usd-zar After months of pressure, the South African Rand is fi

Quick overview

- The South African Rand is gaining strength due to favorable trade sentiment and a weaker dollar, reversing its long-term downtrend against the US dollar.

- Investor confidence has improved, driven by optimism around US-China trade progress and expectations for better South African export prospects.

- Local political developments, including potential changes to the inflation-targeting framework and the abandonment of a VAT increase, have further boosted investor sentiment.

- Upcoming diplomatic meetings between South African and US leaders are seen as crucial for improving bilateral trade relations.

Live USD/ZAR Chart

USD/ZAR

After months of pressure, the South African Rand is finally showing signs of strength, supported by favorable trade sentiment, a softer dollar, and technical shifts in the USD/ZAR currency pair.

Market Reversal: From USD Strength to Rand Resurgence

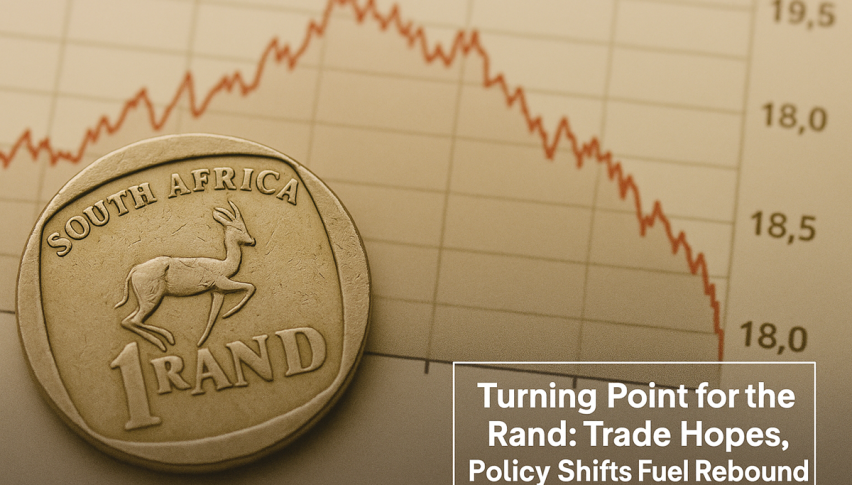

Since early April, the Rand has begun reversing its long-term downtrend against the US dollar, buoyed by improving investor confidence and renewed momentum in global trade. Despite a broader recovery in the greenback following its Q1 decline, the USD/ZAR exchange rate failed once again at the critical 20.00 resistance level. The pair has since retreated sharply to the 18.08 area.

This retreat is notably aligned with growing optimism around US-China trade progress, which has lifted demand for commodity-driven currencies like the Rand. That optimism has spilled into expectations for improved South African export prospects, nudging USD/ZAR lower for over a month.

Technical Signals Support Rand Strength

The pair’s breakdown below the 200-day Simple Moving Average (SMA), which had offered solid support throughout 2025, confirmed a weakening dollar trend. Sellers tested the 18.00 zone but couldn’t push through the 1.08 intraday support level last week.

USD/ZAR Chart Daily – The 200 SMA Is Now Broken

This suggests the pair is currently in a pause phase before a potential further decline, with the next downside target near 17.75, backed by the 200-week SMA.

This pattern echoes a broader shift toward risk-friendly positions among global investors, signaling rising interest in emerging market assets—even in economies grappling with structural issues.

Domestic Politics and Policy Surprise to the Upside

Investor sentiment also received a boost from local political developments. In remarks at an investor forum, Deputy Finance Minister David Masondo hinted that a revised inflation-targeting framework would soon be announced. South Africa’s central bank currently operates with a 3–6% target range, though Governor Lesetja Kganyago has repeatedly advocated for a lower and more focused inflation goal. The move is seen as a potential credibility boost for South Africa’s monetary policy regime.

USD/ZAR Chart Weekly – Five Weeks in Decline After the Upside-down Pin Candlestick

On the fiscal front, political tensions within the ruling coalition had rattled investor confidence earlier in the week. The ANC’s push to raise VAT was fiercely opposed by the Democratic Alliance (DA), its pro-business coalition partner, which not only voted against the proposal but challenged it in court. The VAT hike, initially planned as a two-stage increase beginning May 1, became a flashpoint in coalition politics.

However, recent reports suggest the ANC may now abandon the VAT increase altogether—a move that would preserve coalition unity and likely avert further political instability. That outcome has been interpreted by markets as a sign of policy pragmatism and political coherence, giving the Rand an additional lift.

Geopolitics in Focus

Attention now turns to diplomatic developments, with President Cyril Ramaphosa scheduled to meet US President Donald Trump next week. The high-level meeting is viewed as a crucial step toward mending fractured bilateral trade relations that have worsened since Trump’s return to office in January.

Conclusion: All Eyes on the 18 Level

Despite significant structural hurdles, the Rand’s recent rally reflects a growing appetite for risk and a shift in both technical and macroeconomic sentiment. As USD/ZAR approaches critical support levels and geopolitical developments unfold, the stage is set for potentially deeper gains—provided the momentum holds and global risk sentiment remains upbeat.

Related Articles

www.fxleaders.com