The USD resumed the bullish trend this week as the sentiment turned negative again on an escalating conflict in the Middle East, which increased the b

The USD resumed the bullish trend this week as the sentiment turned negative again on an escalating conflict in the Middle East, which increased the bids for the USD. They were knocking on 5.00% again earlier today before the US data was released, but then suddenly reversed down after some really strong numbers. The Q3 GDP was expected to show a 4.5% expansion of the US economy from 2.1% in Q2, although the actual number came at 4.9%.

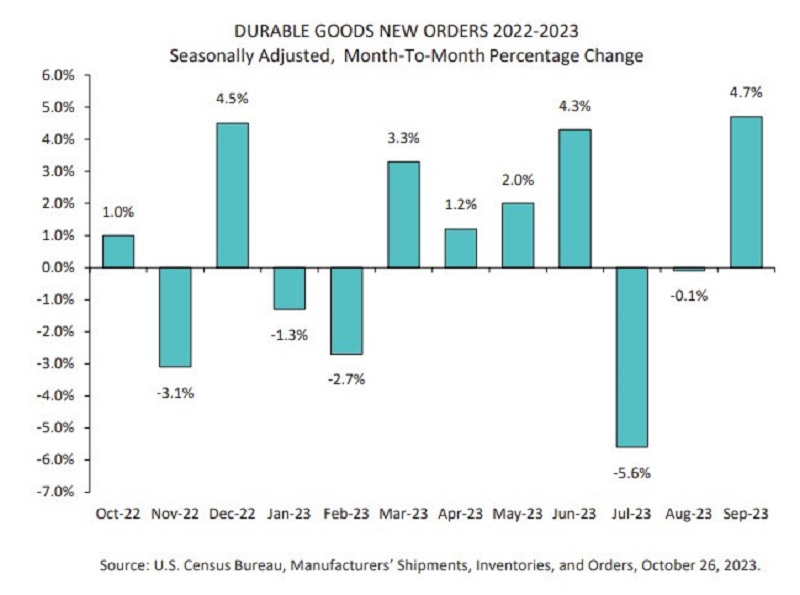

The GDP price index also rose to 3.7% in Q3 from 1.7% in Q2, while durable goods orders jumped by 4.7% in September from 0.2% in August, beating expectations of 1.7%. But, instead of moving higher, the USD retreated lower, although this seems temporary, so we decided to buy the USD by selling NZD/USD just a while ago. GOLD was also retreating lower so we decided to open a buy Gold signal as well, at $1,977.

US September 2023 Durable Goods Orders Report

- September durable goods orders 4.7% versus 1.7% expected

- August durable goods orders +0.2% revised to -0.1%

- Nondefense capital goods orders ex air 0.6% vs +1.1% last month (revised up from 0.9%)

- Orders Ex. Transportation 0.5% versus 0.2% expected. Prior 0.5% (revised from 0.4%)

- Orders Ex. Defense 5.8% versus -0.7% last month

- Shipments -$0.8 billion or -0.3 percent to $283.7 billion. This followed a 0.5 percent August increase.

Other details showed:

- Unfilled orders for durable goods rose by 1.4 percent or $18.5 billion to reach $1,353.8 billion. This increase follows a 0.3 percent rise in August. The growth was primarily driven by the transportation equipment sector, which increased by 2.1 percent or $17.8 billion to reach $855.7 billion.

- Inventories of manufactured durable goods continued to rise, marking two consecutive months of increase. The total inventories increased by $0.5 billion or 0.1 percent, reaching $523.7 billion. This uptick follows a 0.2 percent increase in August. The machinery sector played a significant role in this growth, with an increase of $0.3 billion or 0.3 percent, bringing its total to $95.1 billion.

A sharp rebound in durable goods orders and well above expectations indicative of a rebounding manufacturing sector. The gain comes after 2 months of declines (prior month was revised lower to -0.1%). However, 5 of the last 7 months have been higher. The gain was the largest of the year.

NZD/USD

www.fxleaders.com