US Dollar, Dow Jones, China Lockdown Protests, Fedspeak – Asia Pacific Market OpenUS Dollar soars, Dow Jones falls on Monday’s Wall Street sessionChi

US Dollar, Dow Jones, China Lockdown Protests, Fedspeak – Asia Pacific Market Open

- US Dollar soars, Dow Jones falls on Monday’s Wall Street session

- Chinese lockdown protests and hawkish Fedspeak were key culprits

- Is DXY Dollar Index setting up for reversal? APAC markets at risk

Recommended by Daniel Dubrovsky

Forex for Beginners

Asia-Pacific Market Briefing – Risk Aversion Boosts the US Dollar

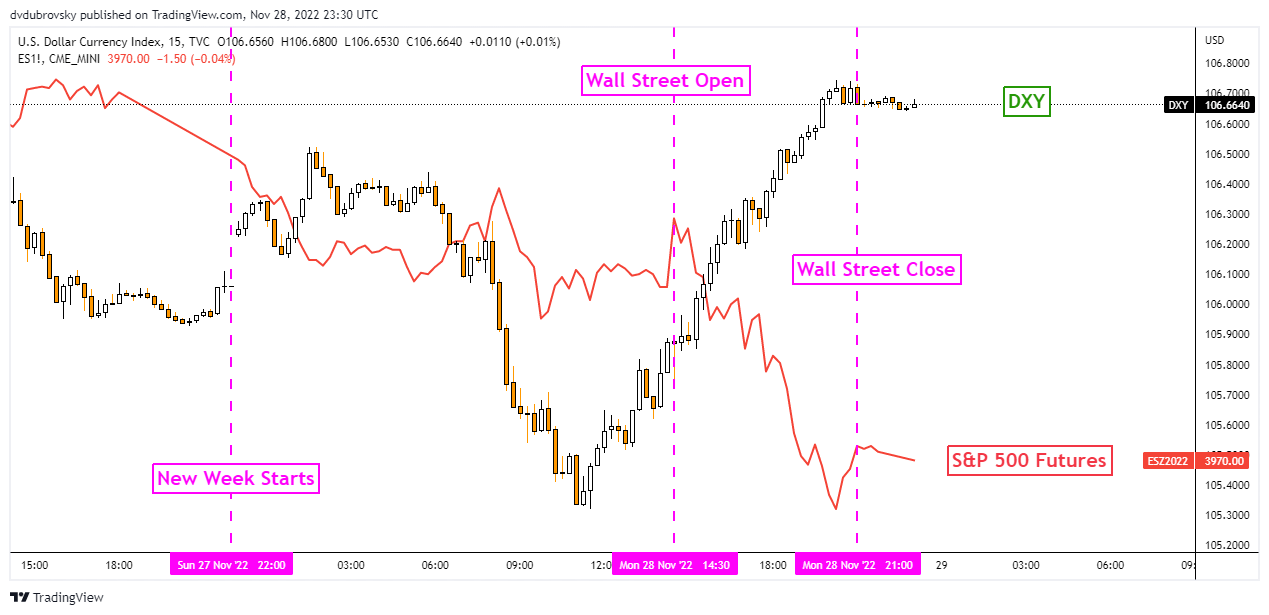

The US Dollar soared against most of its major counterparts on Monday, particularly outperforming the sentiment-linked Australian and New Zealand Dollars. Not surprisingly, this coincided with a general deterioration in risk appetite as Wall Street turned lower. The Dow Jones, S&P 500 and Nasdaq 100 fell 1.4%, 1.5% and 1.41%, respectively.

Market mood deteriorated at the onset of Monday’s trading session in the wake of anti-lockdown protests around China. Last week, we also saw signs that lockdown liftings were running into trouble. If the country does intend on rolling with reversing the zero-Covid strategy, it could run the risk of a rapid spread in cases, opening the door to a rough reopening.

Meanwhile, during the Wall Street trading session, we saw a couple of Fed officials reiterate the central bank’s hawkish stance. Notably, St. Louis Fed President James Bullard noted that financial markets are ‘underestimating’ odds that the central bank may have to hike rates more quickly in 2023 to help curb inflation. This likely resulted in the selloff on Wall Street, boosting the haven-linked US Dollar.

US Dollar and S&P 500 on Monday

Chart Created in TradingView

Tuesday’s Asia Pacific Trading Session – All Eyes on Risk Appetite

Tuesday’s Asia-Pacific trading session is lacking notable economic event risk. This is placing traders’ focus on general risk appetite. In that case, regional indices such as the Hang Seng Index and Nikkei 225 risk following in the footsteps of Wall Street. Such a further deterioration in market mood would likely bode well for the US Dollar, sending AUD/USD and NZD/USD lower.

