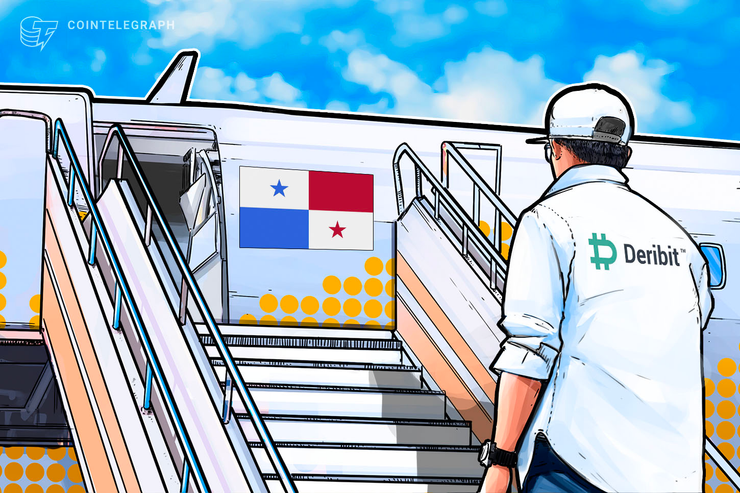

Crypto derivatives trade Deribit is leaving the European Union for Panama to keep away from new AML guidelines whereas altering its Know Your Buye

Crypto derivatives trade Deribit is leaving the European Union for Panama to keep away from new AML guidelines whereas altering its Know Your Buyer (KYC) necessities.

Deribit B.V., the present Netherlands-based firm chargeable for the Deribit.com trade, will formally delegate the buying and selling platform to its daughter firm, DRB Panama Inc. on Feb. 10, 2020, a Jan. 9 statement from Deribit stated.

Altering regulatory winds

Deribit has determined to switch to Panama based mostly on the said chance of tightening regulatory calls for within the Netherlands, ensuing from related calls for seen throughout the EU, the Deribit assertion famous.

These necessities, often known as 5AMLD, pertain to crypto operations and may require Deribit clients to supply important private information with a view to take part on the platform. The assertion added:

“We consider that crypto markets ought to be freely out there to most, and the brand new rules would put too excessive limitations for almost all of merchants, each — regulatory and cost-wise.”

Altered phrases, circumstances and KYC

Deribit’s assertion famous a change in its terms and privacy policy as a part of the upcoming transfer to Panama.

Deribit additionally talked about modifications to its present KYC expectations, expressing plans to make use of verification and cost firm Jumio in addition to software program firm Chainalysis within the course of. Deribit will host a number of buyer exercise ranges on the trade, based mostly on sure KYC parts, per the corporate’s assertion.

In June 2019, Binance announced it might kick U.S. clients off its Malta-based trade in September, organising a unique platform with fewer capabilities for U.S. individuals. Change large OKEx additionally touts Malta as its headquarters, because the evenly populated trip hub has attracted curiosity from the crypto business, Cointelegraph reported final yr. Malta can also be occasion to EU AML regulation, which can show to be a pressure for exchanges based mostly within the nation.