Coming each Sunday, Hodler’s Digest will assist you monitor each single vital information story that occurred this week. The perfect (and worst) qu

Coming each Sunday, Hodler’s Digest will assist you monitor each single vital information story that occurred this week. The perfect (and worst) quotes, adoption and regulation highlights, main cash, predictions and rather more — every week on Cointelegraph in a single hyperlink.

Prime Tales This Week

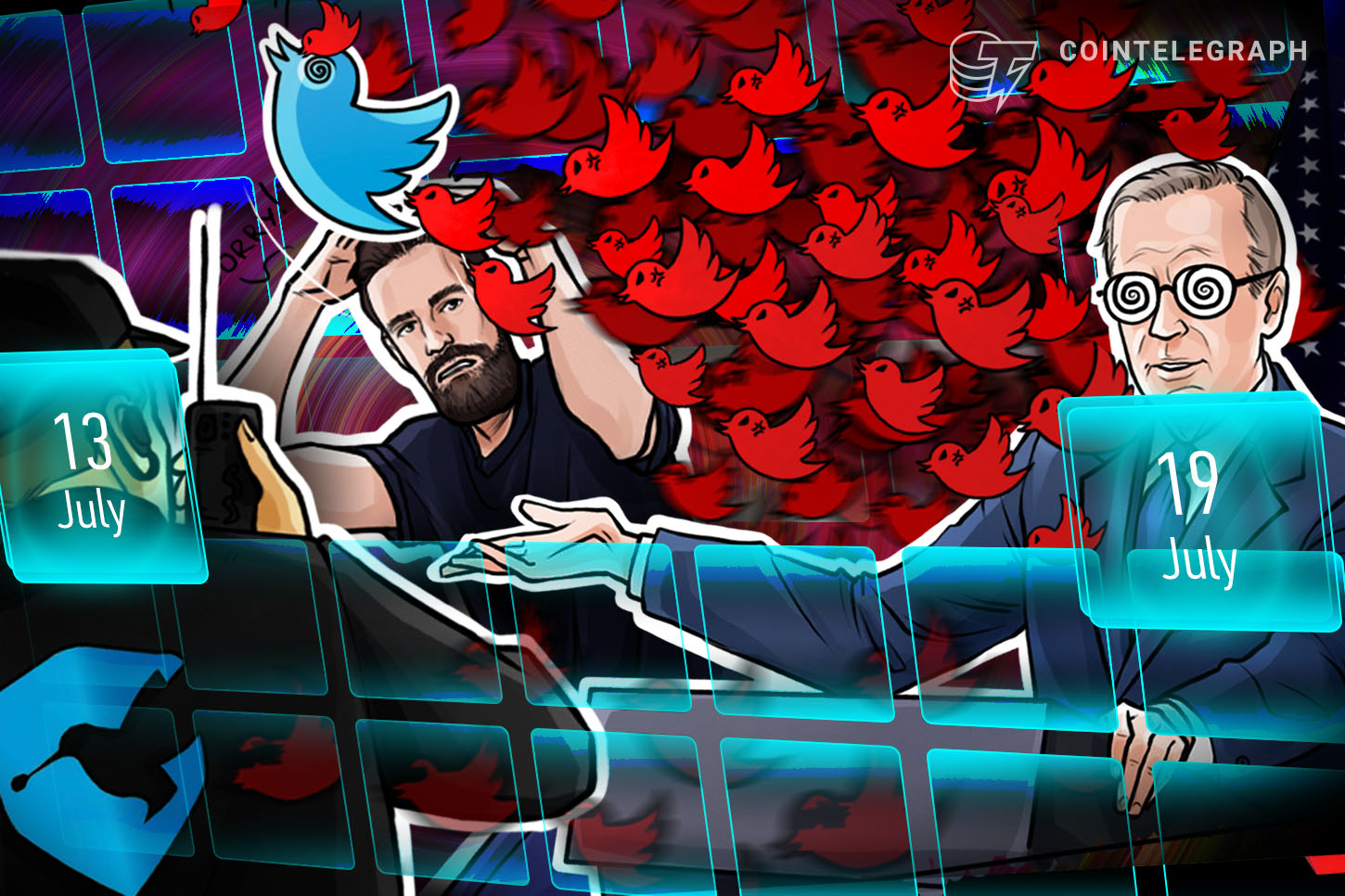

Elon Musk, Kanye West and Invoice Gates’ Twitter accounts hacked by Bitcoin thief

