Ethereum’s community is experiencing its busiest days in 10 months amid elevated issuance of stablecoins and the runup to Ethereum 2.0. The seven-d

Ethereum’s community is experiencing its busiest days in 10 months amid elevated issuance of stablecoins and the runup to Ethereum 2.0.

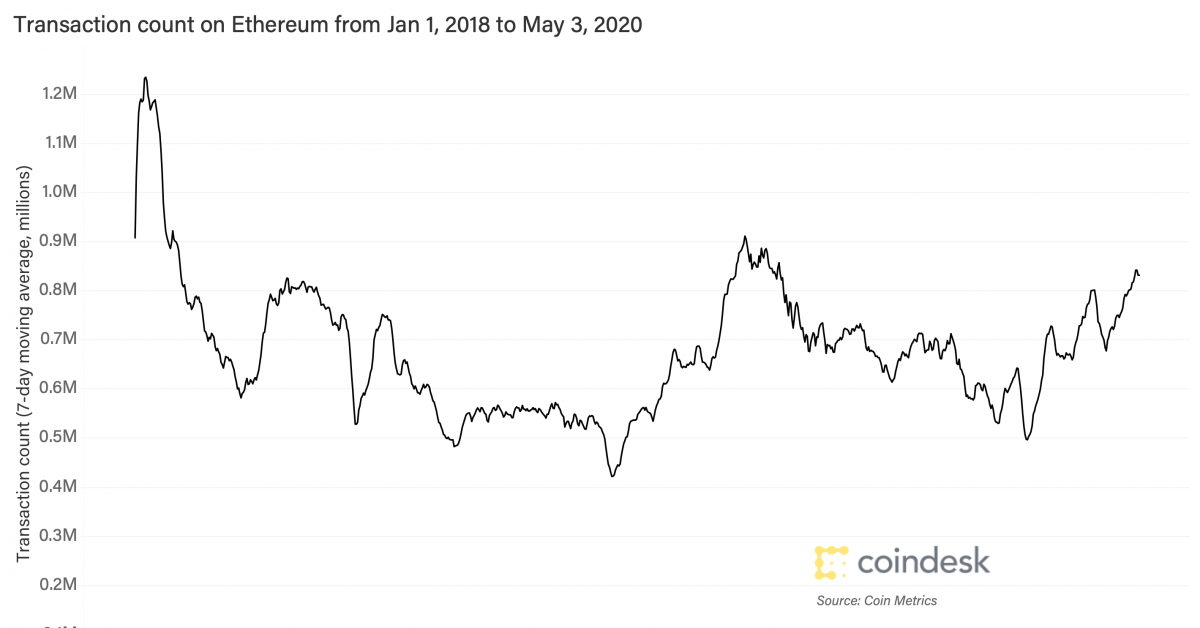

The seven-day shifting common of the full variety of confirmed transactions on Ethereum’s blockchain rose to 845,400 on April 30 to hit the best degree since July 1 , 2019, in keeping with the information supply Coin Metrics. As of Sunday, the typical was 837,100.

The transaction depend had declined to 12-month lows in February. Since then, nonetheless, it has surged by 72%.

“The latest Cambrian explosion of stablecoin issuance has been a substantial driver of on-chain exercise,” stated Lucas Nuzzi, community knowledge product supervisor at Coin Metrics, a supplier of crypto monetary knowledge.

Stablecoins are cryptocurrencies that provide value stability traits by pegging their worth to some exterior reference, normally the U.S. greenback.

Learn extra: The Stablecoin Surge Is Constructed on Smoke and Mirrors

Tether (USDT), trueUSD (TUSD), gemini greenback (GUSD), paxos commonplace (PAX), binance USD (BUSD), USD coin (USDC), Huobi’s HUSD, and MakerDAO’s DAI are a few of the best-known stablecoins. These main stablecoins are primarily based on Ethereum’s blockchain.

The market capitalization of main stablecoins has risen from $3.5 billion to over $7 billion over the past two months, in keeping with Coin Metrics.

Additionally, as of April 21, the market capitalization of all stablecoins working on Ethereum’s blockchain was over $9 billion, according to crypto investor and founding father of Mythos Capital Ryan Sean Adam.

The uptick within the demand for and the issuance of stablecoins has coincided with the coronavirus-induced greenback scarcity influencing the worldwide economic system.

Because the begin of the pandemic, indicators of greenback funding prices in international trade markets have risen sharply. As an example, three-month euro-dollar swaps, a extensively adopted indicator of dollar-funding prices within the international trade markets, rose to a nine-year excessive of 150 foundation factors in March.

Learn extra: Ethereum Now Matches Bitcoin on One Key Metric

Whereas the dollar-funding stress has eased considerably over the previous few weeks as a result of U.S. Federal Reserve’s huge liquidity injections, the disaster seems removed from over for rising markets, which misplaced round $1.5 billion in foreign exchange trade reserves per day in March, in keeping with Bloomberg.

Some observers suppose the disaster has boosted stablecoins’ attraction as less-volatile devices of transferring worth on-chain.

“The financial impacts of COVID-19 have created USD shortages around the globe, particularly in rising markets,” stated Nuzzi. “As such, USD stablecoins could possibly be offering a substitute for bodily {dollars} in jurisdictions experiencing stricter capital controls and forex devaluation.”

But, the rise in transactions is probably not totally because of stablecoin progress. Connor Abendeschien, crypto analysis analyst at Digital Belongings Information, cited Ethereum’s impending transition from the proof-of-work (PoW) to proof-of-stake (PoS) mechanism, dubbed Ethereum 2.0, as one of many potential causes for the rise in Ethereum’s on-chain transactions.

In PoW, miners remedy cryptographically arduous puzzles to finish transactions on the community and get rewarded. In PoS, as a substitute of miners there are validators, which lock up a few of their ether as a stake within the ecosystem. A block validator is then chosen primarily based on its financial stake within the community through a pseudo-random election course of.

Learn extra: What the CFTC Chairman Truly Mentioned About Ether Futures and Ethereum 2.0

Backing Abendeschien’s argument is the latest sharp rise within the variety of addresses holding greater than or equal to 32 ETH, an quantity a holder is required to keep up as a stability to grow to be a validator on 2.0.

The variety of validator addresses rose sharply within the days main as much as the launch of the testnet model of Ethereum’s 2.Zero improve on April 18 and hit a report excessive of 11,6750 on April 28. That boosted the transaction depend, in keeping with knowledge offered by the blockchain intelligence agency Glassnode.

Broad vary intact

Whereas there was a latest uptick within the transaction depend, the metric remains to be throughout the broad vary of 900,000 to 400,000 seen since February 2018.

Gavin Smith, CEO of cryptocurrency consortium Panxora, expects the transaction depend to develop organically sooner or later. “One vital issue to keep in mind is that Ethereum remains to be by far the favored sensible contract automobile within the crypto house and the upcoming transition to PoS will assist the community address the ever-growing demand,” stated Smith.

Learn extra: 5 Takeaways on Ethereum 2.Zero From Vitalik’s ‘Beast Mode’ Weblog Posts

Additionally, a rally in ether’s value may increase transaction depend. “On-chain exercise tends to observe value,” stated Wilson Withiam, analysis analyst at Messari, a supplier of crypto knowledge, instruments, and analysis.

The latest progress in…