Capri Holdings Limited CPRI constantly deploys resources to expand its product offerings, upgrade distribution infrastructure, create seamless omni-retailing capabilities and deepen its engagement with customers. In recent developments, the company’s Versace brand expanded its license deal with EuroItalia for an additional period of 15 years. EuroItalia is a leading global fragrance and cosmetics company based in Italy.

The Versace-EuroItalia partnership began in 2005 and evolved into the world’s leading designer luxury fragrance business. Given the success of Versace’s fragrance business, management is excited to extend this strategic agreement to further leverage the brand’s potential.

In addition, management informed that Michael Kors and EuroItalia will ink a 15-year deal to make EuroItalia the Michael Kors brand’s men’s and women’s fragrance licensee worldwide. The company is encouraged about this expansion too and believes that there is higher potential for further developing the Michael Kors fragrance wing. Going forward, it also expects designing fragrance products that cater well to consumers’ preferences.

What’s More?

Capri Holdings is reinforcing its position in the luxury fashion space. The company is consistently gaining from its core brands, namely Versace, Jimmy Choo and Michael Kors. It remains confident to make Versace a leading luxury leather house and increase accessories revenues to $1 billion over time. The company also continues to boost its accessories business including leather goods and handbags.

At Michael Kors, the company continues to increase signature penetration across all product categories with the goal to increase the same to 50% of the business. Men’s business remains one of the fastest-growing categories at Michael Kors. Management aims to expand the contribution from accessories to 30% of Jimmy Choo’s revenues.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

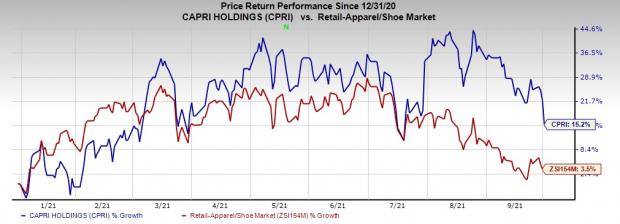

Capri Holdings looks well poised to capitalize on the trends in the apparel space. The fashion and apparel space is brimming with optimism, thanks to the rapid inoculation drive and relaxation in the pandemic-induced restrictions. In addition, this currently Zacks Rank #2 (Buy) company’s e-commerce business has been performing outstandingly for sometime now. E-commerce sales grew double digits during the first quarter of fiscal 2022. Shares of this global fashion luxury retailer have increased 15.2% in the year-to-date period compared with the industry’s 3.5% rise.

More Key Picks in Retail

Abercrombie ANF has a long-term earnings growth rate of 18% and a Zacks Rank #1 (Strong Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tilly’s TLYS presently has a Zacks Rank of 1 stock and a long-term earnings growth rate of 10%.

Children’s Place PLCE has a long-term earnings growth rate of 8% and is currently Zacks #1 Ranked.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Click to get this free report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

The Childrens Place, Inc. (PLCE): Free Stock Analysis Report

Tillys, Inc. (TLYS): Free Stock Analysis Report

Capri Holdings Limited (CPRI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com