Hi there. A late evening interpretative letter from the Workplace of the Comptroller of the Forex (OCC), the U.S.’ federal banking regulator, sayin

Hi there. A late evening interpretative letter from the Workplace of the Comptroller of the Forex (OCC), the U.S.’ federal banking regulator, saying banks can act as stablecoin nodes was the juice wanted to push bitcoin out of the doldrums. JPMorgan analysts see a future the place 1 BTC may commerce arms close to $150,000, in accordance with a brand new report.

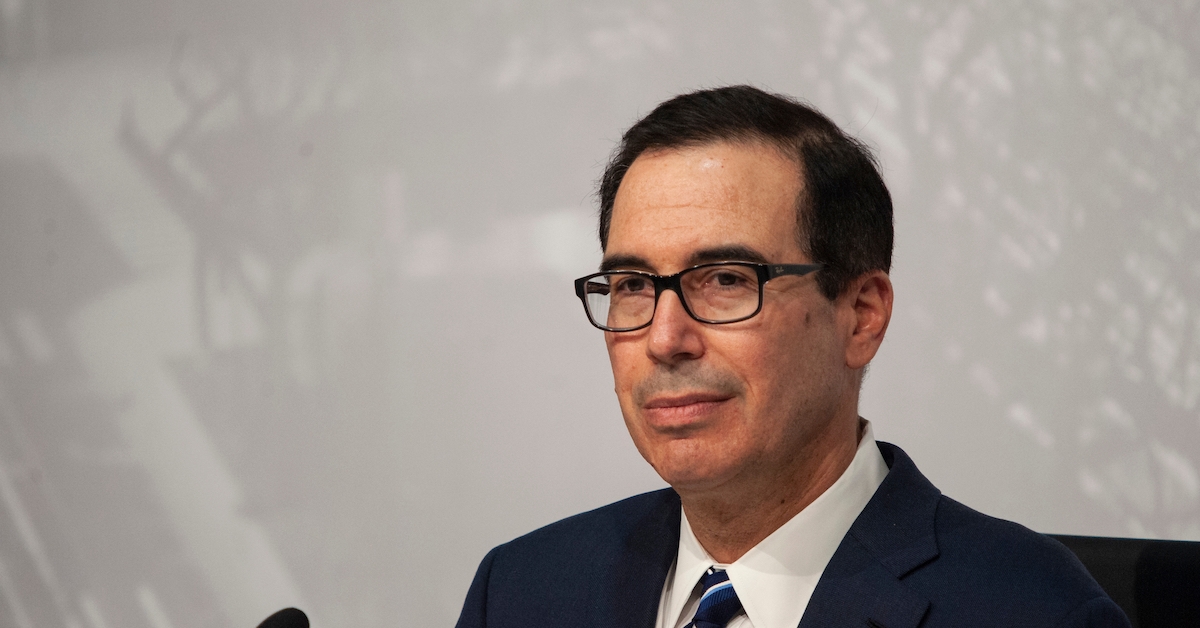

In different regulatory information, the remark interval for a controversial pockets rule closed, with many heavy hitters popping out towards the U.S. Treasury’s proposed guidelines to extend change surveillance. Extra on that later, first the highest tales for the day.

Prime shelf

Banking on stablecoins

A brand new letter from the U.S. federal banking regulator may give stablecoin networks the identical standing as different international funds networks like SWIFT or FedWire. In a attainable final act from Appearing Comptroller Brian Brooks, U.S. banks can now function as stablecoin nodes and are free to ship transactions, as long as they adjust to securities and different laws. Bitcoin markets rebounded on the information.

Provide crunch

Bitcoin mining machine costs are hovering together with bitcoin’s worth. In response to knowledge reviewed by CoinDesk, a surge in mining income, restricted manufacturing capacities and quite a few new mining entrants has led to a provide scarcity. It doesn’t assist that established gamers like Riot and Marathon (each publicly traded) have been shopping for up probably the most up-to-date ASICs miners.

Brazil’s market

The battle to regulate Brazil’s rising crypto retail sector is heated, with Argentina’s Ripio buying BitcoinTrade, the second-largest crypto change in South America’s largest economic system. Final month, Mexico Metropolis-based crypto change Bitso raised a $62 million funding spherical, a piece of which was earmarked for a Brazil push, the corporate stated.

Fast bites

- RIPPLE EFFECT: Grayscale drops XRP from Giant Cap Crypto Fund following Ripple/SEC go well with. (CoinDesk)

- TRADEBLOCK BUY: CoinDesk has acquired institutional analytics and knowledge supplier TradeBlock. (WSJ)

- MINING PIVOT: Two former Canaan administrators are serving to a Chinese language cellular gaming firm enter the crypto mining sector. (CoinDesk)

- VOYAGING OUT: Cryptocurrency dealer Voyager Digital says This autumn income is predicted to achieve round $3.5 million, a rise of 75% from the earlier quarter. (CoinDesk)

- TOKEN GENERATOR: Crypto change LCX is now licensed in Liechtenstein to assist banks create their very own digital belongings and safety tokens. (CoinDesk)

- FIRST MOVER: DeFi retains astounding. (CoinDesk)

- KNOWN UNKNOWN? One River has accomplished “one of many largest digital asset trades in historical past,” in accordance with facilitator Coinbase. The quantity is unknown. (Decrypt)

Market intel

Gold bugs

A brand new funding report from JPMorgan has set a $146,000 worth goal for bitcoin. The bullish goal is the most recent analytical observe that wagers bitcoin will grow to be a preferred various to gold. “Bitcoin’s [current] market capitalization of round $575 billion must rise by 4.6 instances – for a theoretical bitcoin worth of $146,000 – to match the whole personal sector funding in gold by way of exchange-traded funds or bars and cash.” The one factor holding the bitcoin beast at bay? Volatility.

At stake

11th hour?

A remark interval for a proposed algorithm that may improve reporting necessities for crypto exchanges and reduce blockchain person privateness closed yesterday, with many main crypto companies rejecting the maneuver.

Spearheaded by the U.S. Treasury Division in December, however formed primarily by the worldwide Monetary Crimes Enforcement Community (FinCEN), the algorithm would see exchanges implement know-your-customer (KYC) necessities for transactions despatched to unhosted pockets addresses, or addresses that exist exterior a centralized or custodial setting.

This could imply many varieties of private wallets in addition to counterparties to exchanges’ clients would should be recognized. Reporting limits can be set for personal wallets that obtain greater than $10,000 in 24 hours, and record-keeping guidelines for transactions valued at over $3,000. FinCEN and the Treasury Division declare the elevated surveillance will support felony enforcement and scale back monetary malfeasance.

The proposal was rushed out late on Friday, Dec. 18 – every week earlier than many U.S. staff may anticipate to interrupt for the winter vacation season – with the Treasury setting solely a 15-day remark interval. Many crypto business commentators referred to the rushed timeline as onerous and probably unlawful.

Nonetheless, some 6,000 feedback had been filed with FinCEN inside this slim window, with companies akin to Sq., Andreessen Horowitz (a16z), Kraken in addition to civil liberties organizations together with the Digital Frontier Basis (EFF) and Coin Middle popping out exhausting towards the proposal. The reporting interval has since been “prolonged” till Jan. 7.

“The method itself is fraught with an ‘us-versus-them’ hostility to the business’s views – as seen by the breakneck schedule for a significant rule, the thinness of…