Gold Worth Speaking FactorsThe value of gold holds close to the month-to-month excessive ($1779) because the Federal Reserve’s st

Gold Worth Speaking Factors

The value of gold holds close to the month-to-month excessive ($1779) because the Federal Reserve’s stability sheet contracts for the second consecutive week, however the reversal from the Might low ($1670) brings the 2012 excessive ($1796) again on the radar because the Relative Power Index (RSI) approaches overbought territory.

Gold Worth Forecast: 2012 Excessive Again on Radar, RSI Eyes Overbought Zone

The value of gold continues to commerce to recent yearly highs throughout each single month to this point in 2020, and the bullish conduct might persist regardless of the restricted response to US knowledge prints because the Federal Reserve Chairman Jerome Powell vows to “enhance our holdings of Treasury securities and company mortgage-backed securities over coming months no less than on the present tempo.”

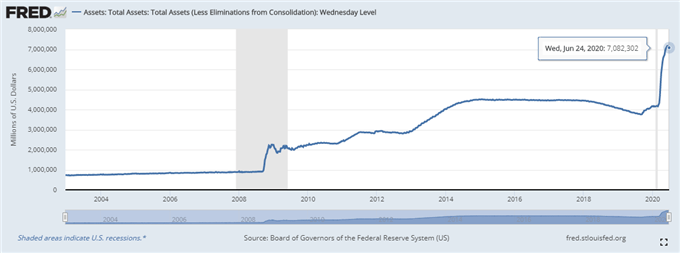

In flip, the contraction within the Fed’s stability sheet might find yourself being quick lived because the discount is basically pushed by a decline in liquidity swaps, and present market circumstances might preserve gold costs afloat because the central financial institution favors asset purchases over different non-standard measures like a yield curve management program.

Consequently, the Federal Open Market Committee (FOMC) might proceed to make the most of its stability sheet within the second half of the 12 months as Chairman Powell guidelines out a adverse rate of interest coverage (NIRP), and it appears as if Fed officers are in no rush to deploy extra non-standard instruments because the replace to the Abstract of Financial Projections (SEP) present “a normal expectation of an financial restoration starting within the second half of this 12 months.”

With that mentioned, the FOMC might persist with the identical script and reiterate its pledge “consider our financial coverage stance and communications” on the subsequent rate of interest determination on July 29, and the central financial institution might name on US lawmakers to additional help the financial system as Kansas Metropolis Fed President Esther George warns that “there’s a danger that the impetus from fiscal coverage will flip adverse earlier than the restoration has been absolutely realized.”

George goes onto say that “it may be awhile earlier than the mud settles and we acquire perception on whether or not additional lodging is important or not,” and the feedback counsel the FOMC will perform a wait-and-see strategy over the approaching months because the Kanas Metropolis Fed President insists that “Federal Reserve actions seem profitable.”

It stays to be seen if Chairman Powell and Co. will alter the ahead steerage within the second half of 2020 as “the enchancment in monetary circumstances ought to additional help a rebound in financial exercise,” however the low rate of interest atmosphere together with the ballooning central financial institution stability sheets might proceed to behave as a backstop for the value of goldas marketindividuals search for a substitute for fiat-currencies.

Advisable by David Track

Obtain the 2Q 2020 Forecast for Gold

Join and be a part of DailyFX Forex Strategist David Track LIVE for a chance to debate potential commerce setups.

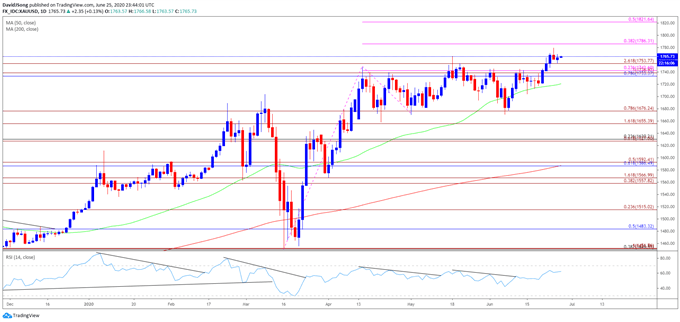

Gold Worth Each day Chart

Supply: Buying and selling View

- The opening vary for 2020 instilled a constructive outlook for the value of gold as the valuable steel cleared the 2019 excessive ($1557), with the Relative Power Index (RSI) pushing into overbought territory throughout the identical interval.

- An identical state of affairs materialized in February, with the value of gold marking the month-to-month low ($1548) through the first full week, whereas the RSI broke out of the bearish formation from earlier this 12 months to push again into overbought territory.

- Nonetheless, the month-to-month opening vary for March as much less related amid the pickup in volatility, with the decline from the month-to-month excessive ($1704) resulting in a break of the January low ($1517).

- Nonetheless, the response to the former-resistance zone round $1450 (38.2% retracement) to $1452 (100% growth) instilled a constructive outlook for bullion particularly because the RSI reversed course forward of oversold territory and broke out of the bearish formation from February.

- In flip, gold cleared the March excessive ($1704) to tag a brand new yearly excessive ($1748) in April, with the bullish conduct additionally taking form in Might as the valuable steel traded to a recent 2020 excessive ($1765).

- The bullish conduct persists in June because the reversal from the Might low ($1670) produces a break of the month-to-month opening vary and pushes the value of bullion to a recent 2020 excessive ($1779).

- Failure to increase the sequence of upper highs and lows from earlier this week might generate vary sure circumstances forward of July, however a break/shut above the $1786 (38.2% growth) area might spur a run on the 2012 excessive ($1796) because the RSI clears the adverse slope from the earlier month and approaches overbought territory, with a transfer above 70 more likely to be accompanied by larger gold worth because the bullish momentum gathers tempo.

- Subsequent space of curiosity is available in round $1803, the November 2011 excessive, adopted by the $1822 (50% growth) area.

Advisable by David Track

Traits of Profitable Merchants

— Written by David Track, Forex Strategist

Observe me on Twitter at @DavidJSong