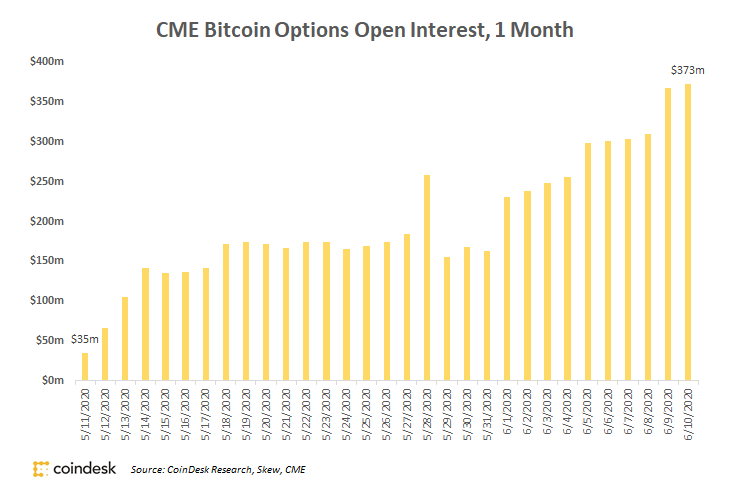

Over a current 30-day interval, the whole open curiosity for CME bitcoin choices elevated greater than tenfold, from $35 million on Might 11 to $37

Over a current 30-day interval, the whole open curiosity for CME bitcoin choices elevated greater than tenfold, from $35 million on Might 11 to $373 million on June 10. Furthermore, open curiosity made a brand new all-time excessive on six consecutive days from June 5-10.

Important development in CME futures factors to quickly rising curiosity by institutional buyers in buying and selling regulated bitcoin derivatives merchandise. Regardless of this development, nonetheless, CME Group “has no plans to introduce extra cryptocurrency merchandise,” a spokesperson advised CoinDesk. Thus for now, CME Group’s cryptocurrency merchandise will solely contain bitcoin.

CME, which launched its bitcoin choices product solely originally of 2020, now represents over 20% of the worldwide bitcoin choices market measured by open curiosity, or the whole variety of excellent by-product contracts. It’s now the second-largest bitcoin choices market on this planet behind Panama-based Deribit, based on Skew.

Progress in CME’s bitcoin choices market is “a powerful sign that regulated establishments are exposing their books to bitcoin,” stated Matt Kaye, managing associate at Los Angeles-based Blockhead Capital. “CME has the next value of capital and is closed on weekends, so anybody buying and selling there may be probably making these sacrifices as a result of they should.”

A lot of CME’s development seems to have come on the expense of Deribit. Market shares claimed by competing bitcoin derivatives markets LedgerX, Bakkt and OKEx have remained largely unchanged since January.

Choices aren’t the one bitcoin derivatives market the place CME is seeing good points. In Might, CME’s bitcoin futures demonstrated equally exceptional development, outpacing practically each different bitcoin derivatives platform on an actual and proportion development foundation. CME bitcoin futures open curiosity grew 29% over the past 30 days as institutional buyers proceed to enter the bitcoin derivatives market.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.