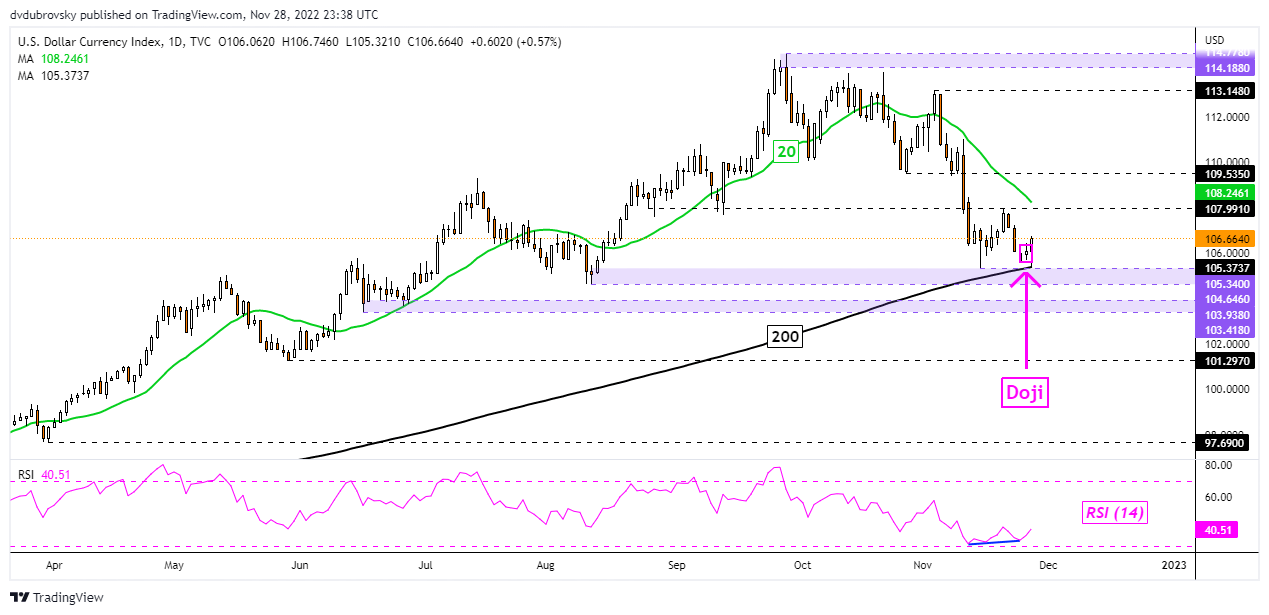

US Dollar Technical Analysis

On the daily chart, the DXY Dollar Index is starting to show early signs of a potential bullish reversal. For starters, prices left behind a Doji candlestick that then saw upside follow-through over the past 24 hours. This is as prices tested the 200-day Simple Moving Average (SMA) and positive RSI divergence emerged. The latter shows fading downside momentum which can at times precede a turn higher. Further gains would place the focus on the 20-day SMA as well as the 107.99 inflection point.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

DXY Index Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

element inside the

element. This is probably not what you meant to do!

Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

US Dollar Soars as Dow Jones Sinks on Hawkish Fed Comments. DXY Ready to Reverse?

US Dollar, Dow Jones, China Lockdown Protests, Fedspeak – Asia Pacific Market OpenUS Dollar soars, Dow Jones falls on Monday’s Wall Street sessionChi

US Dollar, Dow Jones, China Lockdown Protests, Fedspeak – Asia Pacific Market Open

Recommended by Daniel Dubrovsky

Forex for Beginners

Asia-Pacific Market Briefing – Risk Aversion Boosts the US Dollar

The US Dollar soared against most of its major counterparts on Monday, particularly outperforming the sentiment-linked Australian and New Zealand Dollars. Not surprisingly, this coincided with a general deterioration in risk appetite as Wall Street turned lower. The Dow Jones, S&P 500 and Nasdaq 100 fell 1.4%, 1.5% and 1.41%, respectively.

Market mood deteriorated at the onset of Monday’s trading session in the wake of anti-lockdown protests around China. Last week, we also saw signs that lockdown liftings were running into trouble. If the country does intend on rolling with reversing the zero-Covid strategy, it could run the risk of a rapid spread in cases, opening the door to a rough reopening.

Meanwhile, during the Wall Street trading session, we saw a couple of Fed officials reiterate the central bank’s hawkish stance. Notably, St. Louis Fed President James Bullard noted that financial markets are ‘underestimating’ odds that the central bank may have to hike rates more quickly in 2023 to help curb inflation. This likely resulted in the selloff on Wall Street, boosting the haven-linked US Dollar.

US Dollar and S&P 500 on Monday

Chart Created in TradingView

Tuesday’s Asia Pacific Trading Session – All Eyes on Risk Appetite

Tuesday’s Asia-Pacific trading session is lacking notable economic event risk. This is placing traders’ focus on general risk appetite. In that case, regional indices such as the Hang Seng Index and Nikkei 225 risk following in the footsteps of Wall Street. Such a further deterioration in market mood would likely bode well for the US Dollar, sending AUD/USD and NZD/USD lower.

US Dollar Technical Analysis

On the daily chart, the DXY Dollar Index is starting to show early signs of a potential bullish reversal. For starters, prices left behind a Doji candlestick that then saw upside follow-through over the past 24 hours. This is as prices tested the 200-day Simple Moving Average (SMA) and positive RSI divergence emerged. The latter shows fading downside momentum which can at times precede a turn higher. Further gains would place the focus on the 20-day SMA as well as the 107.99 inflection point.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

DXY Index Daily Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, follow him on Twitter:@ddubrovskyFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

RECOMMENDED FOR YOU