The Australian authorities is investing massive in trendy expertise, Nasdaq noticed its first crypto alternate operator itemizing and revenues are

The Australian authorities is investing massive in trendy expertise, Nasdaq noticed its first crypto alternate operator itemizing and revenues are surging for Ethereum miners amid elevated community exercise.

High shelf

Australia modernizes

Australia will commit A$800 million (US$575 million) to spend money on digital applied sciences as a part of its coronavirus restoration plan, Prime Minister Scott Morrison introduced Tuesday. The federal plan will see US$256.6 million for a digital identification resolution, $419.9 million to completely implement the Modernising Enterprise Registers (MBR) program, $22.2 million for small companies coaching to make the most of digital applied sciences and two blockchain pilot packages totalling $6.9 million. “The Plan helps Australia’s financial restoration by eradicating out-dated regulatory boundaries, boosting the potential of small companies and backs the uptake of expertise throughout the financial system,” Morrison mentioned within the announcement.

Nasdaq launch

Blockchain companies agency Diginex has turn into the primary crypto alternate operator to listing on Nasdaq. The inventory went dwell Thursday morning underneath the EQOS ticker image, a nod to the agency’s EQUOS.io buying and selling platform. CoinDesk’s Nathan DiCamillo studies Diginex’s back-door itemizing got here by way of a merger with a special-purpose acquisition firm (SPAC). Diginex CEO Richard Byworth mentioned he expects a mixture of international retail and institutional traders to purchase shares. Over time, he expects nearly all of Diginex shareholders to be U.S. traders due to the Nasdaq itemizing.

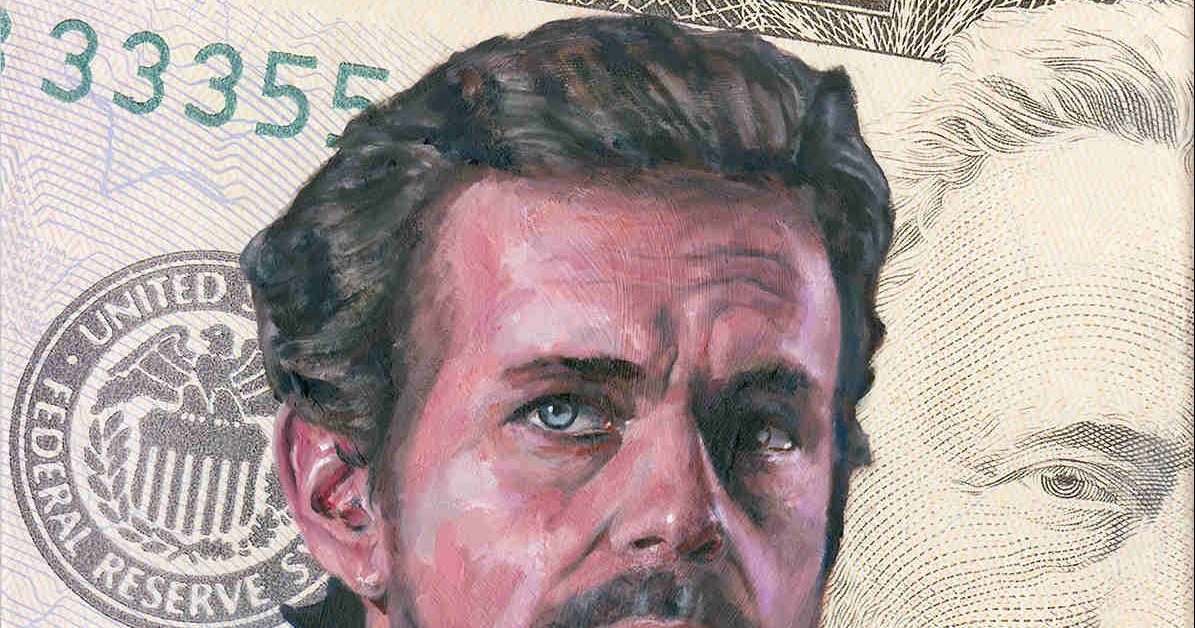

Dorsey responds

Twitter CEO Jack Dorsey tweeted his disapproval of Coinbase CEO Brian Armstrong’s mission assertion to maintain his firm free and away from politics. Dorsey argued that by the very act of being a crypto alternate, Coinbase was all the time already engaged in politics. “Bitcoin (aka ‘crypto’) is direct activism towards an unverifiable and exclusionary monetary system which negatively impacts a lot of our society. Necessary to a minimum of acknowledge and join the associated societal points your prospects face every day. This leaves individuals behind,” Dorsey tweeted. Armstrong made waves this week – out and in of crypto – when saying Coinbase, and its workers, ought to maintain work and activism separate.

Election predictions

Placing stake to their claims, many crypto-political gamblers have solid their vote predicting who may win the contentious U.S. presidential election. CoinDesk markets editor Lawrence Lewitinn regarded on the information following this week’s first presidential debate and located many are betting incumbent President Donald Trump will lose in November. Whereas bettors on decentralized betting platforms like Augur and futures markets on FTX aren’t as bullish on the challenger, former Vice President Joe Biden, he does have the chances. “Thus what’s true on the time of publication can change on a dime. It’s now fewer than 5 weeks till Election Day. Buckle up!” Lewitinn warns.

Mining earnings

HIVE Blockchain has reported its best-ever quarter, because the mining agency raked in report charges from the frenzied exercise in decentralized finance (DeFi) over the summer season. The Toronto-listed mining firm launched its unaudited outcomes Thursday, saying it mined a complete of 32,000 ether (ETH) and 121,000 ethereum basic (ETC) within the second fiscal quarter ending Sept. 30. Per CoinDesk’s value information, that comes to just about $11.eight million for mining ether, and an extra $664,000 for ethereum basic – roughly $12.four million at time of writing. The figures signify a close to 30% enhance from the 25,000 ETH that HIVE mined within the first quarter and a 50% enhance in the identical quarter in 2019.

Stealth launch

Within the newest effort to easy a path for buttoned-up traders, Talos, an institutional-grade conduit to the crypto ecosystem, is rising from stealth mode to serve brokers, custodians, exchanges and over-the-counter (OTC) buying and selling desks. The platform began out in 2018 and is backed by a formidable listing of traders together with Autonomous Companions, Citadel Island Ventures, Coinbase Ventures and Initialized Capital. Over the previous 12 months or so, Talos has been quietly onboarding a core group of capital market contributors, in order that the platform could make its debut in a revenue-generating state.

Fast bites

At stake

SEC motion

Wednesday, a U.S. decide dominated Kik’s $100 million token increase was in violation of securities legal guidelines. That is basically the denouement to a 12 months’s lengthy battle between the Canadian messaging app and the U.S. Securities and Change Fee (SEC). Although Kik can have a chance to enchantment.

Responding to the SEC’s movement to abstract judgment – the place the regulator can ask to conclude a trial primarily based on “undisputed materials information,” slightly than partaking in a trial – U.S. District Choose Alvin Hellerstein discovered Kik’s “token distribution occasion” (TDE) happy the three prongs of the Howey Take a look at.

CoinDesk’s Nikhilesh De studies that preliminary coin choices (ICOs)…