Jack Lu, 23, was struck by the concept for his new DeFi platform Bounce whereas engaged on his thesis on recreation idea and cryptocurrency at Reed

Jack Lu, 23, was struck by the concept for his new DeFi platform Bounce whereas engaged on his thesis on recreation idea and cryptocurrency at Reed Faculty in California.

“It took me fairly a very long time to think about it,” Lu explains about his recreation idea influenced public sale platform. “Everybody was speaking about lending and borrowing, and doing Uniswap and offering liquidity. After I checked out this monetary channel I believe there’s one lacking piece, which is auctions.”

Lu — who counts Andre Cronje from Yearn.Finance, Kain Warwick from Synthetix and Calvin Liu from Compound as friends — describes Bounce as a decentralized model of eBay, Sotheby’s or Christies. Customers can arrange swimming pools to public sale off tokens, and mess around with parameters just like the quantity to be swapped, the time restrict and other ways of accepting bids.

He co-founded it with Ankr CEO Chandler Music and the naked bones, black and white platform went reside on August 4. “I partnered with some buddies and we made it,” Lu says. “The platform has been reside for 2 months and it’s ranked 9 on ETH gasoline station.”

So way over 2,700 swimming pools have been created, and greater than 500,000 Ether ($179M) has modified fingers on the Ethereum model of the platform. Bounce was additionally one of many first 5 tasks introduced for the interoperable Binance Good Chain — which is basically an Ethereum clone with decrease gasoline charges and keep away from congestion — and 700,000 BNB ($18.5M)has been swapped on that model since early September too.

The location launched with two varieties of auctions. Mounted swap, the place everybody has the identical value (like an ICO from 2017) and sealed bid auctions.

“You may put in a ground value and a timer and anybody can come and bid above the ground value. And when the pool closes, the sensible contract will fill the orders from the very best value right down to the underside. So individuals do get totally different costs.”

Lu not too long ago added in some variations on Dutch type auctions — which begin from a excessive value and dump the tokens steadily as the value comes down — in addition to English auctions, which begin from a reserve value and head up.

World tour earlier than San Francisco

Initially from Guangdong Province in China, Lu attended highschool in Britain the place he took intro programs for school economics that enabled him to complete his diploma at Reed Faculty early. “That was the place Steve Jobs went,” says Lu. It was there he found crypto in 2016.

“Various youngsters acquired into crypto on the time and my faculty roommate taught me about Ethereum after which I began to learn medium articles and Reddit,” he says. Lu started becoming a member of crypto teams and have become pleasant with NEO founder Hongfei Da which led to a six month internship with NGC Ventures in Shanghai in 2018.

It became a full-time gig after he graduated in 2019 and he’s now the US Funding Supervisor for the fund, primarily based in San Francisco.

“I assist our portfolio tasks to design their tokenomics,” he says. “Throughout my due diligence on many tasks, I’ve a broader view on what’s happening within the crypto market and what the progress is on tokenomics within the crypto world.”

Studying to play video games

He often is the youngest worker on the agency, however he’s additionally the one one to have written his thesis on blockchain and recreation idea — one among only a handful on the topic on the earth on the time.

