow has an anticipated earnings development charge of round 403% for the present yr. The corporate’s shares have gained 28.9% up to now yr. It at the moment carries a Zacks Rank #2 (Purchase).

Cabot has an anticipated earnings development charge of round 138.5% for the present fiscal. The corporate’s shares have rallied 39.4% up to now yr. It at the moment carries a Zacks Rank #2.

Tech IPOs With Large Revenue Potential: Final years prime IPOs surged as a lot as 299% throughout the first two months. With file quantities of money flooding into IPOs and a record-setting inventory market, this yr might be much more profitable.

See Zacks’ Hottest Tech IPOs Now >>

Click on to get this free report

Nucor Company (NUE): Free Inventory Evaluation Report

Dow Inc. (DOW): Free Inventory Evaluation Report

Cabot Company (CBT): Free Inventory Evaluation Report

Trinseo S.A. (TSE): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com