During Monday’s Asian session, gold (XAU/USD) takes offers to refresh intraday lows around $1,945 while snapping a three-day uptrend. As a result, the

During Monday’s Asian session, gold (XAU/USD) takes offers to refresh intraday lows around $1,945 while snapping a three-day uptrend. As a result, the yellow metal justifies Friday’s Doji candlestick and a stronger US dollar but remains well within a short-term bullish channel amid a light calendar.

It’s worth noting that the recent bond sell-off boosted the US dollar and weighed on GOLD prices. Nonetheless, the benchmark 10-year bond yields in the United States and Japan recently reached their highest levels in 2019 and 2016. The bond coupons are based on expectations that global central bankers, led by the Fed, will portray aggressive monetary policy tightening to combat deflationary pressures.

The risk-off mood resulting from tensions between the West and Russia and indecision over the Moscow-Kyiv talks favors the US dollar. Even as the White House and Germany tried to calm the fears, comments from US President Joe Biden implying an indirect threat to Russian President Vladimir Putin triggered a risk-off mood during the early Asian session.

XAU/USD

Anxiety was high ahead of this week’s peace talks in Turkey, as Ukrainian President Volodymyr Zelenskyy pushed for the continuation of the Ukraine-Russia peace talks, saying, “We’re ready to discuss neutrality and non-nuclear status if security guarantees are provided.” However, his statements such as “Ukraine to insist on sovereignty and territorial integrity in talks with Russia” cast doubt on his chances of success.

Furthermore, hawkish Fed rhetoric and record-high US inflation expectations drive US dollar purchases. On Friday, New York Fed President and FOMC member John Williams stated that this year’s pace of interest rate hikes should be data-driven. However, several Fed policymakers before him have already signaled a faster rate hike path due to inflation concerns. However, US inflation expectations as measured by the 10-year breakeven inflation rate reported by the St. Louis Federal Reserve (FRED) refresh record highs and weigh on the market’s mood.

Looking ahead, a light calendar during the first few weeks of the week may pose a challenge to momentum traders, but risk catalysts and the NFP are likely to keep markets volatile.

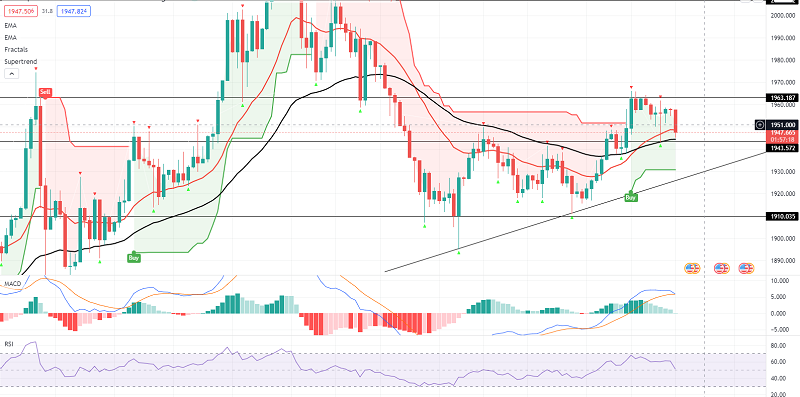

Gold Technical Outlook

Although Friday’s Doji candlestick on the daily chart suggests further gold declines, an eight-day-old rising trend channel limits the metal’s short-term downside. However, the 200-SMA adds strength to the stated channel’s support line near $1,925, while the 50-SMA around $1,937 limits the metal’s immediate downside.

Meanwhile, recovery moves are dependent on a clear break above the $1,975 barrier, which comprises the stated channel’s upper line and the 50% Fibonacci retracement level of late February to March upside.

If gold prices rise above $1,975, the possibility of further gains towards the March 10 swing high near $2,010 cannot be ruled out. Good luck!

www.fxleaders.com