Coming each Saturday, Hodler’s Digest will allow you to observe each single vital information story that occurred this week. One of the best (and w

Coming each Saturday, Hodler’s Digest will allow you to observe each single vital information story that occurred this week. One of the best (and worst) quotes, adoption and regulation highlights, main cash, predictions and way more — per week on Cointelegraph in a single hyperlink.

High Tales This Week

Hawkish Fed feedback push Bitcoin worth and shares decrease once more

The crypto markets had began the week with a spring of their step.

Final Sunday, Elon Musk revealed that Tesla can be ready to simply accept Bitcoin as a fee technique once more — as soon as it could possibly be proved that 50% of the power utilized by miners comes from clear, renewable sources.

Merchants reacted positively to the tweet, and there have been inexperienced candles aplenty. Upbeat sentiment helped drive Bitcoin above $40,000 for the primary time in over a fortnight. Sadly, although, it appears costs above this degree have been unsustainable.

A brand new wave of promoting reared its ugly head days later after Federal Reserve chairman Jerome Powell advised that rates of interest could rise in 2023 — a yr sooner than deliberate. Different officers went additional, indicating the primary enhance might occur in late 2022.

Bitcoin wasn’t alone in struggling the sell-off. Shares and gold additionally fell, consuming away on the narrative that BTC is an uncorrelated asset.

With costs falling as little as $35,000, there at the moment are fears that a “dying cross” could also be forming for Bitcoin. Some merchants are forecasting that $32,500 could possibly be the subsequent cease earlier than BTC revisits the swing low at $30,000.

