Tether disputes allegations of market manipulation introduced in courtroom, Vitalik Buterin points a proposal for Ethereum’s excessive fuel charges

Tether disputes allegations of market manipulation introduced in courtroom, Vitalik Buterin points a proposal for Ethereum’s excessive fuel charges and Voatz weighed in on whether or not a longstanding federal regulation over laptop entry is overly broad.

You’re studying Blockchain Bites, the each day roundup of essentially the most pivotal tales in blockchain and crypto information, and why they’re vital. You may subscribe to this and all of CoinDesk’s newsletters right here.

Prime shelf

Tether disputes

Tether and affiliate trade group iFinex have known as for a market manipulation lawsuit to be dismissed as a result of plaintiffs, they are saying, can not show $three billion value of unbacked stablecoins truly entered the market. 5 crypto merchants are suing the businesses for incurred financial losses after shopping for cryptocurrencies at costs they declare have been inflated by Tether’s manipulation of the market. Plaintiffs declare Tether issued billions of {dollars} value of dollar-backed cryptos, which Bitfinex then used to buy cryptocurrencies on the open market to prop costs up throughout market downturns. Defendants’ legal professionals argue the declare USDT will not be correctly backed is predicated on “unfounded allegations, and that it hasn’t been confirmed cryptocurrency costs have been certainly synthetic on the time in query.

New pairs

BitMEX introduced plans to introduce futures markets for 2 cryptocurrencies, chainlink (LINK) and tezos (XTZ), the primary new cash to seem on the trade in over two years. These two cryptos have seen triple-digit year-to-date returns. BitMEX final listed a brand new token in June 2018, when it introduced a TRON/BTC futures market. Shortly earlier than that announcement, the trade eliminated six altcoin futures markets, together with ethereum basic (ETC), zcash (ZEC), and monero (XMR). Notably, the brand new altcoin futures will commerce in opposition to tether (USDT) as an alternative of bitcoin (BTC). In Friday’s announcement, BitMEX stated the explanation for it is because “USDT pairs account for over 60% of total altcoin quantity.”

Price fixes?

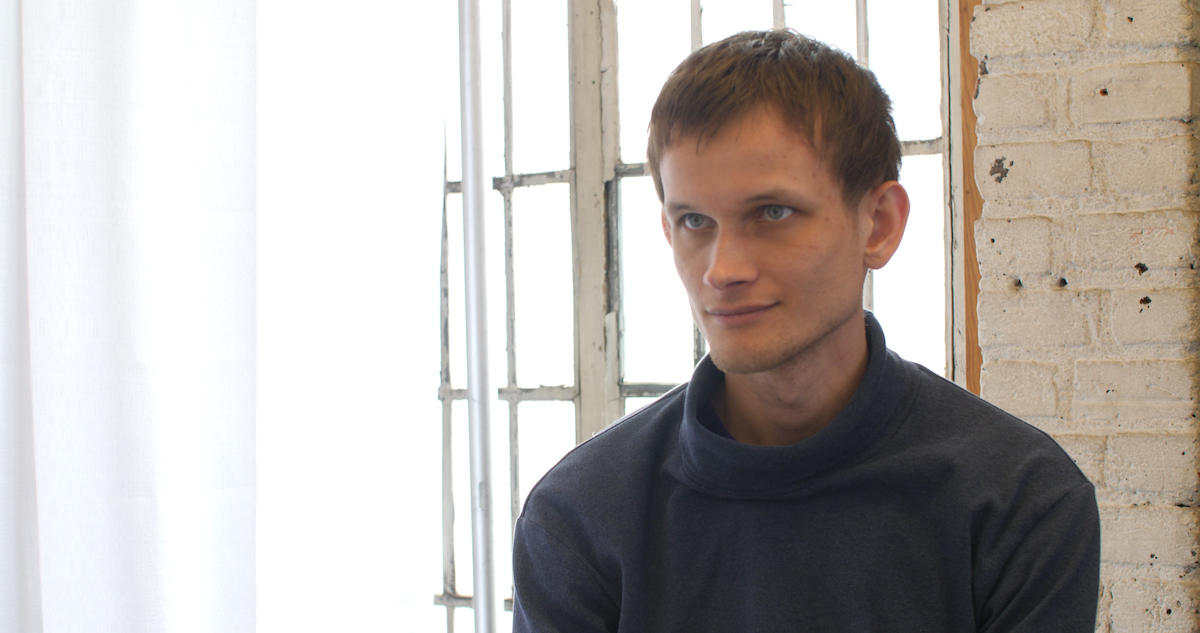

Ethereum co-founder Vitalik Buterin launched an enchancment proposal (EIP 2929) Tuesday in a bid to ameliorate hovering community charges. Common community charges reached $15.21 on Wednesday, up 660% from $2 a month in the past. The surge in charges is probably going being pushed by the rising use and variety of decentralized finance (DeFi) purposes. Buterin’s proposal would make “heavy” contracts, which replace the Ethereum state, dearer by an element of three. This repricing proposal may break some good contracts already working on Ethereum, Buterin wrote, including builders “have had years of warning” about potential adjustments. Mandatory consensus to vote the proposal in may take weeks or months.

Worldwide regulation

Financial institution of England (BoE) Governor Andrew Bailey stated regulators have to return collectively for a “international response” to stablecoin issuance. Talking Thursday, he stated the worldwide nature of stablecoins, which could be based mostly in a single nation and function in one other, meant failure to coordinate may end in confusion and regulatory fragmentation. Whereas admitting stablecoins may scale back frictional prices, even changing into the first means for buying items and companies, regulators should guarantee they preserve their 1:1 backing with fiat currencies. Additional, Bailey known as bitcoin unsuitable for funds and multi-asset backed crypto-dollars like libra untimely. The BoE is actively researching a “digital pound.”

Quickening analysis

Brazil’s chief central banker Roberto Campos Neto stated Wednesday that his nation might be prepared for a digital forex (CBDC) by 2022. By that point, the Banco Central president stated, Brazil can have an interoperable instantaneous funds system and a “credible” and “convertible” worldwide forex – “all of the substances to have a digital forex,” he stated at a Bloomberg occasion coated by native outlet Correio Braziliense. Campos Neto additionally was reported to have stated that CBDCs are the consequence of fast-digitizing monetary methods equivalent to Brazil’s.

Fast bites

At stake

Is the CFAA overly broad?

Blockchain voting startup Voatz weighed in on a longstanding ruling about improper entry to a “protected laptop.”

Showing in a “good friend of the courtroom” temporary earlier than the U.S. Supreme Courtroom, the startup argued that bug bounty applications regarding cybersecurity ought to be operated beneath strict supervision.

The case, Van Buren v. United States, is centered round whether or not it’s a federal crime for somebody to entry a pc “for an improper function,” in the event that they have already got permission to entry different information on that laptop.

Nathan Van Buren, the petitioner within the case, is a former Georgia police officer who was charged beneath the Pc Fraud and Abuse Act (CFAA), which is usually used to prosecute laptop hackers. Enacted earlier than the institution of the web, the CFAA prohibits accessing a “laptop” with out permission in addition to the unauthorized…