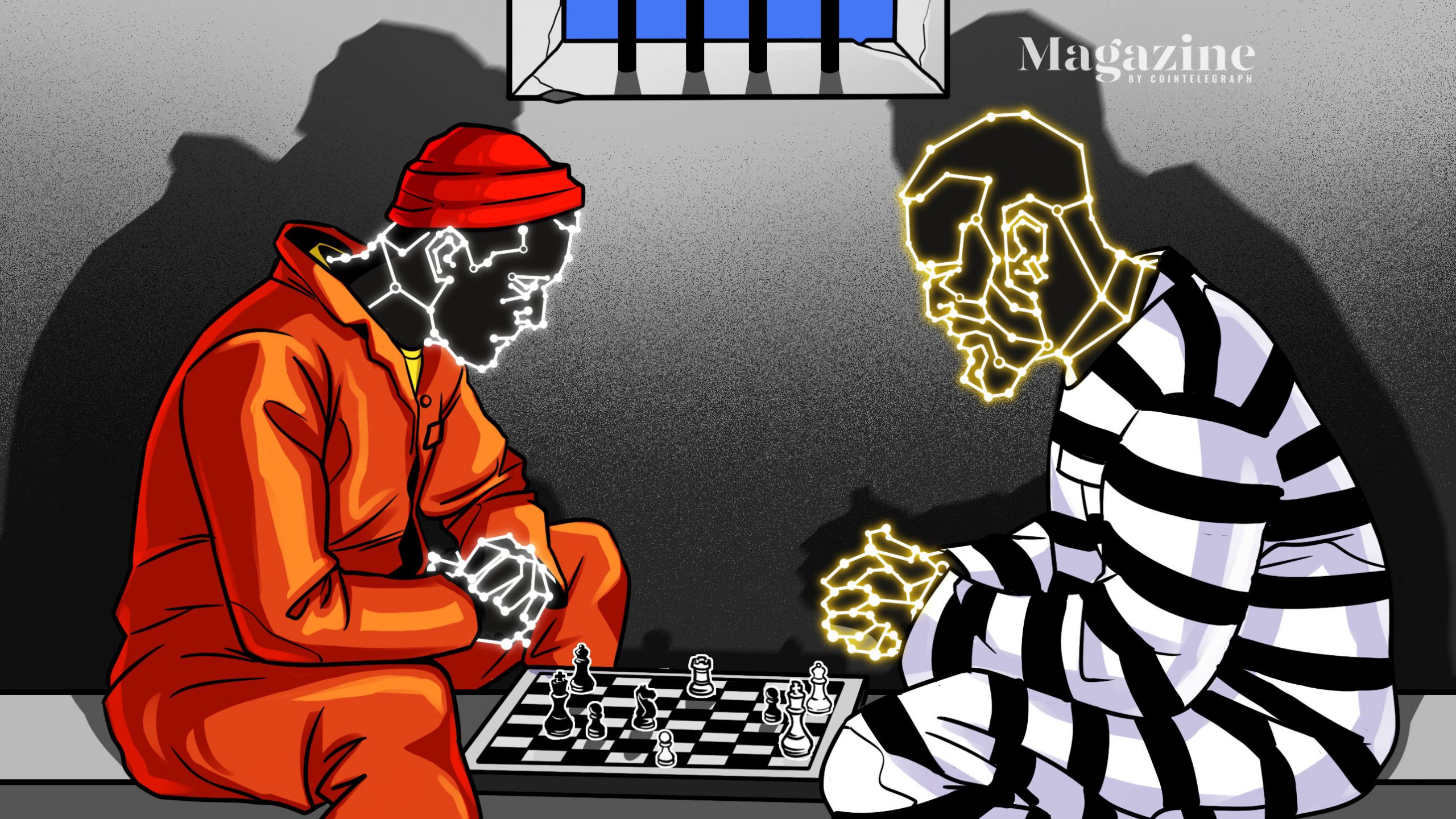

Recreation idea is a department of arithmetic that examines the methods employed in aggressive conditions the place the outcomes for gamers rely critically on the actions of the opposite gamers. It has been utilized to the whole lot from struggle, to enterprise and biology, however Lu’s thesis explores why it’s an ideal match for cryptocurrencies. The ‘gamers’ within the decentralized world of blockchain, from miners to merchants and hackers, are impartial and make choices after evaluating the advantages and prices related to their strikes.

In contrast to in the actual world (because the New Yorker factors out), recreation idea truly works higher when utilized to blockchain and sensible contracts, as a result of the foundations are fastened, the blockchain is clear and the knowledge might be made out there to all of the gamers. Analysis has proven that the extra knowledgeable celebration in a deal sometimes captures as much as 18% extra financial advantages than the much less knowledgeable celebration. Lu explains:

I at all times say it’s a profitable experiment in recreation idea since we use sensible contracts to keep away from plenty of human parts for a recreation, and we will see how pool creators and individuals act.

His thesis examined ideas just like the Nash Equilibrium, which is used to research the end result of video games the place there’s a strategic interplay between a number of resolution makers and the place the end result for every relies on the choices others make, in addition to their very own.

Snitches get 4 years

The well-known instance of the Prisoner’s Dilemma helps illustrate the idea:

Two suspects are interrogated individually for against the law. If each confess, they get 4 years in jail. If neither does, every will probably be sentenced to…