This week, Twitter and Bitcoin suffered a PR catastrophe. In a coordinated, bold assault, about 130 high-profile accounts have been hijacked. Prime celebrities, entrepreneurs, politicians, companies and crypto exchanges have been affected. Many posted comparable tweets that promised followers that Bitcoin funds despatched to a particular tackle can be doubled. Fraudulent messages have been speedily deleted — however on some profiles, resembling Elon Musk’s, they shortly reappeared once more. Twitter had little alternative however to droop all verified accounts because it struggled to get on prime of the breach. It’s estimated the attackers obtained 375 funds price $120,000 on account of the assault, with one Japanese pockets sending $40,000 in BTC. Blockchain intelligence companies have stated a few of the crypto has been moved and despatched by mixing companies, and the FBI has launched an investigation.

Twitter hack: “Social engineering assault” on worker admin panels

The assault has been described as a menace to nationwide safety. We nonetheless don’t know whether or not the criminals managed to entry wise info present in direct messages. It appears the scammers have been capable of succeed with their audacious hack as a result of workers have excessive ranges of entry to info and management on the platform. Twitter has vowed so as to add extra safety measures in an announcement that smacks of closing the steady door after the horse has bolted. Tron founder Justin Solar is providing a reward of $1 million to those that monitor down the attackers. Early detective work suggests the hackers aren’t refined Bitcoin customers as they left trails resulting in and from main exchanges that presumably maintain the keys to their identities. Analysis from Whitestream signifies they seem like consolidating their funds to an tackle that had earlier despatched cash to BitPay and Coinbase.

Twitter hack: The crypto world responds

One thriller behind the hack is how the attackers obtained entry to so many high-profile accounts. Some theories recommend it was an “inside job” and the work of a disgruntled former or present Twitter worker. Others claimed it was clear that the hackers had a “tremendous low IQ” as anybody with entry to so many influential accounts might have simply chosen to govern the markets by FUD slightly than run giveaway scams. One journalist, Josh Barro, tweeted: “, we wouldn’t have to fret about this kind of factor if cryptocurrency was unlawful. I’m not kidding. Crypto has no socially helpful makes use of and fairly a number of socially dangerous makes use of. Why is it allowed?” This argument was shortly shot down in flames — with others stating how Twitter’s centralized controls led to this mess within the first place. As Anthony Pompliano tweeted: “Twitter was hacked. Bitcoin has by no means been hacked.”

Bitcoin worth charts recommend $9,000 impasse might lastly finish subsequent week

Let’s transfer on to another information now. Bitcoin costs largely snoozed by the Twitter fiasco — remaining oddly serene and caught within the low $9,000s. Cointelegraph analyst Michaël van de Poppe says there’s battle within the markets, as each bullish and bearish arguments exist. He believes the bullish situation is primarily constructed round breaking by the $9,200 resistance stage, whereas the bearish situation entails rejecting $9,200 after which dropping help at $9,000. Van de Poppe added: “As Bitcoin’s worth is most definitely going to speed up as soon as it breaks above the $10,500 barrier, the other is true for the bearish case if $8,600 help doesn’t maintain. That is seemingly as a result of there aren’t many help ranges beneath $8,600, suggesting that the value can shortly drop $1,000 in a number of hours as merchants’ cease/losses may additionally add to downward strain with the value dropping under a essential two-month-long help stage. The subsequent main help stage beneath $8,600 is the $7,500 vary.”

PayPal letter appears to verify crypto functionality rumors

PayPal has confirmed that it’s growing capabilities within the cryptocurrency area in a letter to the European Fee. Within the letter, the funds large stated it was “constantly monitoring and evaluating developments within the crypto and blockchain/distributed ledger area.” The corporate additionally careworn that it favors a “harmonized” regulatory method that wouldn’t compromise innovation. Earlier in June, it was reported that PayPal was contemplating introducing direct gross sales of crypto property and providing customers to retailer their crypto utilizing the corporate’s in-house digital pockets. When requested to verify or deny this, a consultant advised Cointelegraph that “PayPal doesn’t touch upon…