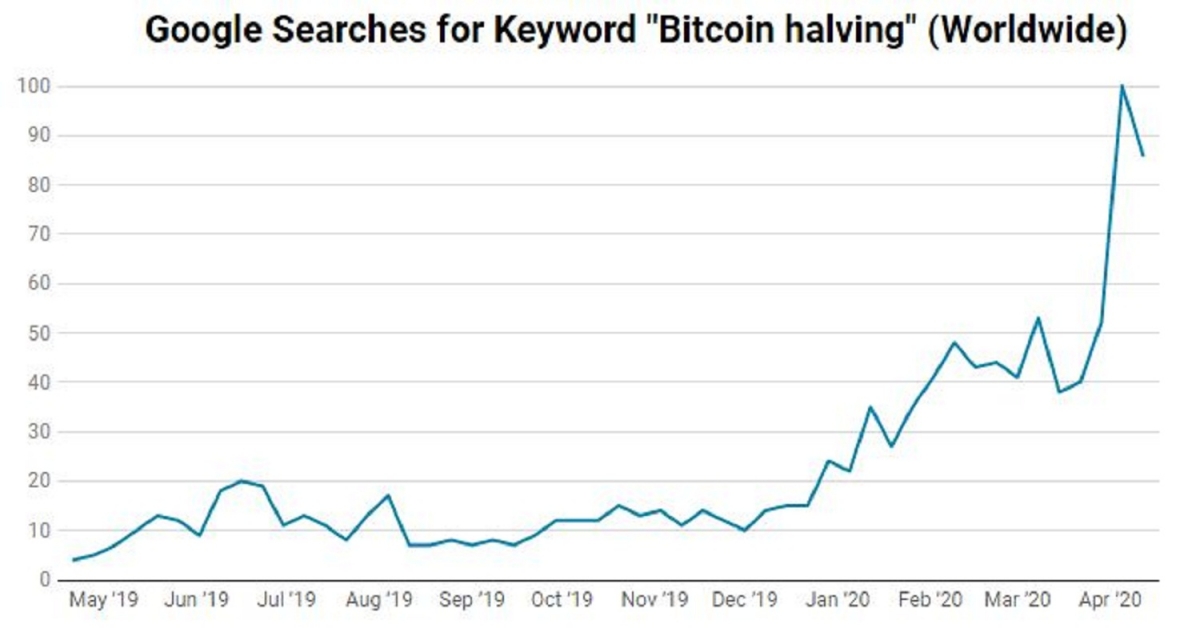

Searches for “bitcoin halving” on Google Developments just lately reached file highs, suggesting peak curiosity within the retail crowd in regards

Searches for “bitcoin halving” on Google Developments just lately reached file highs, suggesting peak curiosity within the retail crowd in regards to the upcoming provide altering occasion.

Queries in regards to the extremely anticipated occasion peaked within the week ending April 11, the very best in bitcoin’s (BTC) 11-year historical past. It moved down 18 % as of press time however stays at elevated ranges. It stays double what it was for the week ending March 21.

Google Developments scale their searches on a variety of Zero to 100 “primarily based on a subject’s to all searches on a subject,” in keeping with the corporate.

The sharp rise is indicative of an “improve in retail curiosity,” in keeping with Mike Alfred, CEO of fintech and information firm Digital Property Knowledge.

Bitcoin goes by a course of referred to as halving each 4 years. The inbuilt mechanism reduces the reward per block mined on bitcoin’s blockchain by 50 %. Primarily, reward halving cuts the tempo of provide enlargement by 50 % each 4 years.

See additionally: Bitcoin Halving, Defined

The cryptocurrency is ready to bear its third-ever reward halving subsequent month, following which the per block reward would drop to six.25 BTC from the present 12.5 BTC.

The favored narrative is that halving is a price-bullish occasion. Bitcoin’s value has witnessed a stable rally over the previous few weeks. The highest cryptocurrency is presently altering fingers close to $7,050, representing over 80 % beneficial properties on the low of $3,867 registered on March 13.

As such, one could affiliate the current value rally with the uptick within the search curiosity for bitcoin halving. Nonetheless, it’s uncertain anyone would be capable of set up simply how a lot of that rise in curiosity has translated into precise purchases of bitcoins.

It is fairly doable that the retail group is merely looking for details about halving and its influence on value, however is sitting on the fence. Even the analyst group is split on the prospects of a post-halving value rally.

Some observers anticipate the 50 % reward reduce to bode nicely for bitcoin’s value. “Halving ought to create elevated upward strain on the worth of bitcoin within the coming two months,” Matthew Dibb, co-founder and COO of Stack, instructed CoinDesk in the beginning of April. Additional, stock-to-flow fashions predict that halving will ship bitcoin’s value to $100,000.

Nonetheless, crypto asset analytics firm Coin Metrics, in its current “State of the Community” report concluded that miner-led promoting strain round bitcoin is prone to improve within the coming months.

Queries for the phrase “purchase bitcoin” haven’t seen an identical spike.

The search time period “purchase bitcoin” is sort of a 3rd down from when bitcoin suffered its “Black Thursday” crash on March 12.

Thus rising retail curiosity within the upcoming halving could not translate into extra shopping for strain across the cryptocurrency.

But, some observers cite the current rise within the variety of bitcoin addresses holding at the very least 1 BTC and at the very least 0.1 BTC as proof of accumulation by retail traders forward of halving.

The variety of distinctive addresses holding at the very least one bitcoin rose to a file excessive of 805,805 on April 16 after dropping from 795,140 to 789,399 within the seven days to March 16, in keeping with information offered by Blockchain intelligence agency Glassnode. Throughout that point interval, bitcoin’s value fell from $9,000 to $4,000.

The variety of distinctive addresses holding at the very least 0.1 BTC additionally rose to a file excessive of two,984,777. The quantity started rising sharply in February and maintained its ascent even throughout the March value crash.

“We’re listening to and seeing elevated retail curiosity. The unprecedented period of stimulus and cash printing has pushed many individuals towards bitcoin as a substitute financial system,” stated Mike Alfred, CEO of Digital Property Knowledge.

The Federal Reserve reduce rates of interest to zero and launched an open-ended asset buy program to counter the coronavirus-led financial slowdown. The stability sheets of G4 central banks – the Fed, Financial institution of Japan, European Central Banks and the Financial institution of England – have expanded to 40 % of their respective nation’s mixed gross home product, as noted by common analyst Jeroen Blokland.

See additionally: Bitcoin Mining {Hardware} Conflict Is Heating Up Forward of the Halving

Whereas the rise within the variety of distinctive addresses does recommend accumulation, it must be famous {that a} single consumer can maintain 50,000 cash in 50,000 totally different addresses. Due to this fact, these metrics don’t essentially characterize retail accumulations.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.