Will bitcoin (BTC) transfer past "digital gold"? Is ether (ETH) viable as cash? In 24 charts, CoinDesk Analysis reveals what occurred to crypto pro

Will bitcoin (BTC) transfer past “digital gold”? Is ether (ETH) viable as cash? In 24 charts, CoinDesk Analysis reveals what occurred to crypto property in Q1 2020 and examines what might emerge sooner or later. Obtain our Q1 evaluation right here, and be part of us on April 15 for a webinar discussing our findings and different related cryptocurrency analysis.

The CoinDesk Quarterly Evaluation gives research-based insights on how the narrative has modified for blue-chips akin to bitcoin and ether. We take a look at which property outperformed on returns, and the way the contributors in crypto markets are shifting within the wake of Q1’s defining occasion, the March 12 plunge.

Bitcoin’s “digital gold” narrative grew up in a “bull market in all the things.” Bitcoin as gold 2.0, a hedge towards inflation and a protected haven in an eventual crash, was a meme buyers readily understood.

Learn extra: Bitcoin’s Bull Case Strengthens After Breaching Worth Hurdle at $7.1K

Now, we’ve seen an financial disaster trigger dislocation in crypto markets and push bitcoin’s worth downward in tandem with shares. Gold and Treasury bonds appeared to have didn’t dwell as much as “protected haven” expectations. If gold’s narrative is being debated, can we nonetheless know what “digital gold” means? On the very least, the occasions of the previous month have put to relaxation the notion that bitcoin at present generally is a “haven.”

How March 12 shook crypto markets, and the way it did not

The crash shook contributors in crypto markets. Open curiosity in bitcoin futures and perpetual swaps fell off a cliff in March. These markets are utilized by merchants massive and small to invest on bitcoin’s worth, and as a brief hedge towards positions within the spot market. Futures quantity spiked and settled at a better baseline, because it did in spot markets. The elevated exercise is happening in a shrunken market. About $1.6 billion of merchants’ positions had been liquidated over two days in March. The sharks are consuming one another in a smaller pool, because it had been.

On the very least, the occasions of the previous month have put to relaxation the notion that bitcoin at present generally is a “haven.”

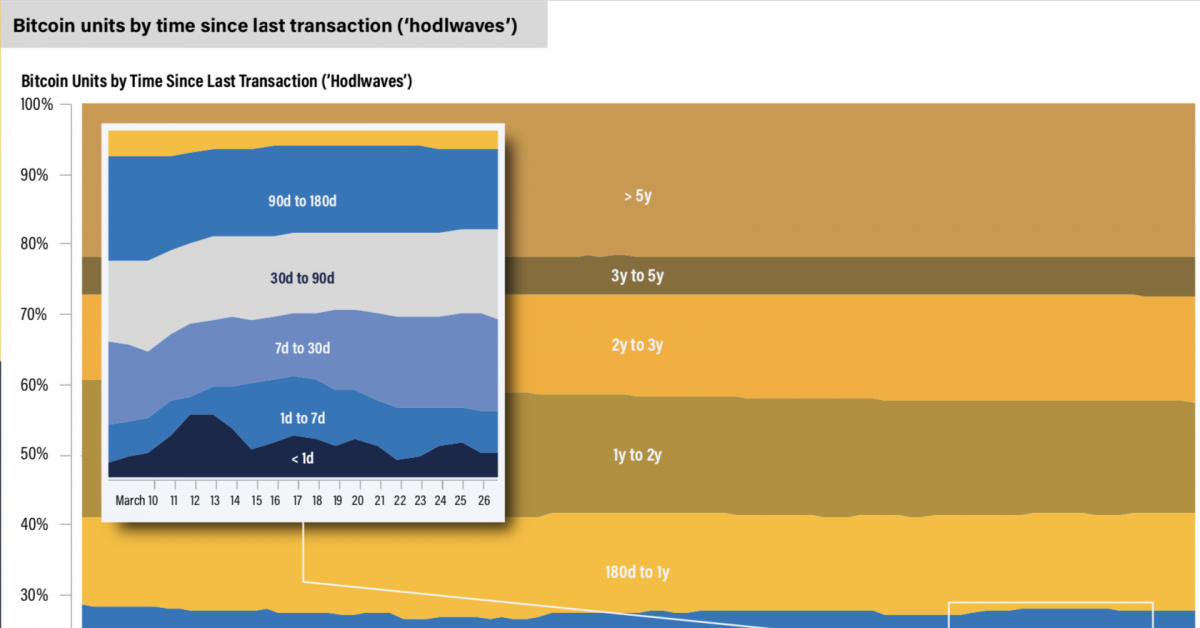

Bitcoin’s long-term holdings, nevertheless, remained unmoved. “Hodlwaves” use Bitcoin timestamps generally known as UTXOs to measure how lengthy every bitcoin has been held. Monitoring time between transactions is a helpful measure of long-term “buy-and-hold” exercise. That exercise is in step with bitcoin’s use case as “digital gold,” a putative store-of-value. Word that long-term holdings (180 days or extra) didn’t change perceptibly in the course of the March 12 crash. Balances held between 90 days and 180 days shifted abruptly. Had been bitcoin sellers concentrated amongst three- to six-month holders? Or had been change balances, which shifted on these dates, concentrated in that band?

Various person narratives: Return of funds?

A few of bitcoin’s long-term holders are certainly hoping in time it’ll show itself as a haven or retailer of worth. However occasions such because the March crash open the door to new narratives. The flagship crypto asset’s subsequent meme will set the adoption curve for verifiably scarce digital property. Will funds re-emerge as an avenue to adoption?

Learn extra: Bitcoin’s Lightning Turns into Newest Protocol to Court docket Publishers With Micropayments

Since launch, the variety of computer systems working the Lightning Community has elevated on common 53 p.c each quarter. Lightning is a “layer two” funds system constructed on high of the Bitcoin community. The worth held inside Lightning cost channels has additionally elevated.

New significance for bitcoin and ethereum technical street maps

It is doable a brand new person adoption narrative will probably be one thing fairly completely different from what long-term buyers in bitcoin have contemplated to this point. Will Bitcoin builders add capabilities — like Schnorr signatures, with their privateness and programmability — that result in its adoption as digital monetary infrastructure?

Learn extra: Chicago’s Buying and selling Companies Look to DeFi With New ‘Alliance’

The technical street map emerges from Q1 2020 with elevated significance for ethereum, as nicely. Ether evangelists have unfold the meme “ETH is cash” within the perception that it has potential as the bottom foreign money of a decentralized, digital banking system, dubbed “decentralized finance” or “DeFi.” The failure of flagship DeFi techniques in the course of the March 12 crash have raised questions on that narrative. Now greater than ever it appears to be depending on a comparatively unsure street map for “ETH 2.0,” an enchancment designed to permit extra transaction throughput.

On March 12, complete ETH locked in DeFi purposes elevated as anticipated, then crashed amid a disaster in DeFi’s programmatic governance. If “ETH is cash,” we’d count on to see the quantity locked in DeFi…