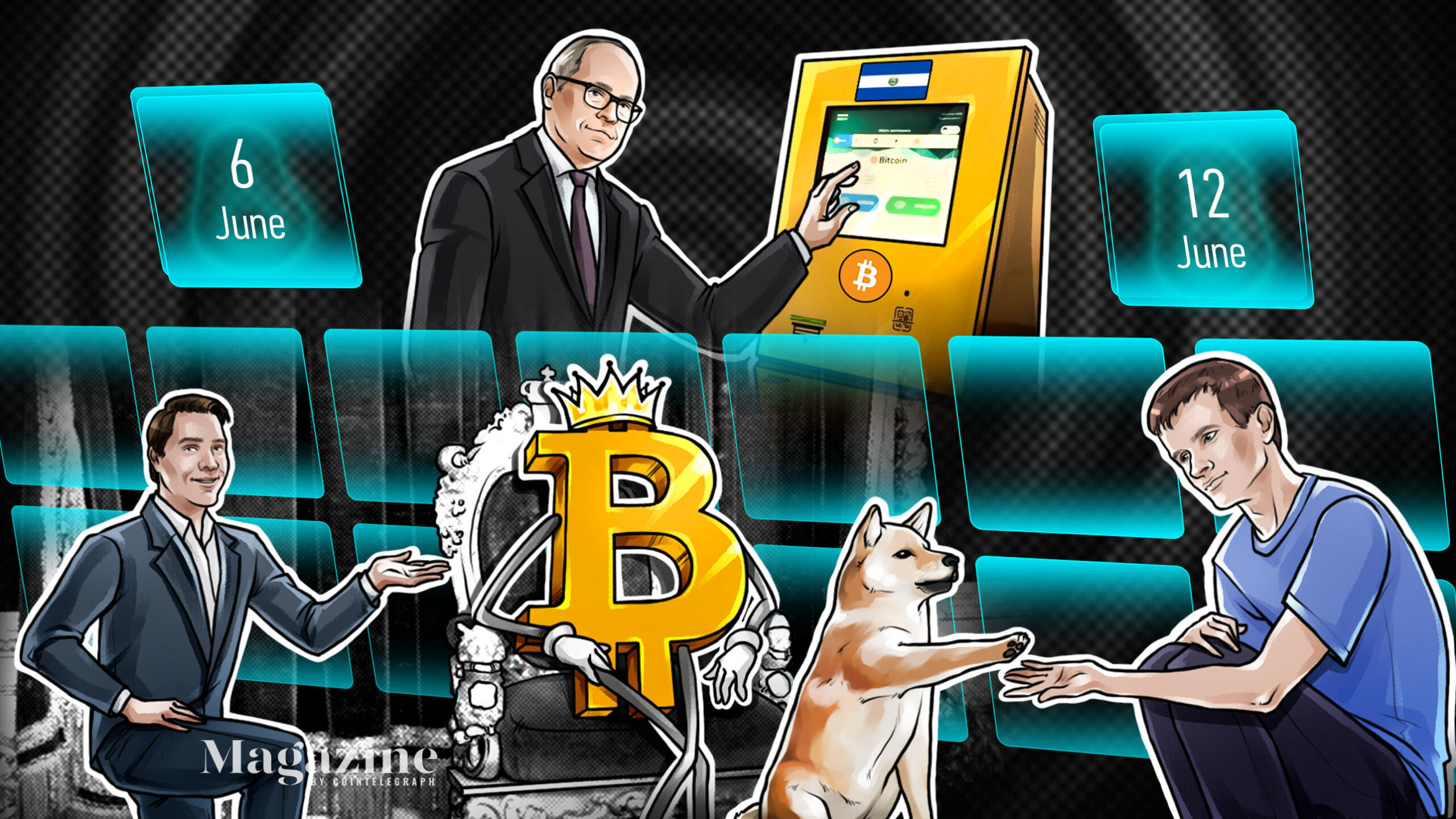

World Financial institution refuses El Salvador’s request for assistance on BTC transition

As decided as El Salvador’s president could also be to introduce Bitcoin as authorized tender, a sequence of unlucky occasions this week confirmed that it’s more durable than it appears.

The World Financial institution has refused to help the nation in its transition, citing “the environmental and transparency shortcomings” related to the digital asset.

Though distinguished Bitcoiners weren’t happy with the World Financial institution’s refusal, it’s honest to say that they weren’t stunned both.

One notably sarcastic contribution got here from Blockstream’s chief technique officer Samson Mow, who tweeted: “BREAKING: WORLD BANK CANNOT HELP EL SALVADOR MAKE WORLD BANK OBSOLETE.” Miaow.

Elsewhere, an El Salvadorean minister denied studies that the nation was analyzing the potential of utilizing Bitcoin for wage funds, warning such speak was “too untimely.”

Economists have additionally been persevering with to challenge warnings in regards to the potential ramifications of El Salvador’s transfer. Steve Hanke pulled no punches when he stated going by means of with this legislation has the potential to “utterly collapse” the nation’s already fragile economic system.

Putting a cheery notice, he stated the politicians who backed President Nayib Bukele’s Bitcoin Regulation have been “silly,” including: “You’re not going to pay in your taxi trip with a Bitcoin. It’s ridiculous. […] 70% of the folks in El Salvador don’t even have financial institution accounts.”

Mark Cuban requires stablecoin regulation in wake of Iron Finance “financial institution run”

Billionaire crypto fanatic Mark Cuban has referred to as for stablecoins to be regulated after dropping cash in a dramatic “rug pull.”

Iron Finance fell sufferer to a “historic financial institution run” that detailed the worth of the IRON stablecoin. Consequently, the worth of its native token TITAN crashed by nearly 100% over two days — from all-time highs of $64.04 to a mere fraction of 1 cent.

In an e mail despatched to Bloomberg, Cuban wrote: “Despite the fact that I acquired rugged on this, it’s actually on me for being lazy. The factor about DeFi performs like that is that it’s all about income and math and I used to be too lazy to do the mathematics to find out what the important thing metrics have been.”

Crypto Twitter, already reeling from the U-turn carried out by Elon Musk, wasn’t a fan of Cuban’s remarks.

Kraken’s CEO Jesse Powell stated an absence of regulation wasn’t the issue, tweeting: “Not doing your personal analysis and YOLOing in to a horrible funding as a result of your time was price greater than your cash is your drawback.”

The dying of NFTs? CNN, Fox, Mila Kunis (and the U.S. Area Drive) don’t suppose so

Earlier this month, some critics have been sounding the dying knell for nonfungible tokens after a Protos report advised that gross sales had slumped by 90% because the peak in early Might. Nonetheless, issues will not be as dire as they first seem.

First off, let’s not neglect that Sotheby’s auctioned off a uncommon CryptoPunk for $11.eight million earlier this month… setting a brand new world document within the course of. Additionally, it’s price noting that there’s no scarcity of latest NFT bulletins.

Right here’s only a few which have emerged in latest days. CNN stated that it’s planning to tokenize historic moments from the information. That got here as Fox, one other U.S. media behemoth, revealed it’s launching a $100 million fund for NFT content material creation. Sotheby’s confirmed that it’s going to public sale off the supply code for the World Extensive Internet within the type of a digital collectible. And never…