Bitcoin's value jumped Wednesday by essentially the most in six weeks, outpacing U.S. shares, after the Federal Reserve pledged to maintain pumping

Bitcoin’s value jumped Wednesday by essentially the most in six weeks, outpacing U.S. shares, after the Federal Reserve pledged to maintain pumping new cash into markets and authorities knowledge confirmed the financial system sliding into recession.

Bitcoin rallied 12% to $8,703 as of 19:30 UTC (3:30 p.m. Jap time). The Customary & Poor’s 500 Index rose 3.1%.

When it comes to year-to-date efficiency, bitcoin’s returns elevated to 20%, surging previous gold’s 12%. Many cryptocurrency buyers see bitcoin as a hedge in opposition to inflation, much like gold, which may theoretically be a long-term consequence of central-bank cash injections. Deutsche Financial institution estimates that central financial institution steadiness sheets have expanded by some $3.7 trillion simply for the reason that begin of March.

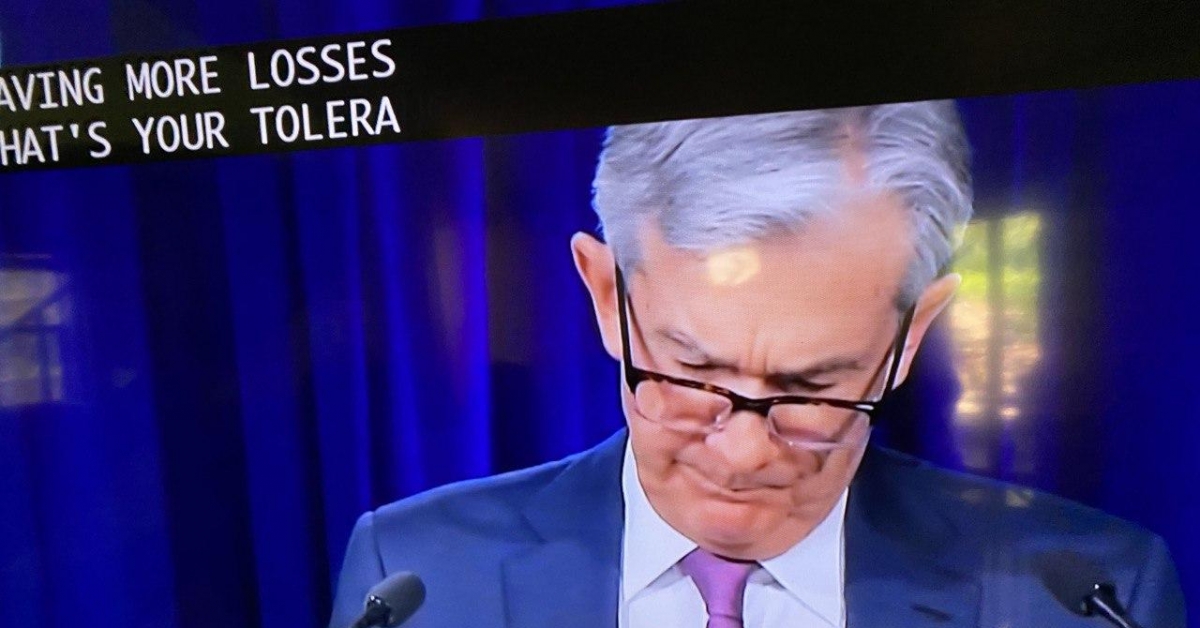

The Fed, led by Chair Jerome Powell, mentioned it might maintain benchmark U.S. rates of interest near zero whereas reiterating a pledge to proceed shopping for U.S. Treasury bonds and different belongings in an unbounded quantity to maintain world markets functioning easily. Some economists had speculated the central financial institution would possibly announce plans to start out tapering the asset purchases, which together with emergency-lending packages have ballooned the Fed’s steadiness sheet previous $6.5 trillion for the primary time in its 107-year historical past.

“It is clear that the results on the financial system are extreme,” Powell mentioned throughout a press convention Wednesday. Reporters, based mostly remotely, dialed into the occasion by way of a gaggle video name. “We cannot run out of cash. It is an infinite pot.”

The Fed’s bulletins got here after a report from the Commerce Division’s Bureau of Financial Evaluation earlier Wednesday displaying that gross home product contracted at an annual fee of 4.8% through the first quarter as authorities issued stay-at-home orders. The report supplied what economists described as the primary official knowledge confirming that the nation is sliding right into a recession.

Powell, in his press convention, warned that second-quarter financial knowledge will reveal the “unprecedented” harm from the coronavirus.

Bitcoin’s rally was possible abetted by “worry of lacking out,” or FOMO, on the a part of merchants, mentioned Kevin Kelly, co-founder of Delphi Digital, a cryptocurrency analysis agency.

“Shopping for begets extra shopping for,” he mentioned.

Bitcoin tumbled 11 % through the first quarter of 2020, however the value has soared for the reason that begin of April.

“Bears are but to place up any combat and, given the contained squeeze previous $8,000,” mentioned Denis Vinokourov, head of analysis at BeQuant, a London-based institutional bitcoin brokerage agency. Such buying and selling motion “suggests the upside might have some longevity.”

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.