Immunovant, Inc. IMVT reported a net loss of 36 cents per share in the third quarter of fiscal 2022 (ended Dec 31, 2021), wider than the Zacks Consensus Estimate of a loss of 34 cents. In the year-ago quarter, the company reported a loss of 32 cents.

Currently, the company does not have any approved product in its portfolio. As a result, it is yet to generate revenues.

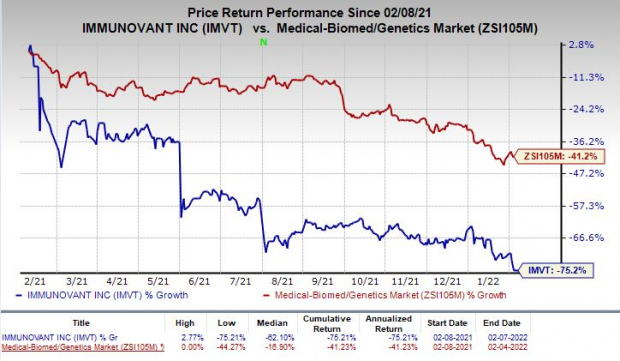

Shares of Immunovant have plunged 75.2% in the past year compared with the industry’s decrease of 41.2%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Quarter in Detail

In the reported quarter, research and development (R&D) expenses were $29.8 million, up 41.2% from the year-ago quarter. The year-over-year surge was due to increased personnel-related expenses and higher manufacturing costs related to clinical activities.

General and administrative (G&A) expenses were $11.5 million in the reported quarter, up 9.5% on a year-over-year basis. The increase was primarily due to increased personnel-related expenses.

As of Dec 31, 2021, the company had cash balance of approximately $527 million compared with $559 million as of Sep 30, 2021.

Pipeline Update

Immunovant is developing its lead pipeline candidate, batoclimab (formerly known as IMVT-1401), as a subcutaneous injection for the treatment of autoimmune diseases mediated by pathogenic IgG antibodies. The company is developing batoclimab with an initial focus on the treatment of myasthenia gravis (“MG”), thyroid eye disease (“TED”) and warm autoimmune hemolyticanemia (“WAIHA”).

In December 2021, Immunovant provided regulatory updates on batoclimab. The company plans to begin a phase III study evaluating batoclimab for the treatment of MG in the first half of 2022, with data expected in 2024.

In July 2021, the FDA granted an Orphan Drug designation to IMVT-1401 for the treatment of MG.

In February 2021, the company voluntarily paused dosing in ASCEND GO-2 — a phase IIb study in TED, and in ASCEND- WAIHA — a phase II study on IMVT-1401 in WAIHA — due to elevated total cholesterol and LDL levels observed in patients who were treated with IMVT-1401.

Successful development of the candidate remains the main focus of the company.

Immunovant, Inc. Price, Consensus and EPS Surprise

Immunovant, Inc. price-consensus-eps-surprise-chart | Immunovant, Inc. Quote

Zacks Rank & Stocks to Consider

Immunovant currently carries a Zacks Rank #4 (Sell).

Better-ranked stocks in the biotech sector include Axsome Therapeutics, Inc. AXSM, Editas Medicine, Inc. EDIT and Stoke Therapeutics, Inc. STOK, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axsome Therapeutics’ loss per share estimates have narrowed 0.8% for 2022 over the past 60 days.

Earnings of Axsome Therapeutics have surpassed estimates in three of the trailing four quarters, and missed the same on the other occasion.

Editas Medicine’s loss per share estimates have narrowed 1.4% for 2022 over the past 60 days.

Editas Medicine’s earnings have surpassed estimates in two of the trailing four quarters and missed the same on the other two occasions.

Stoke Therapeutics’ loss per share estimates have narrowed 8.6% for 2022 over the past 60 days.

Stoke Therapeutics’ earnings have surpassed estimates in one of the trailing four quarters and missed the same on the other three occasions.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021 Zacks Top 10 Stocks portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Click to get this free report

Axsome Therapeutics, Inc. (AXSM): Free Stock Analysis Report

Editas Medicine, Inc. (EDIT): Free Stock Analysis Report

Stoke Therapeutics, Inc. (STOK): Free Stock Analysis Report

Immunovant, Inc. (IMVT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com