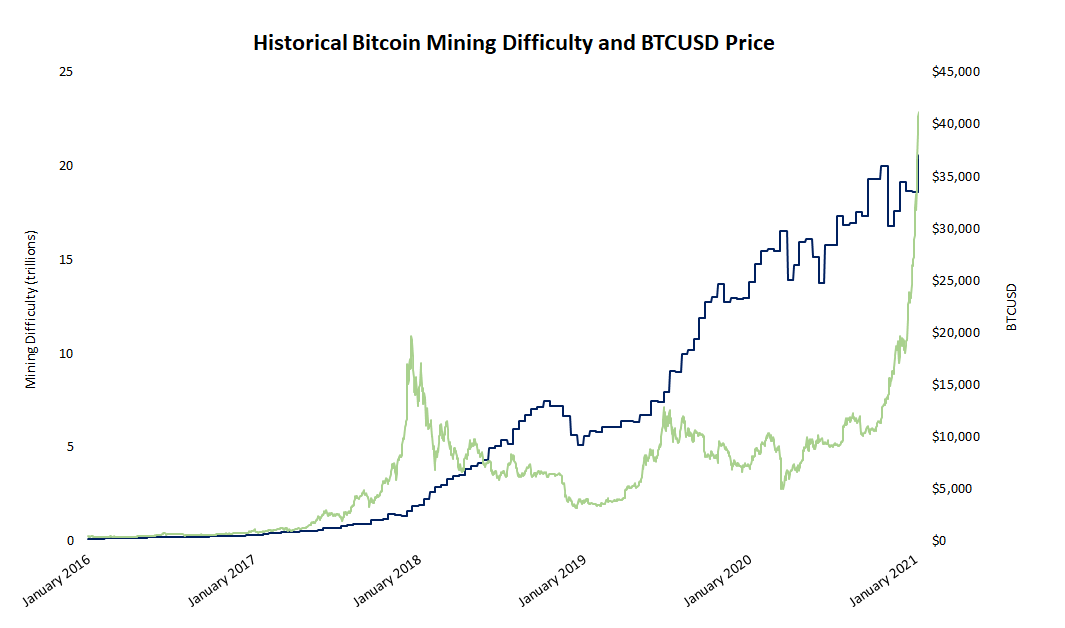

Bitcoin’s mining issue simply reached a report excessive above 20.6 trillion as extra persons are mining at a bigger scale than ever earlier than d

Bitcoin’s mining issue simply reached a report excessive above 20.6 trillion as extra persons are mining at a bigger scale than ever earlier than due to ballooning mining income and bitcoin’s parabolic worth rally.

“A brand new issue all-time excessive is not any shock contemplating mining income has tripled in current months,” stated Edward Evenson, enterprise improvement lead at Braiins, a mining software program firm that just lately acquired full possession of main pool Slush Pool after being majority stakeholders since 2013.

Saturday’s adjustment at block 665,280 marks an 11% improve from the final adjustment on Dec. 27.

Problem is a relative measure of the quantity of assets required to mine bitcoin that climbs or falls relying on the quantity of computing energy consumed by the community, referred to as its hashrate.

As bitcoin’s worth continues to soar – briefly virtually touching $42,000 Friday – miner revenues preserve tempo, incentivizing much more members to mine. Twelve months in the past, bitcoin’s issue was beneath 15 trillion.

“I see this development persevering with within the first half of 2021,” Evenson instructed CoinDesk.

“Present me the cash”

Signalling much more upward issue changes sooner or later, mining firms plan to capitalize on larger revenues at such a scale that their orders for brand spanking new machines have left main producers like Bitmain bought out till August even after almost doubling the worth of some fashions.

“ASIC producers have needed to flip away greater than half a billion {dollars} in mining tools orders in This fall 2020 alone,” Evenson stated. “{Hardware} provide chains are at present overloaded by immense demand.”

Firms like Core Scientific are handily contributing to the overload with large 59,000-machine orders from Bitmain, that are set to triple its mining capability.

Publicly traded mining corporations like Riot Blockchain (RIOT) and Marathon Patent Group (MARA) positioned comparable pre-orders for 31,000 and 90,000 machines by 2020, respectively.

Primarily based on the continuing mining frenzy, Bitcoin’s hashrate is “prone to not less than double in 2021,” Evenson predicts.

A serious miner downside

Greater than an inconvenience, the present ASIC scarcity alerts a deeper elementary weak spot within the mining sector amid hovering revenues and exercise.

“Proper now, the most important danger to the mining enterprise is the ASIC scarcity,” stated Steve Barbour, president of moveable mining infrastructure producer Upstream Knowledge, in a direct message with CoinDesk.

Barbour stated he doesn’t see “any indicators but” that producers are “ramping up quick sufficient” to fulfill the but unabated surge in demand for machines. They aren’t even pursuing non permanent options like providing mid-tier machines for “miners who aren’t concerned about high-priced, high-efficiency gear.”

With no indicators of replenished provides, miners have been scavenging secondary markets for any obtainable and dealing machines, inflicting costs of some fashions to succeed in 12-year highs, per CoinDesk’s prior reporting.

The miner manufacturing enterprise “positively has room for extra diversified competitors,” Barbour stated.