Although main bitcoin mining producer Bitmain doubled costs to capitalize on overwhelming demand ensuing from the surge within the worth of bitcoin

Although main bitcoin mining producer Bitmain doubled costs to capitalize on overwhelming demand ensuing from the surge within the worth of bitcoin, it nonetheless pre-sold three months of stock in just a few weeks.

In early December, Bitmain was pre-selling bitcoin ASIC miners with an anticipated delivery date of Might 2021, per CoinDesk’s prior reporting. Lower than a month later, Bitmain has bought out by way of August 2021 and has raised its costs considerably.

In late November, Bitmain’s Antminer S19 was priced at $1,897. Now, the identical machine sells for $3,769 a 98% markup.

Bitmain’s costs have gone up, mentioned Kevin Zhang, vice chairman of enterprise growth for New York-based mining firm Foundry, noting that demand for brand new ASICs reveals no signal of abating quickly. “However there additionally has been very restricted further allocation for Might although July subsequent 12 months for S19s and S19 Professional fashions.”

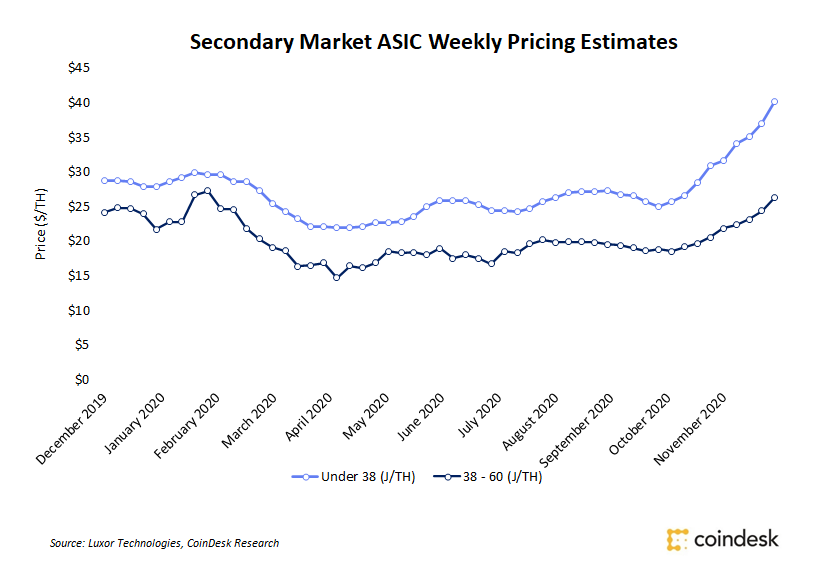

With miners keen to purchase any out there machines, secondary mining markets proceed to learn from main producers’ low stock with exercise surging to its highest ranges since 2017. Costs for extra environment friendly, second-hand fashions have climbed to 12-month highs, per Luxor Applied sciences market knowledge.

“Secondary markets are additionally booming”, mentioned Amanda Fabiano, head of mining at Galaxy Digital. “S9s that had been being bought in Might 2019 for $20 are actually being bought at $130 on some channels,” she advised CoinDesk in an e-mail.

The surge in mining exercise comes as bitcoin ended 2020 with a greater than 300% acquire, at the moment buying and selling just under $31,000. Miner income has additionally soared with the greenback quantity earned per terahash per second (TH/s) reaching $0.25 Sunday, its highest stage since August 2019, per knowledge from Luxor.

To fulfill rising market demand, Bitmain has “been enhancing the effectivity and capabilities of our manufacturing amenities,” mentioned Worldwide Advertising Director Nathaniel Yu.

However Yu doesn’t count on demand for mining machines to subside anytime quickly as “extra institutional buyers take curiosity in cryptocurrencies and blockchain know-how.”

Fabiano described the present mining machine market situations as a “excellent storm” for provide constraints: restricted capability on the foundries, bigger amenities shopping for up provide, and firms with robust stability sheets getting into the market with the power to put large orders.

“At this price, {hardware} procurement will proceed to be an impediment all through 2021,” Fabiano mentioned.