The assembly begins with most cancers analysis.“On the X-axis, you may have time. After which on the Y-axis you may have illness burden … or the di

The assembly begins with most cancers analysis.

“On the X-axis, you may have time. After which on the Y-axis you may have illness burden … or the dimensions of the tumor within the individual’s physique,” explains Simon Barnett on the Zoom name, sharing his display to show a graph that explains a expertise known as Minimal Residual Illness testing.

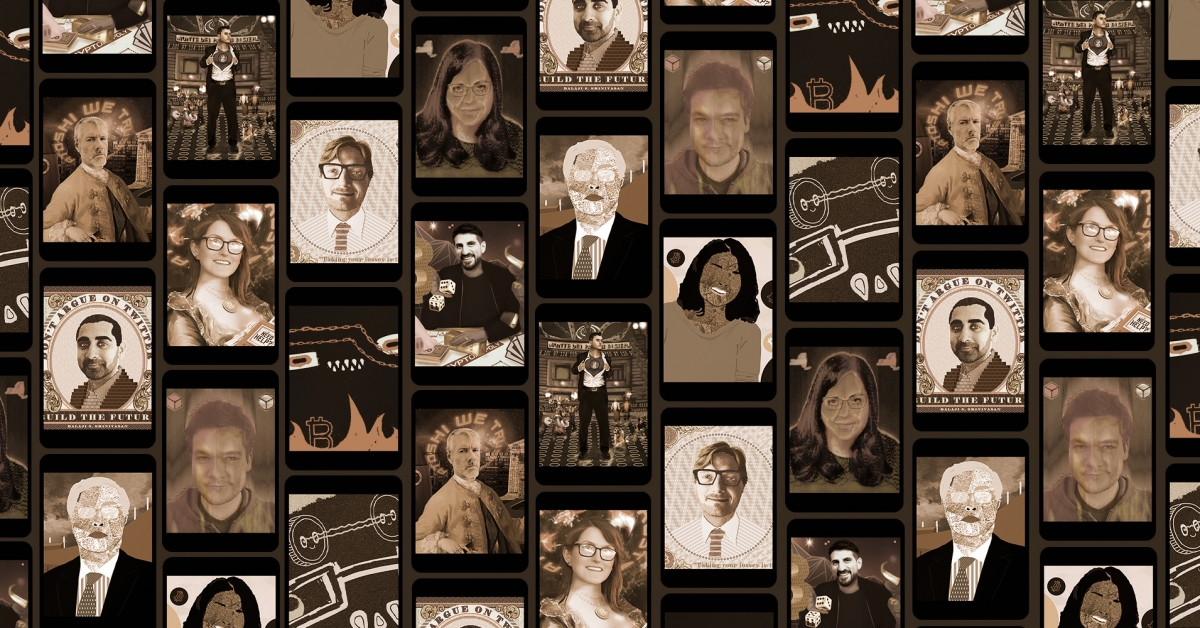

This text is a part of CoinDesk’s Most Influential 2020 – a listing of impactful folks in crypto chosen by readers and employees. The NFT of the art work, by Alotta Cash, is accessible for public sale at The Nifty Gateway, with 50% of the sale proceeds going to charity.

Others leap in with questions: What’s the timeline on this tech? If early screenings are extra widespread, would most cancers surgical procedures turn into a factor of the previous? And if most cancers surgical procedures disappear, how would the hospitals reply? “That is how hospitals make their cash,” somebody says. “They chop folks up.”

Barnett speaks with confidence. He shows a mastery of the topic. He casually refers to a research that simply got here out the prior week, from the Worldwide Society for Liquid Biopsies Convention.

This isn’t a Zoom name of docs, medical professionals, or well being care analysts. It’s the weekly brainstorming assembly for Ark Investments, the actively managed exchange-traded fund (ETF) based in 2014 by Cathie Wooden, a former economist, hedge fund supervisor and chief funding officer at AllianceBernstein. Each Friday morning, at 10:30 a.m. sharp, the brains at Ark talk about a handful of “Huge Image” concepts (which frequently embrace blockchain – Wooden has been a bitcoin bull since no less than 2015; extra on that in a bit.) There is no such thing as a point out of inventory costs, earnings or PE ratios. The main target is on the tech, on the longer term, on what may be.

Ark is completely targeted on the longer term, or “disruptive innovation.” In a world the place passive ETFs – like index funds that monitor the S&P 500 – keep on with the Warren Buffet ethos of “you’ll be able to’t beat the market,” Wooden and Ark have confirmed that, properly, truly, possibly you’ll be able to. As of late November, Ark’s flagship fund, ARKK, with web belongings of $8.9 billion, has fetched a jaw-dropping return of 83.7% on the 12 months, in comparison with 14.5% for the S&P 500. This isn’t a one-year fluke. Since its inception in 2014, the fund has hauled in common annual returns of 30.97%, trouncing the index funds pegged to the market.

Wooden isn’t a fan of indexes. “Indexes symbolize one of the crucial large misallocations of capital in historical past,” she advised me a number of days earlier. “Greater than half of all equities are in a passive portfolio. This doesn’t make any sense and that’s very backward-looking.” Her logic: A basket of firms within the S&P 500, say, merely tracks the efficiency of those older corporations and has a blind eye to the actually rising tech, which Wooden clumps into 5 buckets: DNA sequencing, power storage, robotics, synthetic intelligence and blockchain.

Ark invests closely in these 5 buckets. Most index funds don’t. In maybe probably the most notable instance, Tesla didn’t crack the S&P 500 till Dece. 1, 2020, which means that thousands and thousands of 401(ok) retirement portfolios, most of which monitor the S&P, would have missed out on Tesla’s eye-popping returns. At Ark? Tesla is 10% of the fund.

The massive wager

Subsequent matter on the Zoom name: Tesla. The ground is ceded to Tasha Keeney, the primary analyst Ark employed, to debate some breaking information from China. “The information is about an organization known as Xpeng, in China, which originated as a Tesla copycat,” explains Keeney. She’s a former math main. She wears darkish glasses, and a few wired Apple headphones, her hair pulled again in a ponytail. Simply earlier than this assembly, on Twitter, Keeney had posed a query that’s filled with insider jargon:

“Why is Xpeng utilizing lidar?” she requested her 58,000 followers. “Huge deviation from copying Tesla. Xpeng says it should enormously enhance accuracy – I imagine it, however can severely restrict scalability for his or her autonomous method. Did they understand they couldn’t make their Tesla-copy method work?”

Instantly after Keeney’s tweet, the replies poured in from electric-vehicle Twitter. One of many replies got here from a shocking supply: Elon Musk. “They’ve an outdated model of our software program & don’t have our NN inference laptop,” Musk tweeted to Keeney, simply 11 minutes after her query.

Being a reserve forex is kind of the exalted position, proper? It’s the flight-to-safety forex. It’s the insurance coverage coverage forex.

This can be a plum instance of Cathie Wooden’s technique of utilizing social media to realize an edge. Ark analysts are usually not the standard I-banking number-crunchers who toil away in cubicles, anonymously crushing their spreadsheets. Most have public platforms. And so they make connections with trade consultants and researchers, who can then present the type of deep insights that you just don’t – can’t – get from skimming the headlines and even studying the tech journals.

“Info…