The Workplace of the Comptroller of the Foreign money (OCC) is letting all nationally chartered banks present custody providers for cryptocurrencie

The Workplace of the Comptroller of the Foreign money (OCC) is letting all nationally chartered banks present custody providers for cryptocurrencies.

In a public letter dated July 22, Senior Deputy Comptroller and Senior Counsel Jonathan Gould wrote that any nationwide financial institution can maintain onto the distinctive cryptographic keys for a cryptocurrency, clearing the best way for nationwide banks to custody digital property for his or her purchasers. The letter marks a significant shift for crypto firms: at current, solely particular crypto custodians, corresponding to Coinbase, can achieve this, normally with a belief constitution issued by a state monetary regulator.

The letter, which seems to be addressed to an unidentified financial institution or related entity, notes that banks “might provide safer storage providers in comparison with current choices,” and that each customers and funding advisors might want to use regulated custodians to make sure they don’t lose their non-public keys, and due to this fact, entry to their funds.

“Offering custody for cryptocurrencies would differ in a number of respects from different custody actions,” the letter stated.

It pointed to the necessity for digital wallets, including that as a result of they exist on a blockchain, there is no such thing as a bodily possession for cryptos.

“The OCC acknowledges that, because the monetary markets develop into more and more technological, there’ll possible be growing want for banks and different service suppliers to leverage new know-how and revolutionary methods to offer conventional providers on behalf of consumers,” the letter stated.

Banks can present each fiduciary and non-fiduciary custodian providers, the letter stated.

It additionally specified that banks coming into the house “ought to develop and implement these actions per sound danger administration practices and align them with the financial institution’s total enterprise plans and methods.”

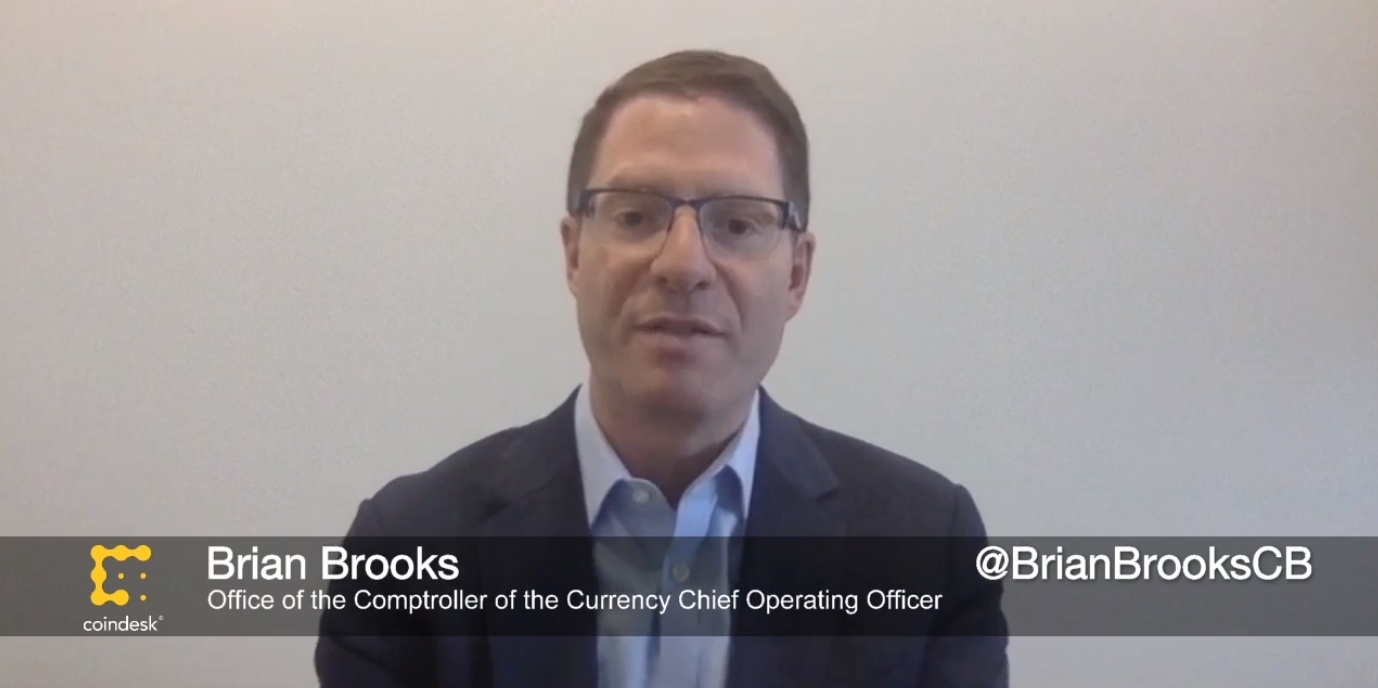

The OCC is at the moment headed up by Brian Brooks, a former Coinbase exec who joined the regulator earlier this 12 months. He’s stuffed in as Performing Comptroller for the reason that starting of the summer time, and has already proposed various reforms that may profit crypto firms, together with a nationwide funds constitution which might let crypto startups bypass the state-by-state method when it comes to buying cash transmission licenses if they supply fee providers.

Wednesday’s letter additionally “reaffirms the OCC’s place that nationwide banks might present permissible banking providers to any lawful enterprise they select, together with cryptocurrency companies, as long as they successfully handle the dangers and adjust to relevant legislation.”

JP Morgan is one such nationwide financial institution that gives banking providers to crypto firms, having supplied help to Gemini and Coinbase earlier this 12 months.

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.