Bitcoin’s one-year correlation to the Normal & Poor’s 500 index hit report highs because the main cryptocurrency continues to commerce in locks

Bitcoin’s one-year correlation to the Normal & Poor’s 500 index hit report highs because the main cryptocurrency continues to commerce in lockstep with conventional monetary markets.

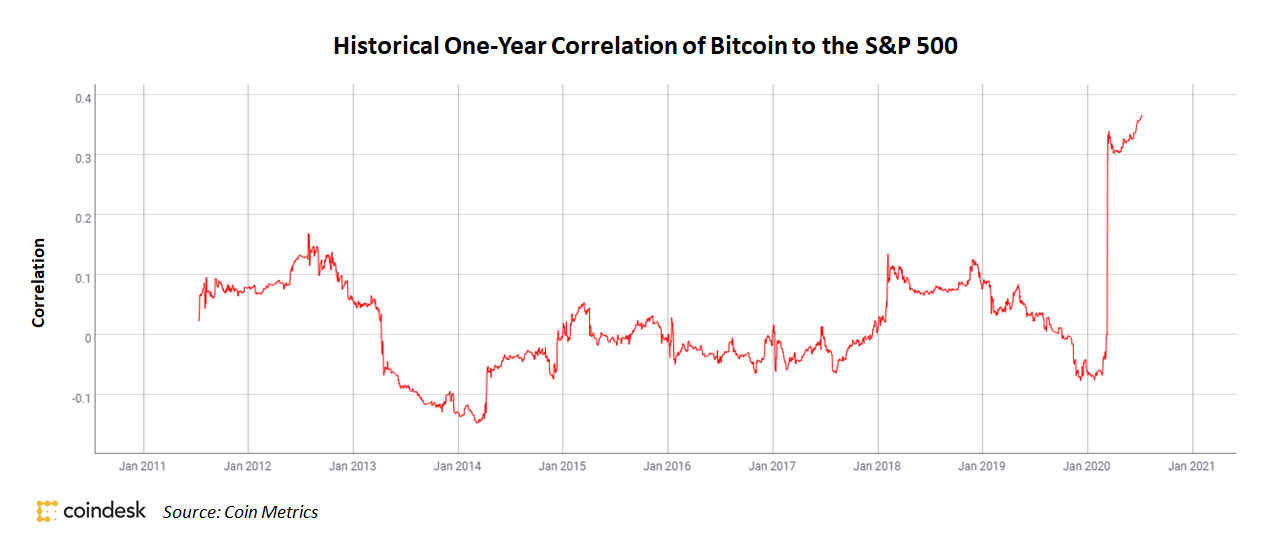

The realized correlation, which measures the connection between two belongings, reached 0.367 on Thursday, up from -0.06 on January 1, based on knowledge from Coin Metrics. Bitcoin’s correlation to the benchmark index of U.S. shares has made new all-time highs for the previous three consecutive buying and selling days. Earlier than this, the earlier excessive was on July 5, which lasted for in the future.

It’s price noting {that a} coefficient of 0.367 just isn’t overwhelmingly robust, however correlations on shorter-term bases are considerably greater. The nearer a correlation coefficient is to 1.0, the extra probably two issues are to maneuver in the identical route.

Bitcoin’s one-month correlation to the S&P, for instance, reached a multi-year excessive of 0.79 on Wednesday, based on knowledge from Skew, indicating a a lot stronger short-term correlation pattern as ranges of investor uncertainty and anticipated volatility stay excessive. Analysts anticipate the pattern to proceed and even strengthen.

Bitcoin’s robust efficiency from March lows has fueled demand to purchase and commerce bitcoin, even with the coronavirus pandemic battering the economic system. Traders are more and more in search of inflation hedges like gold or bitcoin amid aggressive expansionary financial coverage, which has additionally pushed fairness costs greater on the identical time.

Bitcoin has traditionally exhibited little to no correlation to conventional asset courses. However extra constant correlations are probably because the cryptocurrency area matures, based on Kevin Kelly, former fairness analyst at Bloomberg and co-founder of cryptocurrency analysis agency Delphi Digital.

“One of many largest causes we haven’t seen these develop already is the typical investor profile is not like conventional markets, the place giant institutional gamers dominate,” Kelly stated in a letter to purchasers.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.