|

|

Crypto’s university grooming rumors echo China’s ‘naked loan’ scandal

Major cryptocurrency exchanges are under fire over allegations that they gave leveraged platform-locked funds to university students in China to encourage speculative trading. The controversy has drawn comparisons to the country’s campus lending scandal nearly a decade ago, when students burdened with debt were offered exploitative “naked loans” in exchange for nude pictures as collateral.

Bruce Xu, co-founder of ETHPanda, claimed that centralized exchanges were giving students non-withdrawable trial funds for futures trading. Profits could be kept, and students who posted high-return screenshots on WeChat were reportedly offered additional rewards. Xu called the model a way of grooming the next generation of gambling degens.

Crypto media outlet BlockBeats called on all exchanges to halt any trial fund promotions targeting students, describing the campaigns as exploitative of a financially inexperienced demographic.

While many speculated that Bitget was involved due to its February campus ambassador program, Xie Jiayin (Smith Tse), the exchange’s head of Asia, said the initiative focused on Web3 education and career support, not trading. He denied Bitget ever distributed trial funds to students and said the program was taken offline within 16 hours due to public misunderstanding.

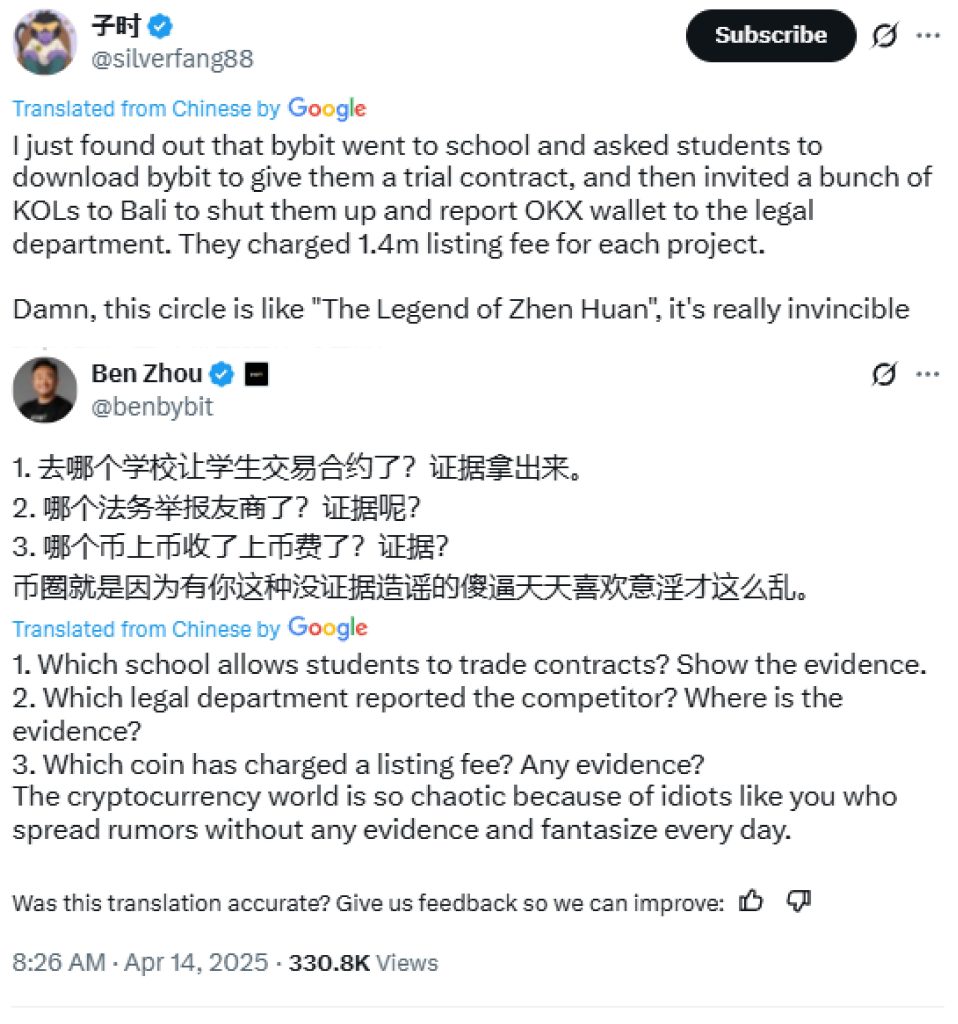

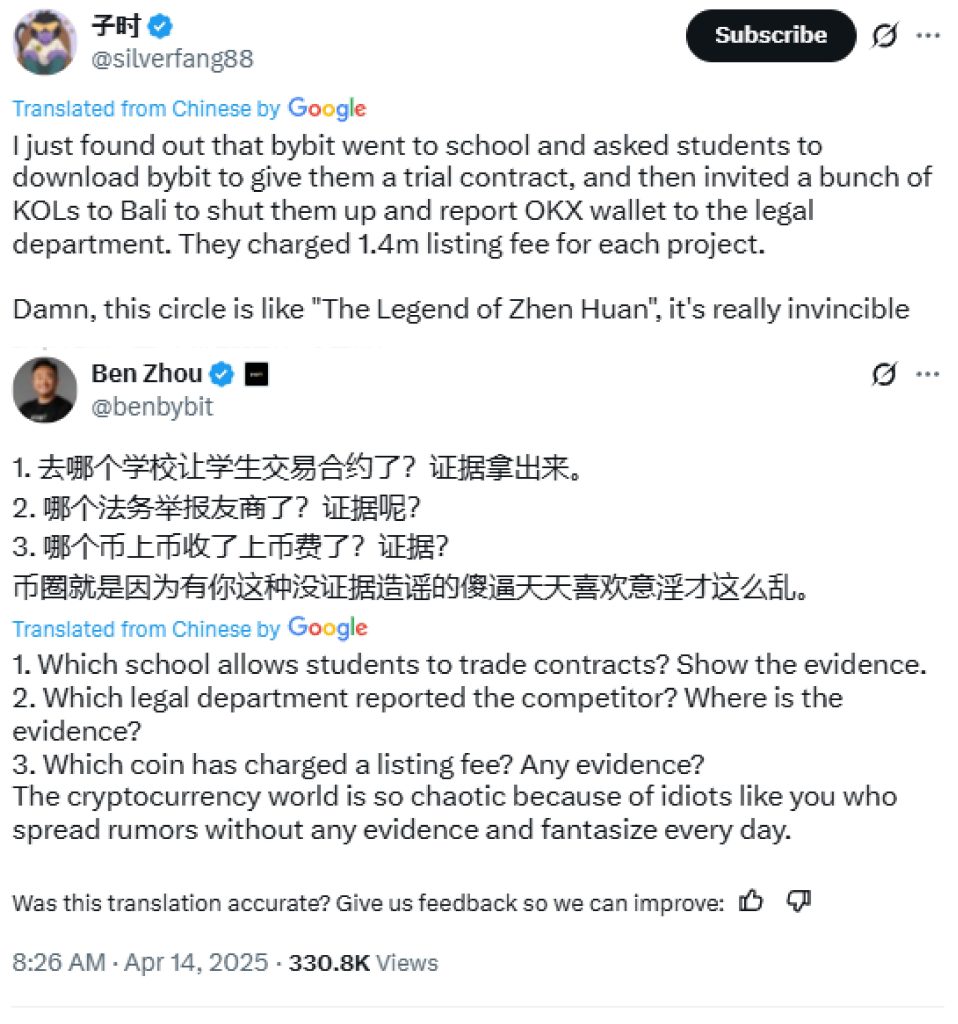

One X user accused Bybit of visiting universities and distributing trial funds. CEO Ben Zhou dismissed the claims, asking for proof and criticizing the spread of unsubstantiated rumors in the crypto space.

BlockBeats compared the uproar to a fintech scandal in China around a decade ago involving Qufenqi. Founded in 2014, the company offered installment loans to students for electronics and other goods, allowing them to make monthly payments with nothing more than a student ID. The company physically visited college campuses with booths and flyers to push its product.

