Five years after the first Solana block was generated, the netwo

|

Five years after the first Solana block was generated, the network is entering a new period of fear and uncertainty as the once-lucrative memecoin-casino starts to wind down.

To be fair, the layer 1 blockchain has overcome bigger obstacles before, staging an incredible comeback from just $8 in the aftermath of the 2022 FTX collapse to a new all-time high above $294 in January this year.

But the sudden evaporation of the memecoin market could pose a big challenge over the coming months — where are the activity and fees going to come from next?

After peaking in January, memecoin activity has nose-dived after a string of scandals and celebrity rug pulls, along with the dawning realization that memes can be every bit as extractive as any VC coin.

More than a decade on from the launch of Dogecoin, it would take a brave soul to predict the end of memecoins. But have memecoins peaked? And if so, what are the implications for Solana?

Solana’s memecoin market crash: Revenue and volume

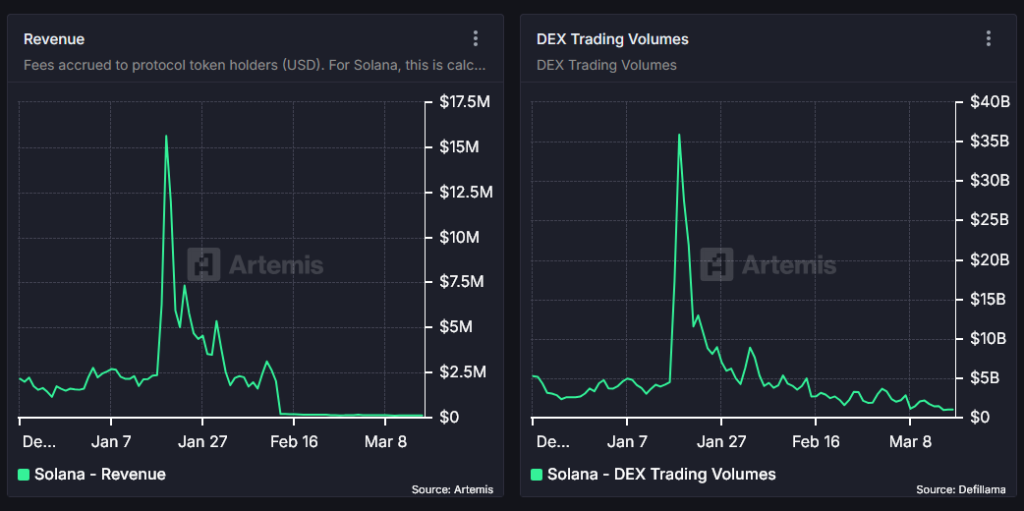

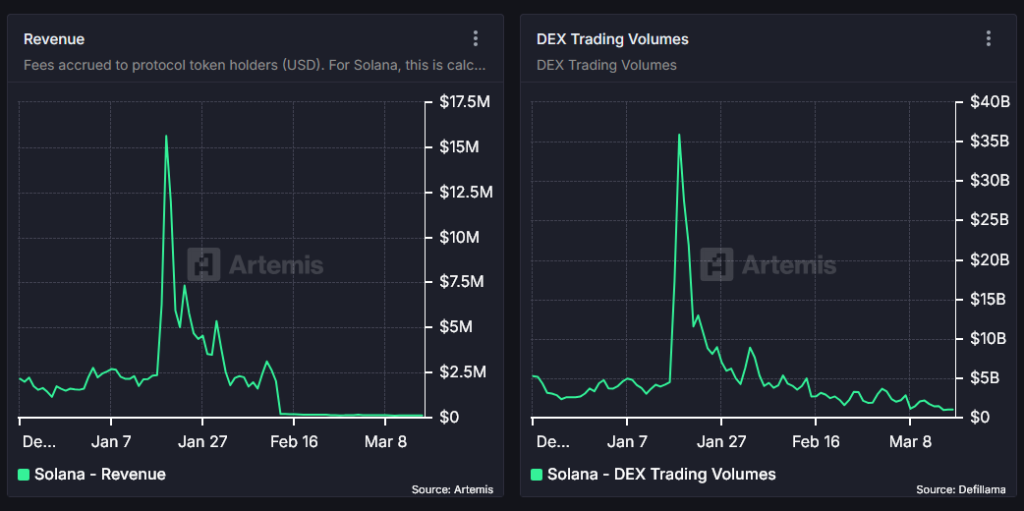

The latest statistics look grim. Solana network revenue has plunged by 93% since the January peak, with transaction fees down 83% in the past month alone. Decentralized exchange volumes fell from a daily peak of $35.9 billion on Jan. 21 to just $979.5 million on March 15, according to Artemis — the lowest figures recorded since October last year. Pump.fun’s daily volume is down by 70%.

