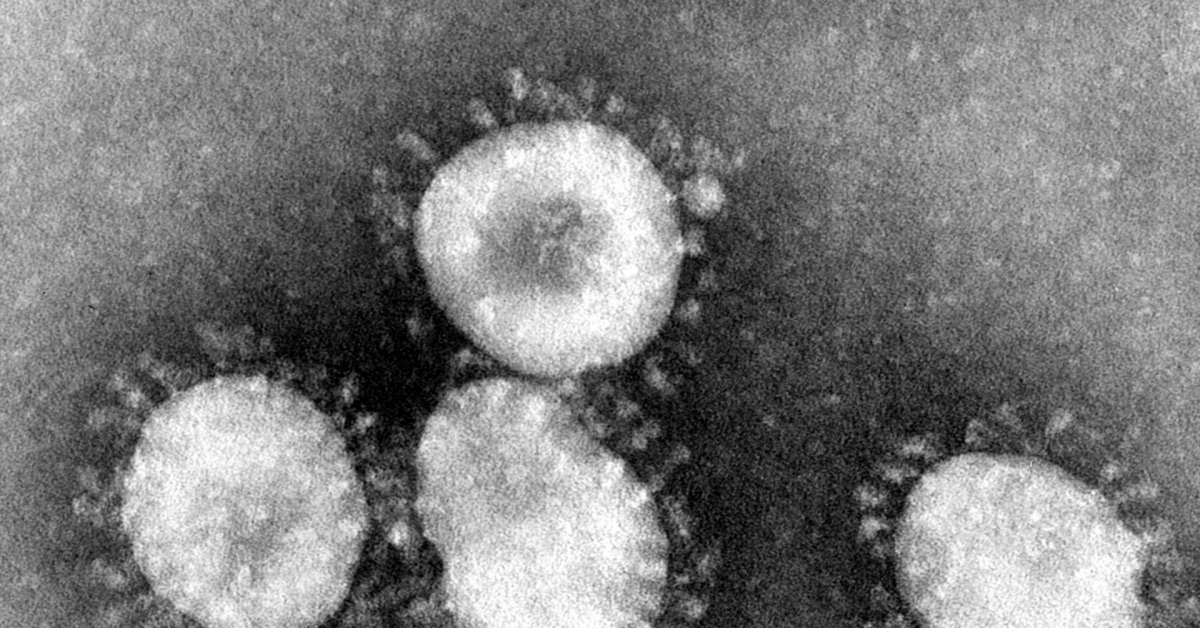

The spreading coronavirus sowed a brand new bout of concern amongst buyers, triggering a inventory market sell-off and flight to safe-haven propert

The spreading coronavirus sowed a brand new bout of concern amongst buyers, triggering a inventory market sell-off and flight to safe-haven property like gold and U.S. Treasury bonds, with 47 nations now reporting infections amid widespread reviews of journey cancellations, cargo delays and enterprise interruptions.

U.S. shares fell for the sixth straight day, Treasury yields slid to a report low and gold costs had been little modified near a seven-year excessive. Bitcoin’s price climbed 1.four % to $8,902, rising together with well-liked cryptocurrencies together with ether.

Analysts for the Wall Road agency Goldman Sachs warned Thursday in a report that the virus may disrupt factories’ provide chains, damp demand for exports and in the end stunt financial output in China, the U.S. and elsewhere. The agency warned the influence of the contagion may wipe out any progress within the mixed earnings of firms within the Commonplace & Poor’s 500 Index.

“Now we have up to date our earnings mannequin to include the chance that the virus turns into widespread,” the Goldman analysts led by Chief U.S. fairness strategist David Kostin wrote.

Financial institution of America analysts wrote Thursday the coronavirus had “gripped world markets.” Prevailing rates of interest, already at or near historic lows and set at adverse ranges in Europe and Japan, should not anticipated to rise “till Chinese language financial exercise improves and there are indicators of worldwide containment.”

“Whereas most U.S. buyers have been ready for a reversal-of-the-virus bump within the charges market, the state of affairs has gotten worse,” the analysts wrote. “We see U.S. Treasurys as clearly the optimum alternative of perceived safe-haven safety.”

U.S. President Donald Trump tweeted on Wednesday that “faux information” media shops had been “doing every thing potential to make the caronavirus (sic) look as unhealthy as potential, together with panicking markets.” However because the U.S. financial system faces a brand new threat that might damage his reelection possibilities in November, Trump put Vice President Mike Pence answerable for coordinating the U.S. authorities’s response to the general public well being issues.

Trump needed governors and members of Congress to have a single level individual to speak with, “eliminating any jockeying for energy in a decentralized situation,” the New York Instances reported, citing unnamed White Home aides.

This week’s sell-off within the S&P 500, which tracks giant U.S. shares, left the index down 7 % thus far in 2020.

The yield on the 10-year U.S. Treasury observe declined by 0.02 share level to 1.29 %, a report low.

Gold futures on the New York Mercantile Alternate had been little modified Thursday, near the seven-year excessive of $1,662 an oz reached earlier within the week.

Bitcoin fell earlier this week because the coronavirus fears began to hit conventional markets, main some analysts to query the thesis that the 11-year-old cryptocurrency might serve as a safe haven from financial panic, much like the best way many buyers view gold. Costs for bitcoin fell to $8,627 on Wednesday, the bottom in a month. The digital asset was born within the throes of the final world monetary disaster, greater than a decade in the past.

However some optimism returned to the market on Thursday, with the cryptocurrency’s value rebound leaving costs up 24 % on the yr.

The billionaire investor Chamath Palihapitiya, who serves as chairman of the spaceflight firm Virgin Galactic, advised CNBC on Wednesday that bitcoin seems “completely uncorrelated” with different asset classes like shares, bonds and rising markets.

That dynamic ought to push buyers to place 1 % of property into bitcoin, although they need to accumulate the positions steadily, he mentioned.

“While you get up and see a coronavirus scare and the Dow down 2,000 [points], you shouldn’t be getting into and shopping for bitcoin,” he mentioned. “That’s an idiotic technique.”

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an impartial working subsidiary of Digital Foreign money Group, which invests in cryptocurrencies and blockchain startups.