Bitcoin is unlikely to interchange the dollar as a world reserve foreign money any time quickly, in keeping with probably the most extremely regard

Bitcoin is unlikely to interchange the dollar as a world reserve foreign money any time quickly, in keeping with probably the most extremely regarded analysts in international alternate.

“Backing the greenback is the world’s greatest, deepest and essentially the most clear authorities bond market,” Marc Chandler, chief market strategist at Bannockburn International Foreign exchange and writer of the e book “Making Sense of the Greenback,” informed CoinDesk in a video chat on Wednesday. “I simply don’t understand how bitcoin can change the dollar from that viewpoint.”

A worldwide reserve foreign money is the one which facilitates cross-border commerce, together with investments and worldwide debt obligations. International central banks maintain reserve currencies to assist shield towards main swings in foreign-exchange charges, in addition to within the conduct of financial coverage.

The U.S. greenback has been the first reserve foreign money since 1944, and traders are inclined to park funds in dollar-denominated property or maintain {dollars} throughout instances of stress within the international financial system. For example, the U.S. Greenback Index, which tracks the dollar’s worth towards a basket of different main fiat currencies, rose from 94.65 to 103.00 in mid-March as international fairness markets tanked on coronavirus-induced recession fears.

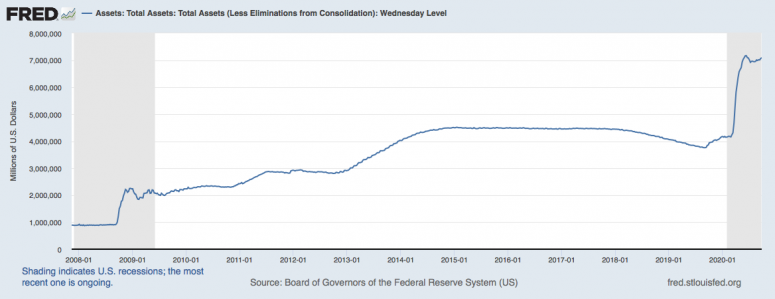

Some analysts, nevertheless, foresee markets dropping confidence within the greenback over the following few years. That’s as a result of the Federal Reserve has pumped trillions of {dollars} of liquidity into the monetary system over the previous decade and is more likely to proceed printing cash at an elevated tempo for a while.

The central financial institution’s steadiness sheet has expanded from $905 million to over $7 trillion up to now 9 years, in keeping with the St. Louis Fed. It has grown by greater than $four trillion up to now 5 months, because the Fed rolled out emergency liquidity applications to counter the financial toll of the coronavirus, whereas ramping up month-to-month asset purchases in a course of generally known as quantitative easing.

“The U.S. greenback is getting ready to dropping its place of world’s international reserve as inflation considerations within the U.S. grows,” Goldman Sachs mentioned in July. Whereas the funding financial institution speculates that gold may change the greenback, the crypto group contends that bitcoin, with its deflationary financial coverage, is the perfect various to the greenback.

Bitcoin’s tempo of provide enlargement is diminished by 50% each 4 years by way of a course of referred to as mining reward halving. At inception, every bitcoin block reward was value 50 BTC. As of now, per block reward is 6.25 BTC – down from 12.5 BTC previous to Could 12. Bitcoin’s tapering provide development whereas the Fed has elevated {dollars} is a big motive why many within the crypto markets have lengthy been predicting the greenback’s collapse and bitcoin’s rise as a world reserve.

Nonetheless, such predictions usually neglect that international locations don’t simply accumulate {dollars} but in addition purchase U.S. authorities bonds. “Central banks don’t simply maintain {dollars}; they maintain U.S. Treasuries. That’s what companies and enormous establishments do,” Chandler mentioned.

Why international locations purchase U.S. Treasury Bonds

As of June 2020, Japan held U.S. Treasury securities value $1.26 trillion, and China held $1.07 trillion, in keeping with knowledge supplier Statista. In keeping with the Federal Reserve and U.S. Division of the Treasury, international international locations held $7.04 trillion value of U.S. Treasury securities as of June 2020.

The Chinese language and Japanese purchases of Treasury bonds isn’t a case of those nations’ generosity, as is popularly perceived, however financial math. These nations run substantial present account surpluses (and capital account deficits) and make investments their surplus foreign exchange reserves within the U.S. authorities bonds, given it’s the deepest on the planet. Additionally, investing within the U.S. Treasury helps Japan and China preserve their currencies from appreciating and preserves present account surpluses.

As of Aug. 20, the dimensions of the worldwide sovereigns, supranational and businesses bond market was $87.5 trillion, of which the U.S. accounted for $22.four trillion and China $19.eight trillion. Whereas China is an in depth second, its foreign money, the yuan, has but to realize full capital account convertibility and there are transparency considerations concerning Chinese language markets.

Put merely, no different bond market has the depth and transparency to soak up billions of {dollars} of demand aside from the U.S. bond market. “No bond market can come near Treasurys,” Chandler mentioned.

In the meantime, no central financial institution has bought bitcoin up to now. Whereas the institutional participation has elevated this 12 months, the cryptocurrency continues to behave like an funding asset moderately than a secure haven or a future international reserve. Bitcoin fell in the course of the March crash and has risen strongly over the previous six months alongside the united statesdollar’s sell-off.

In addition to, worth volatility is a matter. Bitcoin has moved at a mean tempo of 16% per thirty days this 12 months, considerably increased…