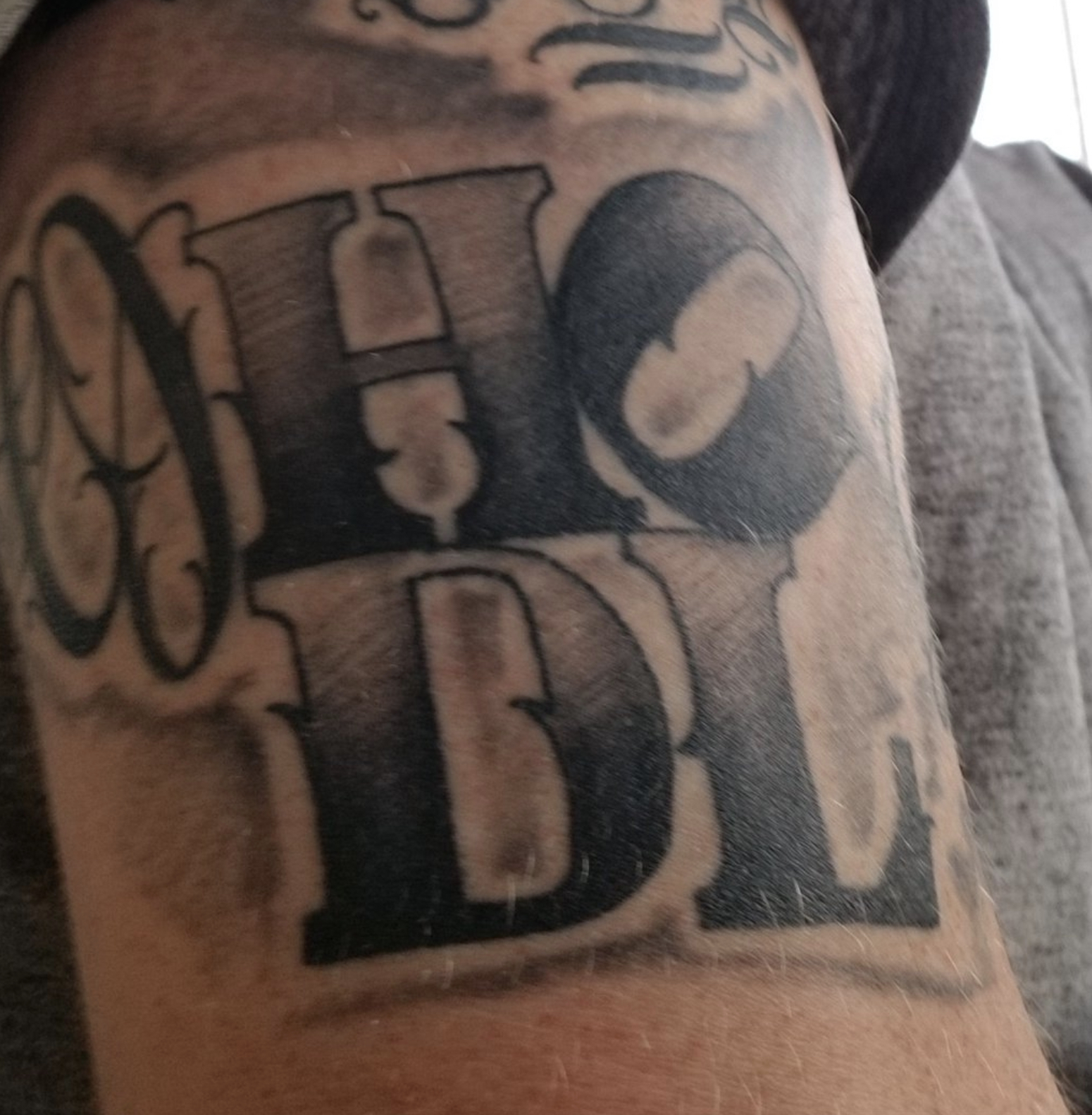

The variety of bitcoin on-chain deposits has dropped sharply during the last six months, indicating a robust optimistic or “HODLing,” sentiment out

The variety of bitcoin on-chain deposits has dropped sharply during the last six months, indicating a robust optimistic or “HODLing,” sentiment out there.

The seven-day common of the variety of transfers to change addresses, or distinctive each day change deposits, fell to 23,986 on Jan. 1. That’s the bottom stage since November 2016 and comes after topping out at 58,925 on the finish of June 2019, in accordance with crypto analytics agency Glassnode. The quantity has since inched as much as 27,289 as of Feb. 4.

Notably, the rely of deposits dropped by 60 % within the second half of 2019 whilst costs collapsed from $13,800 to $6,425.

Throughout violent value drops, traders normally transfer their cash to exchanges to promote them out there. Nevertheless, traders held onto their cash in the course of the second half of 2019 regardless of the value slide.

It signifies elevated “HODLing,” an indication of strengthening perception within the long-term viability of the cryptocurrency, in accordance with Ashish Singhal, CEO and co-founder at CRUXPay and CoinSwitch.co.

“HODLers aren’t in it for a ‘get wealthy fast’ mentality and at the moment are much less fazed by micro components that beforehand led to an exodus or panic promote,” Singhal informed CoinDesk.

Nicholas Pelecanos, advisor to NEM Ventures, sees the slowdown in buying and selling and on-chain transaction volumes as indicative of a not-so-healthy market within the short-term.

“A divergence between on-chain transaction quantity and value appreciation has sometimes been a bearish sign,” Pelecanos informed CoinDesk.

Bitcoin’s value rallied by 30 % in January, diverging greater from the the rely of transfers to change addresses, which remained close to multi-year lows hit on Jan. 1.

Though the variety of transfers to exchanges declined, the variety of transactions just lately noticed an upswing together with value. The seven-day common of transactions jumped rose from 290,200 on Jan. 6 to a three-month excessive of 324,745 on Feb. 3.

That traders hoarded cash in January amid a value rally suggests sturdy bullish sentiment amongst traders; if they’d doubted the sustainability of the latest value good points, they’d have moved their cash to exchanges to promote them at market value, resulting in an increase in change deposits.

Alternate deposits might rise after halving

Bitcoin will endure mining reward halving in Might 2020. The method goals to curb inflation by lowering rewards per block mined by 50 %. When it happens, the block rewards will drop to six.25 BTC from the present 12.5 BTC.

Bitcoin has picked up a bid forward of the supply-cutting occasion. The cryptocurrency is at present buying and selling at $9,400, representing a 46 % achieve on December’s low of $6,425.

Connor Abendschein, crypto analysis analyst at Digital Property Knowledge, expects change deposits to rise ought to the value of the cryptocurrency proceed to take action forward of the halving and within the following months. That’s as a result of some traders might resolve to e book earnings, he stated.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.