Actively daily addresses have more than halved from 6.4 million in November to 2.8 million in March, according to Token Terminal.

And following the failure of inflation-busting proposal SIM-228 last week, the network is still being subsidized to the tune of $228 million each month, while taking just $39.25M in fees in the past 30 days. Figures compiled by Helius last year suggest that more than half of all validators would be unprofitable without subsidies.

Adding to the gloom, 11.2 million Solana (SOL) was unlocked on March 1, hitting the price of SOL, which is now down 58% from the peak.

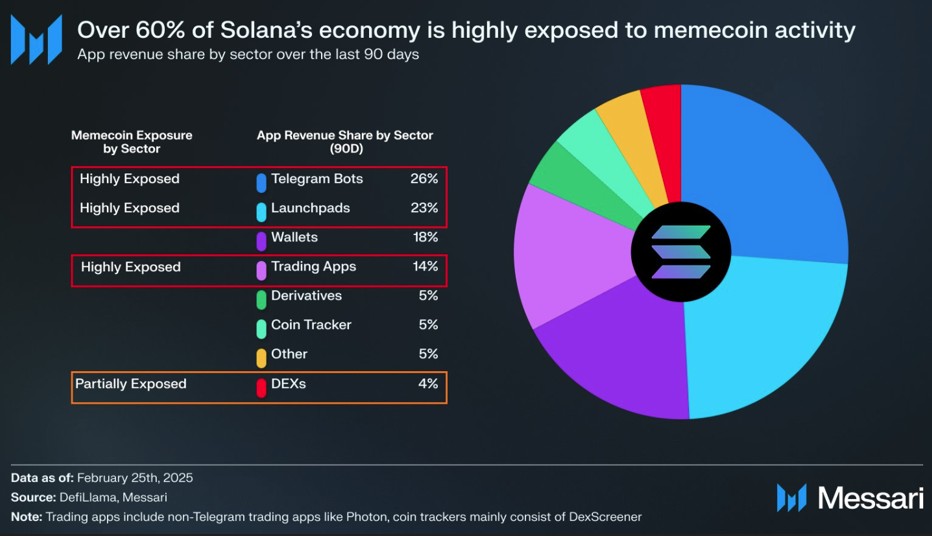

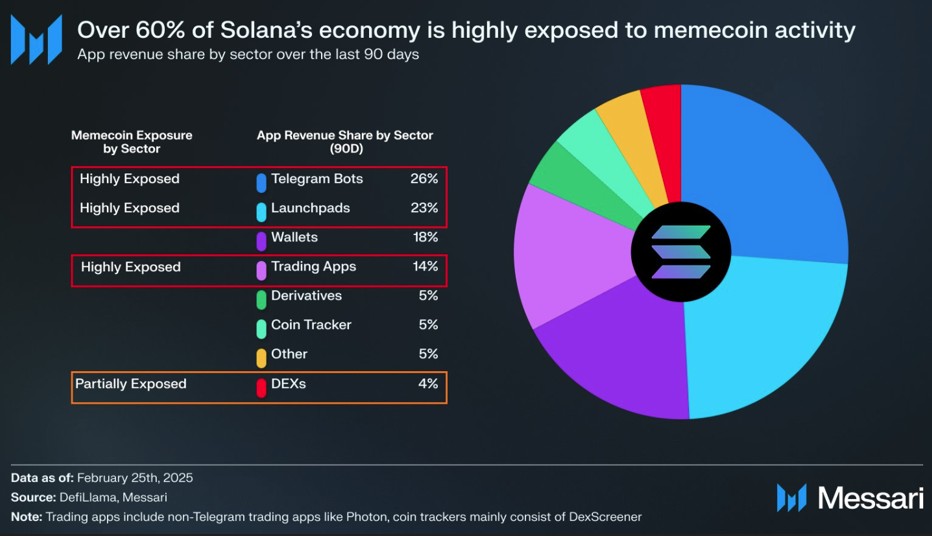

“Today, it’s not unfair to say Solana is a ‘memecoin economy,’” Messari analyst Sunny Shi said in a Feb. 26 thread highlighting the issue. “And that means a deep contraction in memecoin volumes could cause a cascade of revenue declines.”

We have passed ‘peak memecoin’ this cycle

Former Ethereum-maxi turnedSolana-memecoin enjoyer Kain Warwick from Infinex believes we probably have passed peak memecoin, at least for this stage of the cycle.

“I’m not ready to declare memecoins dead yet,” he says but adds: “They’re a lot deader than they used to be. So I am willing to say that the likelihood of us returning to an environment where 90% of the attention is on memecoins in the short term feels unlikely to me.”

