One of many newer entrants to the decentralized finance (DeFi) house, Curve, is driving the wave of demand for the freshly issued Compound governan

One of many newer entrants to the decentralized finance (DeFi) house, Curve, is driving the wave of demand for the freshly issued Compound governance token, COMP, which has surged to a $774.Three million market cap since first being distributed on Monday.

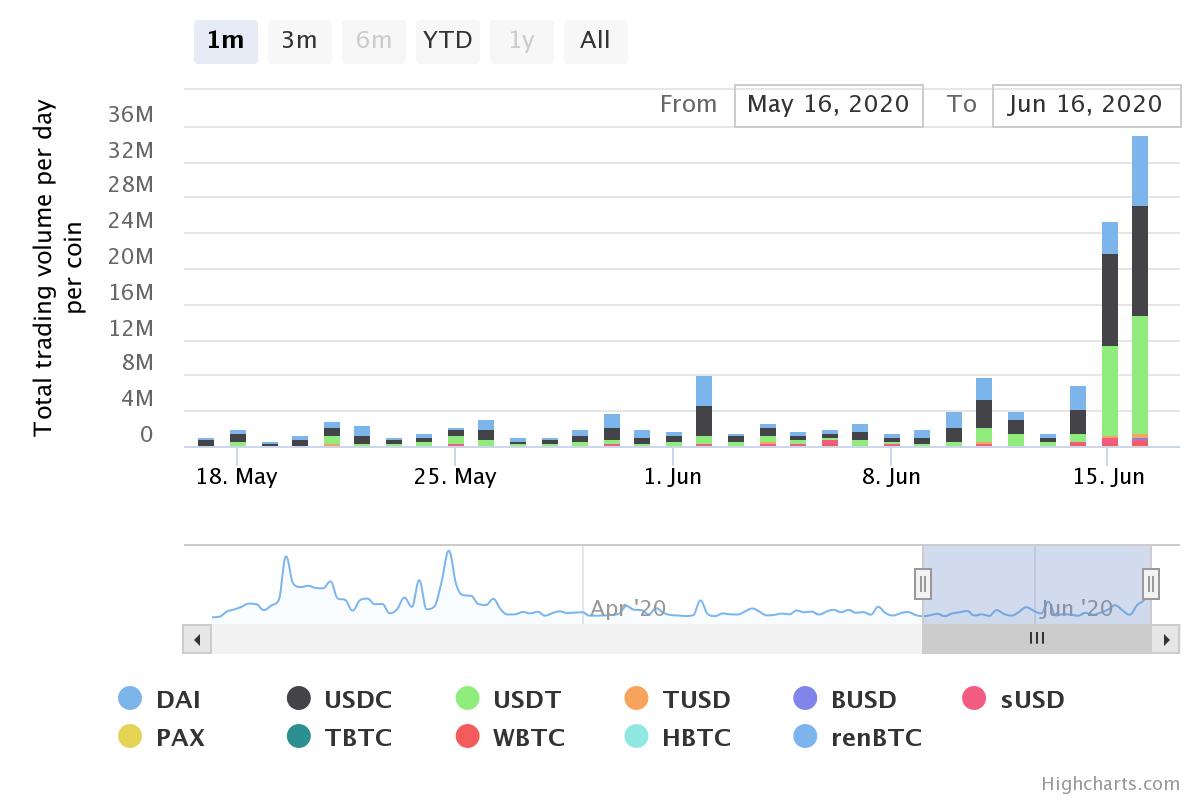

Curve is an automatic market maker devoted solely to stablecoins. On Sunday, it noticed $3.5 million in every day buying and selling quantity, in line with its self-reported stats. On Monday that shot as much as $12.6 million; as of this writing on Tuesday, it’s at $23.Three million in buying and selling quantity over the past 24 hours, a roughly 7X achieve.

In keeping with Curve founder Michael Egorov (additionally a co-founder of encryption firm NuCypher), that is largely pushed by demand for COMP.

“Folks began placing USDC as collateral on Compound, taking USDT, swapping on Curve to USDC to place as collateral on Compound [and] doing that as much as 30 instances to earn COMP with leverage,” Egorov wrote CoinDesk in an e mail.

That’s as a result of Compound offers essentially the most COMP every day to the markets with essentially the most curiosity. Proper now, amongst stablecoins, these are USDC and USDT. In different phrases, customers put in USDC, borrow as a lot USDT as they will, change it on Curve for extra USDC, put that in Compound as nicely to allow them to borrow extra, take out further USDT and repeat till they’ve capped out their leverage. This permits them to completely maximize their exercise on Compound as each a borrower and lender, which earns COMP on each side.

COMP is at present buying and selling at $78.33 as of press time, in line with Uniswap.Curve at present has $16.2 million in deposits, down from a excessive of $17.2 million reached this weekend. Deposits on Compound have gone from $97.7 million on Sunday to $159.5 million at press time, in line with DeFi Pulse.

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.