The platform was soon mired in controversy due to hidden fees and debt traps that left students borrowing from one platform to repay another. Local media investigations uncovered a much darker side of campus loans, as some students turned to black-market lenders to pay off their debt. Desperate college students resorted to what’s known as naked loans, where female students were asked to provide nude photos or videos as collateral, with the threat of public exposure if they failed to repay. Some fell into irreversible debt spirals and repaid their debt with sexual favors. In the most tragic cases, some were driven to suicide.

Firms offering campus loans shut down following a regulatory crackdown in 2016 and 2017. Qufenqi ditched its campus lending model and rebranded as Qudain and listed on the Nasdaq. But its negative image has damaged its reputation and its stocks are down more than 90% from their peak.

Nine Chinese scammers defraud 67,000 Indian men pretending to be Indian women

A court in eastern China’s Shandong Province has handed down prison terms up to over 14 years to nine telecom fraudsters who defrauded 66,800 Indian men by pretending to be successful Indian women, according to state-run newspaper Legal Daily.

The fraud ring reportedly swindled 517 million rupees (over $6 million) from June 2023 to January 2024 in a pig-butchering-style scheme, using translation tools and chat apps to lure victims.

The ringleader, identified by the surname He, confessed to receiving investments in Indian rupees and converting the proceeds into USDT, which were then laundered into Chinese yuan through third-party payment services.

To make their personas more convincing, the group used glamorous lifestyle photos, like fitness selfies, travel shots and other curated images, to pose as emotionally vulnerable but financially successful Indian women. They geolocated their social media profiles to Indian cities and created a fake company to gain victims’ trust.

This isn’t the first time Chinese scammers impersonated wealthy foreign women to target men overseas. According to the Chenzhou Internet Police, two suspects were busted in March 2024 for using translation apps to defraud Turkish men through a fake online shopping and rebate scheme, posing as rich Malaysian women. They were supported by a team of more than 10 staff members and worked during Turkish business hours, or from 3 p.m. to 1 a.m. local time.

The police quoted a staffer known as “Xiao A” saying: “I played the character Lisa, a 31-year-old Malaysian-Chinese woman, divorced, sweet-looking, long hair, about 170 cm tall. She…

cointelegraph.com