Helius founder and Solana maximalist Mert Mumtaz also thinks we may have seen the zenith of memecoin popularity but points out the current lull is linked to macro conditions that have hammered risk assets more generally.

“Memecoin decline, in is somewhat temporary in that all risk ‘assets’ (I understand calling memecoins an asset is a stretch) are declining globally, but also BTC, ETH, SOL are all down massively,” he says.

“I think they will come back though I doubt it will be to the same extent. One key theme across all crypto cycles is that they’ve all had massive speculative elements (ICOs, NFTs, memes) — so it’d be a very strong claim to assume they never come back.”

Memecoins have played a huge part in Solana’s success to date, accounting for up to 70% of Solana DEX volumes in February. Memecoin-dependent Telegram bots, launchpads and trading apps generated approximately 60% of Solana’s $3.3 billion app revenue per year.

Interdependent revenue for memecoin trading apps

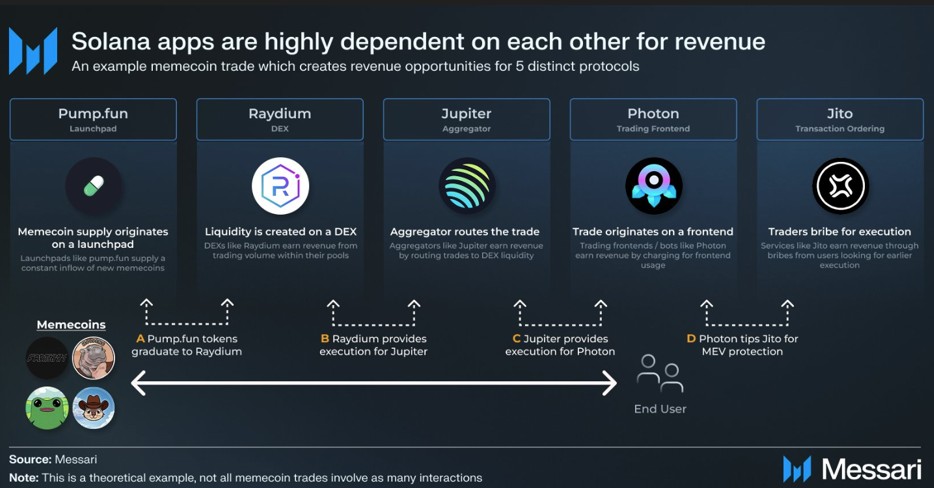

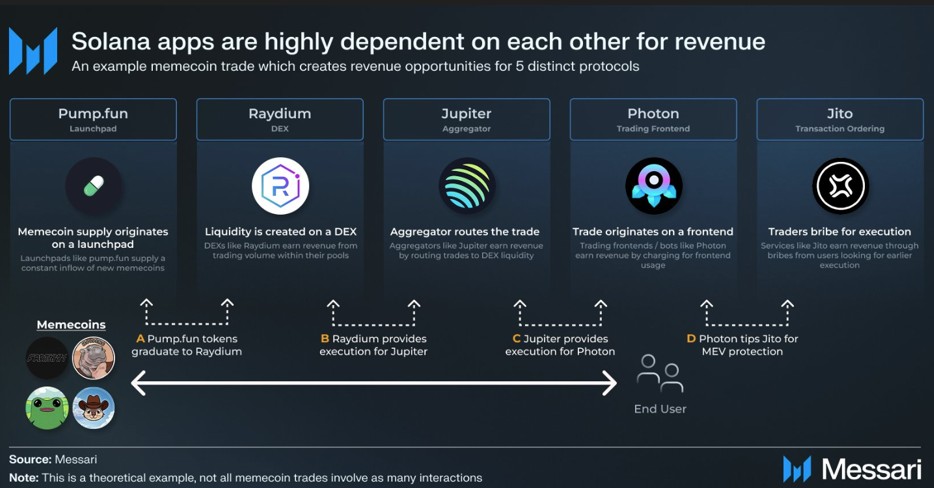

Amplifying the effects is the fact that a number of big memecoin trading apps rely on each other for revenue. A single memecoin trade can create revenue for five distinct apps, as Messari shows below.

Matthew Nay, a Messari research analyst who collates Solana’s quarterly report, explains that this inter-dependency is because Pump.fun takes the fees initially from a memecoin’s launch, but after a token graduates and launches on Raydium, the automated market maker then gets the fees.

But as many users prefer trading on Jupiter, that aggregator gets a cut of those fees, as does Raydium. Telegram bot BonkBot, meanwhile, takes its own trading fees while also providing fees for Jupiter and Raydium downstream, and the Photon trading bot sends fees down the river to everyone.

“One memecoin transaction on Photon definitely trickles down, and some of that revenue is also included to the Jitos, the Raydiums, the…

cointelegraph.com